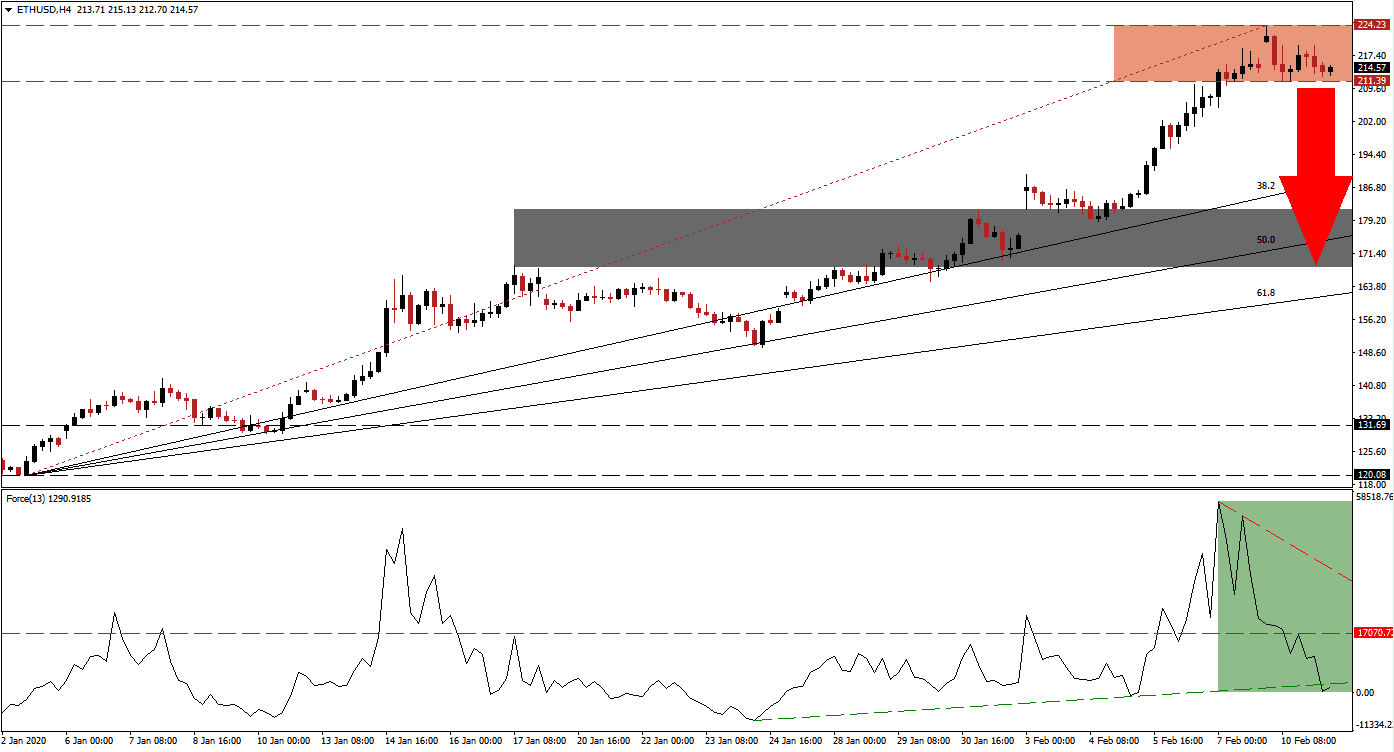

Ethereum enjoyed a massive rally, following Bitcoin to the upside. Since the beginning of this year, the cryptocurrency market enjoyed a broad bullish bias. With the ETH/USD recording a fresh 2020 high, predictions of massive rallies are piling in. The upside is extremely exhausted, and while hope is factored into the launch of Ethereum 2.0, technical developments point towards a bigger corrective phase in this cryptocurrency pair. A breakdown below its resistance zone is likely to trigger a profit-taking sell-off.

The Force Index, a next-generation technical indicator, initially followed the ETH/USD to the upside. As price action closed in on its resistance zone, the Force Index collapsed. The magnitude was severe enough to invalidate a negative divergence. After the horizontal support level was converted into resistance, as marked by the green rectangle, a move below its ascending support level followed. This technical indicator is now favored to contract below the 0 center-line, allowing bears to regain control of this cryptocurrency pair. You can learn more about the Force Index .

After reversing from the top range of its resistance zone, the ETH/USD is now pending a breakdown. This zone is located between 211.39 and 224.23, as marked by the red rectangle. One important milestone was reached by the Ethereum network, as the total value locked (TVL) in decentralized finance (DeFi) surpassed $1 billion. This development provides a minor distraction away from the wider competition between Ethereum and Tron, while other projects are joining the race. As the social media hype is expanding, caution is advised. You can read more about a breakdown here.

This currency pair is anticipated to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level, on the back of a pending profit-taking sell-off. A breakdown below the psychological $200 support level is favored to initiate the next wave of net sell positions in this cryptocurrency pair. The ETH/USD will then be on track to correct into its next short-term support zone located between 168.17 and 181.61, as marked by the grey rectangle. This will additionally close a previous price gap to the upside. More downside is possible, if price action pushes below its 50.0 Fibonacci Retracement Fan Support Level, currently crossing through the short-term support zone.

ETH/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 214.50

Take Profit @ 168.20

Stop Loss @ 225.00

Downside Potential: 4,630 pips

Upside Risk: 1,050 pips

Risk/Reward Ratio: 4.41

In the event of a breakout in the Force Index above its descending resistance level, the ETH/USD is likely to attempt to push to a new 2020 high. The intra-day high of 235.01 represents a critical pivot point for price action, the low of a massive price gap to the downside. A push above this level should fill the gap and take this cryptocurrency pair into its next resistance zone located between 257.61 and 267.00, presenting traders with an outstanding short-selling opportunity.

EUR/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 240.00

Take Profit @ 267.00

Stop Loss @ 227.50

Upside Potential: 2,700 pips

Downside Risk: 1,250 pips

Risk/Reward Ratio: 2.16