With Covid-19 crippling the global supply chain, Canada is faced with the impact of rail blockades staged by indigenous and anti-pipeline activists. Cargo ships remain backed-up, cargo and rail traffic is blocked, and roughly 25% of businesses across the country already feel the impact. According to Canada’s First Nations, reconciliation with the Trudeau government is impossible, further pressuring the fragile economy. While the CAD/JPY is in the midst of a corrective phase, a short-term bounce is anticipated, following the breakdown below its short-term support zone.

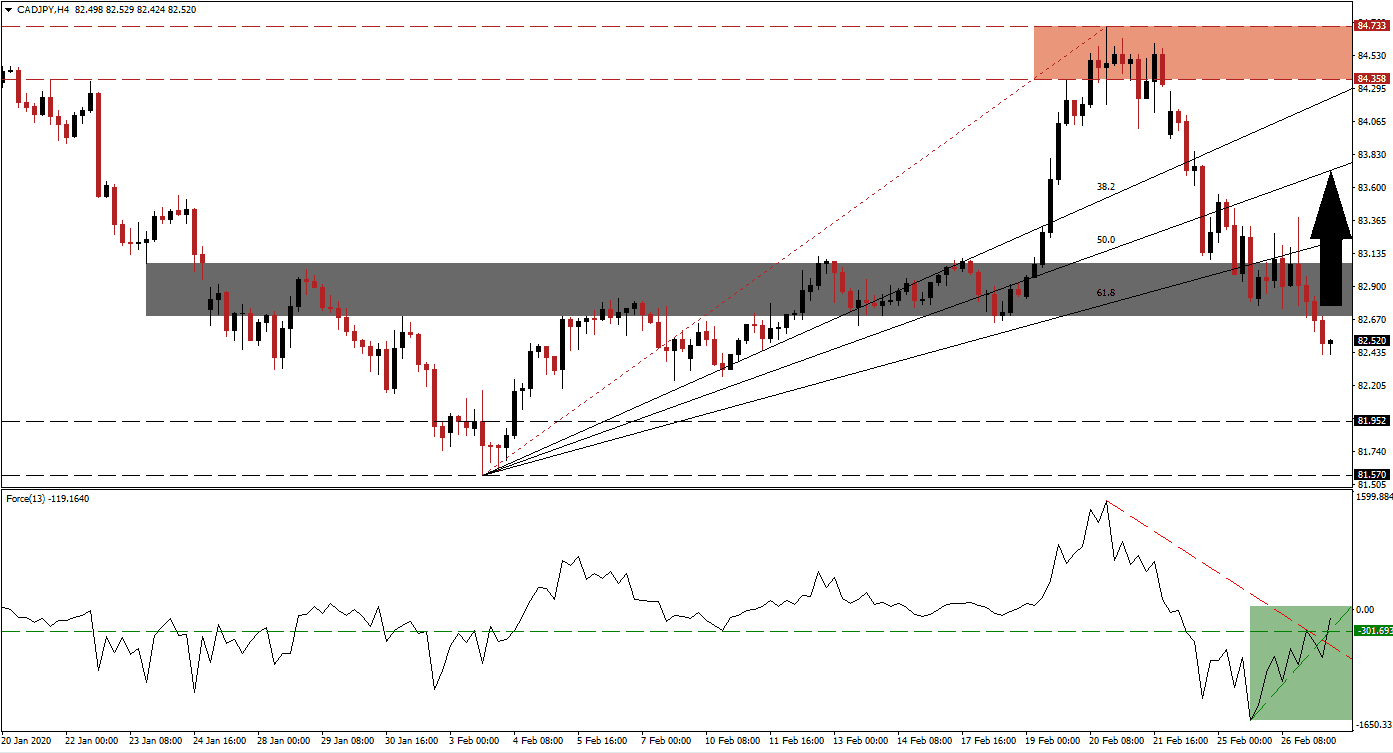

The Force Index, a next-generation technical indicator, initially collapsed to a fresh 2020 but quickly recovered. A positive divergence materialized as price action pushed below its short-term support zone. The Force Index was guided higher by its ascending support level, resulting in the conversion of its horizontal resistance level into support. It also allowed for a breakout above its descending resistance level, adding to bullish developments. This technical indicator is now on track to move into positive territory, granting bulls control of the CAD/JPY. You can learn more about the Force Index here.

Price action completed a breakdown below its short-term support zone located between 82.688 and 83.066, as marked by the grey rectangle. Given the sharp reversal in bullish momentum, a breakout is expected to take the CAD/JPY into its ascending 61.8 Fibonacci Retracement Fan Resistance Level. It is just above this zone, from where a spike into its 50.0 Fibonacci Retracement Fan Resistance Level is likely. This will keep the long-term downtrend intact, and positions this currency pair for a more massive correction.

Forex traders are advised to monitor price action as it approaches its intra-day high of 83.391, the peak before the breakdown below its short-term support zone. A move higher, confirmed by a volume spike, may allow this currency pair to accelerate into its 38.2 Fibonacci Retracement Fan Resistance Level. It is on the verge of crossing its resistance zone located between 84.358 and 84.733, as marked by the red rectangle. Long-term breakdown pressures for the CAD/JPY remain in place, backed by a bearish fundamental scenario.

CAD/JPY Technical Trading Set-Up - Reversal Scenario

Long Entry @ 82.550

Take Profit @ 83.650

Stop Loss @ 82.250

Upside Potential: 110 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.67

A reversal in the Force Index below its descending resistance level, currently acting as temporary resistance, is favored to pressure the CAD/JPY into more downside. A short-term recovery is necessary to ensure the longevity of the corrective phase, and an extension of the sell-off from current levels will create a more significant reversal scenario at a later stage. The next support zone is located between 81.570 and 81.952, from where a breakdown cannot be dismissed.

CAD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 82.100

Take Profit @ 81.600

Stop Loss @ 82.350

Downside Potential: 50 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.00