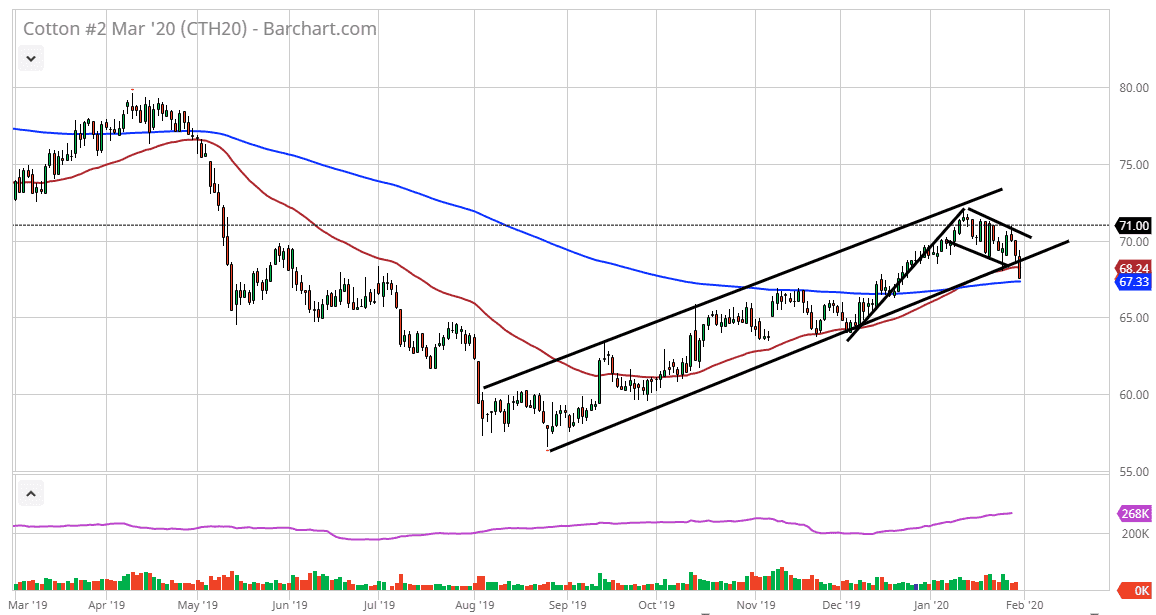

Cotton markets have broken down significantly during the trading session on Friday, slicing through the uptrend line that had been so bullish and so reliable since early September. The market is testing the 200 day EMA, an area that of course attracts a lot of attention. The cotton contract close that the very bottom of the range for the day, which of course is another ugly and negative sign. If that’s going to be the case, then it’s difficult to get overly bullish about this market. At this point, we need to see a recovery that wipes out the negativity of the Friday session in order to feel comfortable going long. This is particularly alarming, because not only have we broken down below an uptrend line, but we have sliced through the bottom of the 50 day EMA and blown out the bullish flag that I have marked on the chart. The only thing holding up this market right now is the 200 day EMA.

If you watched yesterday’s video, you know that a close on the daily chart below the 200 day EMA could open up the market to reaching towards the $65 level, and then possibly even as low as the $60 level. All things being equal, you should also pay attention to the fact that the $71 level has been important more than once, a point that I have been hammering over the last several videos. Simply put, it was previous support so it should now be resistance.

The cotton market is not insulated completely from the China story, as there are a lot of garment manufacturers in that part of the world, along with other places like Vietnam and Laos. As coronavirus becomes an issue in Asia, it could close down some of these factories, and therefore drive down the value of cotton just due to the lack of short-term demand. It doesn’t necessarily mean that the cotton markets are going to fall apart forever, but clearly there are a lot of concerns out there when it comes to global demand for commodities in general. Cotton isn’t going to be any different, and if the US dollar certainly strengthens it’s going to take less of those US dollars to buy a bale of cotton. If this market closes below the 200 day EMA, and especially if it closes below the $65 level, it then becomes a nice shorting opportunity for a longer-term move. Otherwise, if we wipe out the losses from Friday it’s likely that we continue to consolidate around $70.