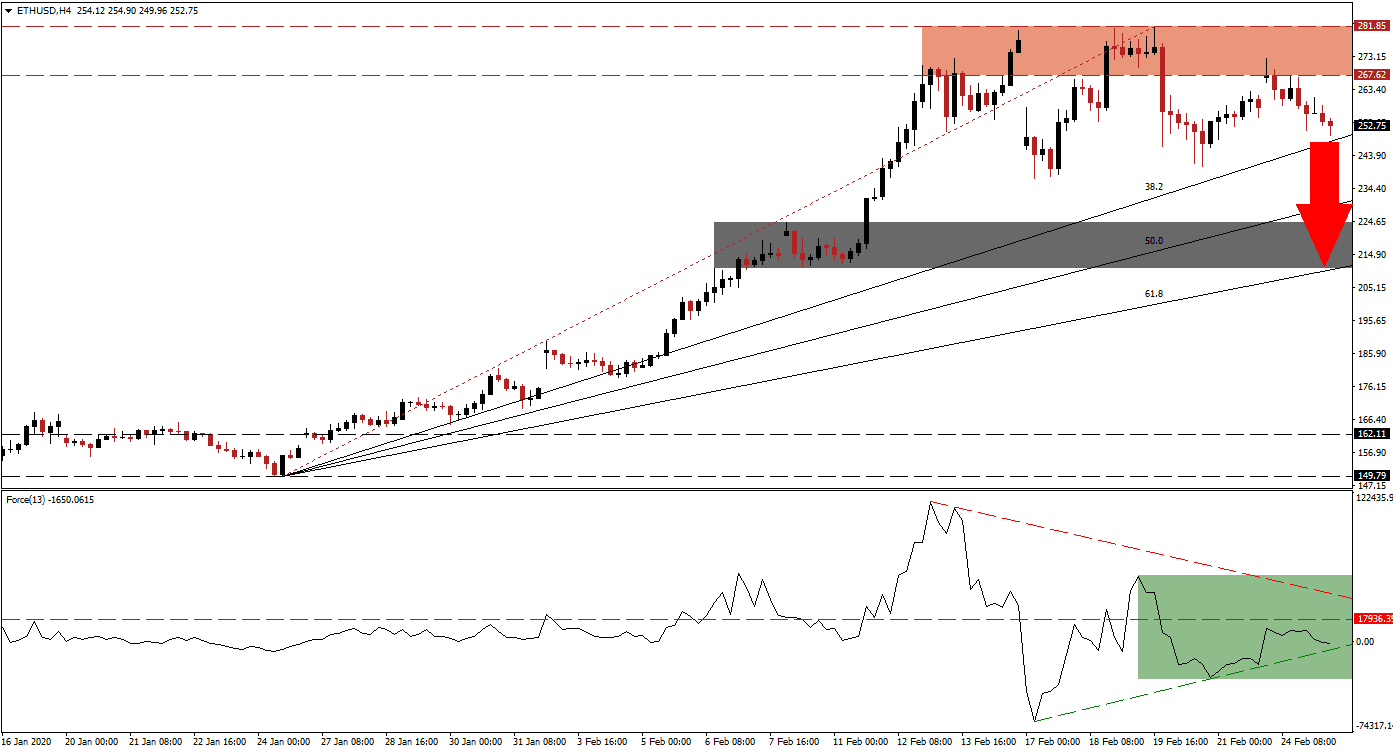

Ethereum failed to extend its advance, being rejected three times by its resistance zone. With the community hyped over developments regarding Ethereum 2.0, the hard fork meant to switch the network from the current proof-of-work model to proof-of-stake. Plenty of hopes are built into this cryptocurrency pair based on the hard fork, creating an environment for price action to enter an extended corrective phase until more clarity emerges. Pressures for either a breakout or breakdown in the ETH/USD are expanding, initiated by its ascending 38.2 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, has recovered from its 2020 low but recorded a lower high before reversing once again. It led to a higher low, and an ascending support level emerged. The Force Index remains below its horizontal resistance level, with its descending resistance level closing in, as marked by the green rectangle. Bears are in control of the ETH/USD, while this technical indicator is on the verge of pushing below its ascending support level in negative conditions. You can learn more about the Force Index here.

Bearish pressures spiked after the initial breakdown in the ETH/USD below its resistance zone, which materialized with a price gap to the downside. This zone is located between 267.62 and 281.85, as marked by the red rectangle. A quick recovery led to a marginally higher high and a second rejection. The third rejection resulted in a lower high, adding to bearish pressures, from where a breakdown in this cryptocurrency pair below its 38.2 Fibonacci Retracement Fan Support Level is anticipated.

Price action may accelerate into its short-term support zone located between 206.34 and 224.23, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is enforcing this zone, maintaining the uptrend in the ETH/USD. While a breakdown extension remains an option, a fresh fundamental catalyst will be required. Competing projects continue to attract developers away from Ethereum, posing a structural challenge, which is not accurately priced yet. You can read more about a support zone here.

ETH/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 252.75

Take Profit @ 207.75

Stop Loss @ 263.00

Downside Potential: 4,500 pips

Upside Risk: 1,025 pips

Risk/Reward Ratio: 4.39

In case of a breakout in the Force Index above its descending resistance level, the ETH/USD is expected to follow suit. The next psychological resistance is located at $300, from where the next resistance zone awaits price action between 306.03 and 313.78. Given the uncertainty over the fallout from the pending hard fork, coupled with unaddressed structural issues, caution is advised, as a more massive correction may unfold.

ETH/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 283.00

Take Profit @ 308.00

Stop Loss @ 273.00

Upside Potential: 2,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.50