Oil prices remain depressed, and OPEC+ may not rush in to attempt to stabilize the sell-off just yet. The Canadian economy, a major oil exporter dependent on the commodity sector, has felt the negative impacts of the global slowdown. With the coronavirus affecting the supply chain, the Bank of Canada noted that it monitors the situation strictly for influences on its domestic economy. The CAD/CHF entered a minor short-covering rally as fears eased, but negative probabilities remain in place.

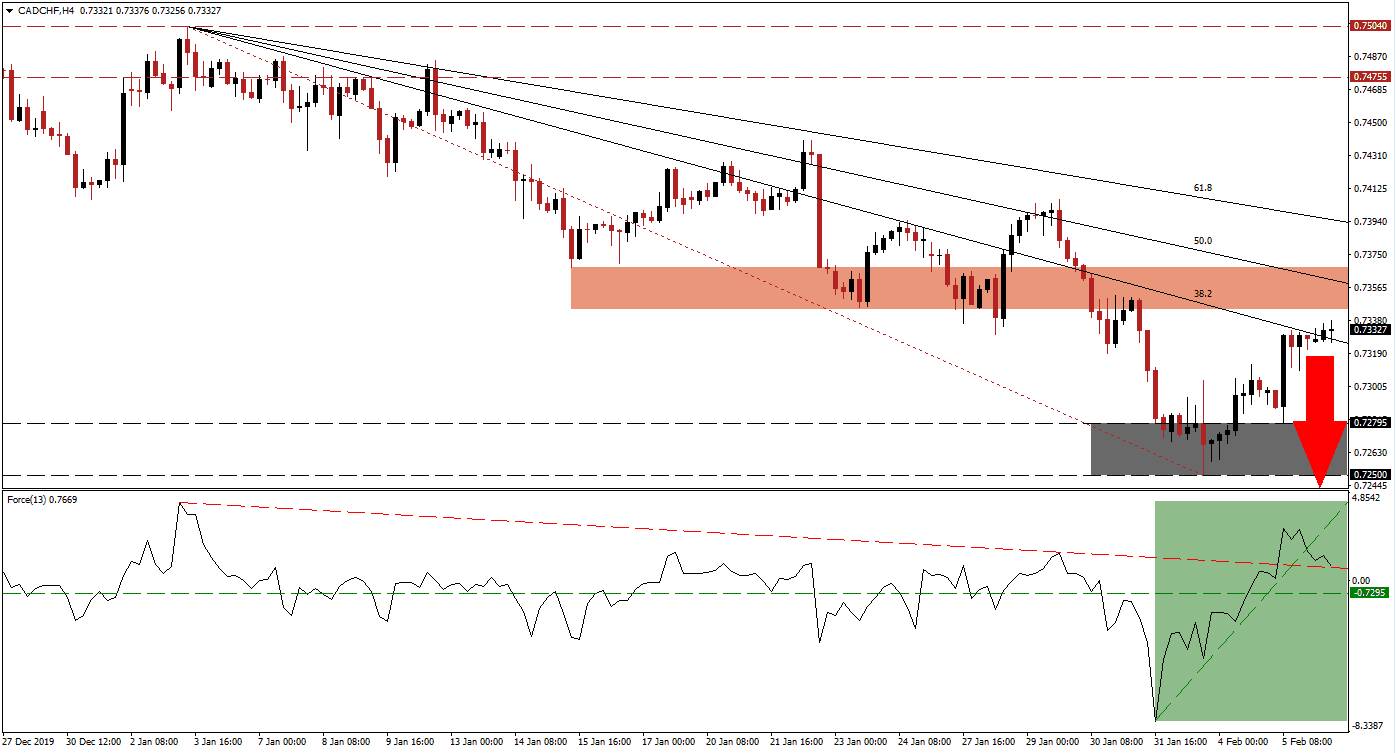

The Force Index, a next-generation technical indicator, confirmed the breakout with a spike of its own after recording a lower low. Bullish momentum allowed for a conversion of the horizontal resistance level into support, while a steep ascending support level emerged. A breakout above its descending resistance level followed, but the Force Index now collapsed below its ascending support level, as marked by the green rectangle. This technical indicator is now on the verge of extending its corrective phase, and bears are set to take control of the CAD/CHF with a crossover below the 0 center-line.

Price action is nearing its short-term resistance zone located between 0.73439 and 0.73676, as marked by the red rectangle, enforced by its descending 50.0 Fibonacci Retracement Fan Resistance Level. Neither dominant fundamental conditions nor the developing technical scenario warrants a breakout above this zone. Forex traders are recommended to monitor the CAD/CHF for a breakdown below its 38.2 Fibonacci Retracement Fan Support Level, which is favored to result in the addition of new net short positions.

A reversal is anticipated to take this currency pair back down into its support zone located between 0.72500 and 0.72795, as marked by the grey rectangle. The Swiss Franc is exposed to safe-haven demand and market interference by the Swiss National Bank. Switzerland is dependent on its export industry, which benefits from a weaker Swiss Franc, but the coronavirus outbreak may keep the SNB sidelined in the short-term. This exposes the CAD/CHF to a renewed push to the downside, with a breakdown sequence pending. You can learn more about a support zone here.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.73350

Take Profit @ 0.72500

Stop Loss @ 0.73600

Downside Potential: 85 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.40

Should the Force Index push through its ascending support level, currently acting as temporary resistance, the CAD/CHF is favored to attempt a breakout. While the long-term fundamental outlook for this currency pair is uncertain, short-term technical developments suggest more downside. Any breakout attempt is expected to remain confined to its long-term resistance zone located between 0.74755 and 0.75040, representing a great short selling opportunity.

CAD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.74000

Take Profit @ 0.74800

Stop Loss @ 0.73700

Upside Potential: 80 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.67