With Covid-19 days away from being declared a global pandemic, safe-haven assets continue to enjoy demand. The Japanese Yen and the Swiss Franc are the two primary currencies Forex traders favor during uncertain times. Volatility in the CHF/JPY has increased over the past few trading sessions, likely to remain elevated. Similarities between both economies include negative interest rates, an export-oriented economy, and a highly-skilled labor force. The Swiss government announced that its 2019 budget surplus of CHF3.1 billion exceeds its estimates for a surplus of CHF1.2 billion, providing a limited fundamental catalyst, allowing price action to push above its short-term support zone.

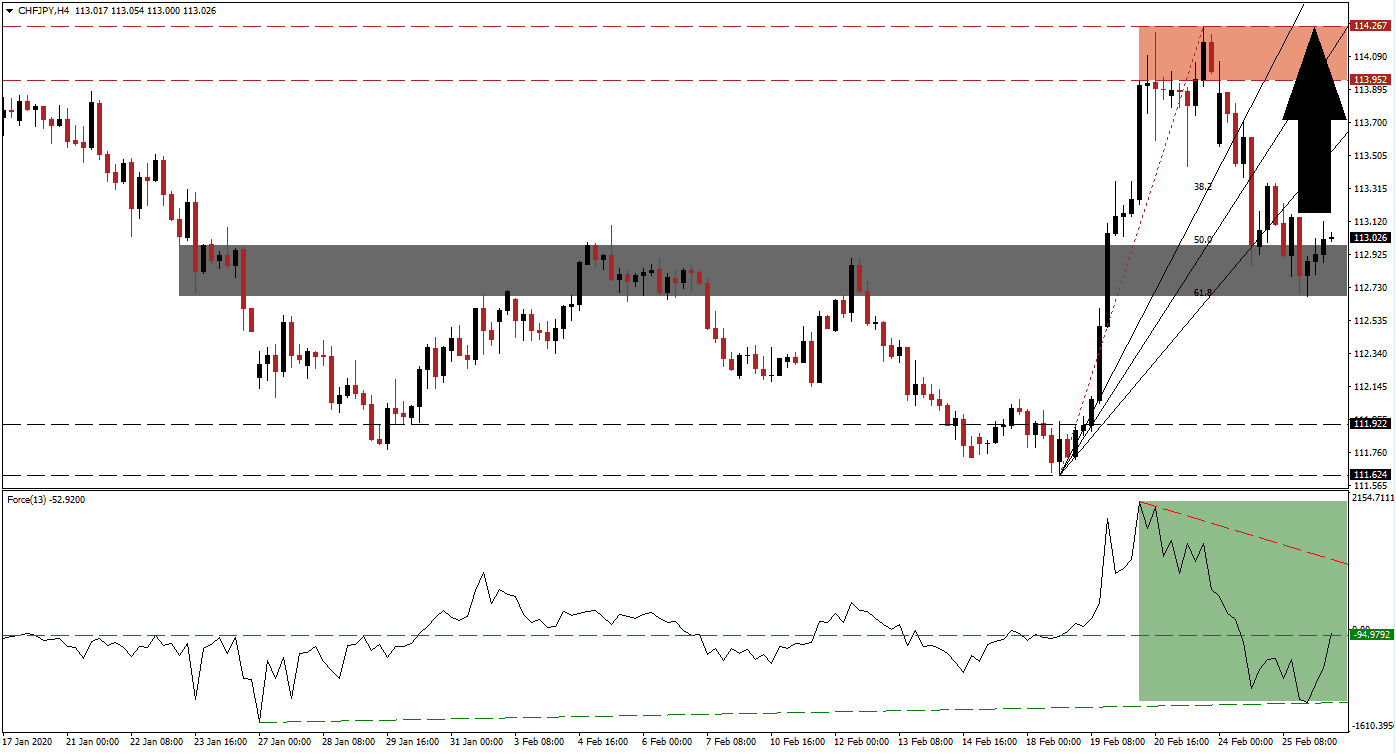

The Force Index, a next-generation technical indicator, shows a bullish momentum recovery following a marginally higher low. A shallow ascending support level formed, providing enough stability for a reversal. The Force Index is now converting its horizontal resistance level into support, as marked by the green rectangle. This technical indicator is expected to extend its recovery into positive territory until it can challenge its descending resistance level. It will place bulls in charge of the CHF/JPY, preceding more upside in this currency pair. You can learn more about the Force Index here.

Following the breakout in this currency pair above its short-term support zone, the previous resistance zone, which rejected price action three times, more upside is pending. This zone is located between 112.678 and 112.976, as marked by the green rectangle. The CHF/JPY is favored to close the gap to its ascending 61.8 Fibonacci Retracement Fan Resistance Level. A push above it will allow the Fibonacci Retracement Fan sequence to guide it farther to the upside, with the 50.0 and 38.2 Fibonacci Retracement Fan Resistance Levels above its next resistance zone.

Forex traders are recommended to monitor the intra-day high of 113.342, the peak of a failed bounce off of its short-term support zone that was reversed to a lower low. A breakout above it is anticipated to initiate the next wave of net buy orders, providing upside momentum. The CHF/JPY is likely to challenge its resistance zone located between 113.952 and 114.267, as marked by the red rectangle. An extension of the breakout sequence will require a fresh fundamental catalyst.

CHF/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 113.000

Take Profit @ 114.250

Stop Loss @ 112.650

Upside Potential: 125 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.57

Should the Force Index contract below its ascending support level, the CHF/JPY is expected to attempt a breakdown. The downside potential remains limited to its next support zone, located between 111.624 and 111.922. Forex traders should consider this an excellent buying opportunity, as weakness in the Japanese economy persists. Covid-19 is adding to problems for the Bank of Japan to address, positioning this currency pair for more upside.

CHF/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 112.400

Take Profit @ 111.650

Stop Loss @ 112.750

Downside Potential: 75 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.14