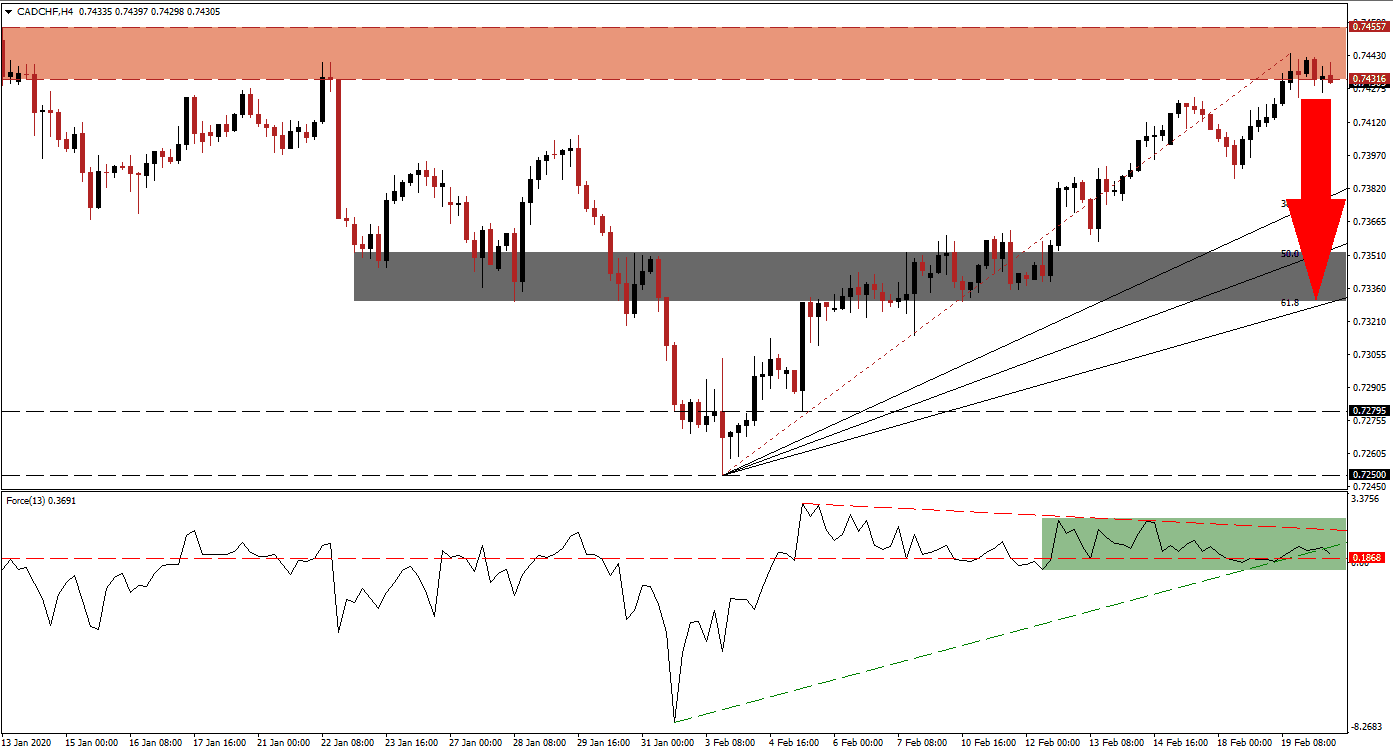

Financial markets continue to dismiss the threat to the global economy posed by Covid-19, which continues to spread, cases soar, and the death toll rises. This poses a tremendous challenge for the Canadian Dollar, heavily dependent on the commodity sector depressed due to lack of demand across the supply chain. Despite gowning pains embedded in the core economy, the CAD/CHF embarked on a massive advance, assisted by market manipulation by the Swiss National Bank. Bullish momentum started to fade as this currency pair reached its resistance zone.

The Force Index, a next-generation technical indicator, provided Forex traders an early warning that the advance is vulnerable to a correction. As this currency pair initiated its breakout sequence, the Force Index started to contract, resulting in the formation of a negative divergence. This technical indicator has now moved below its ascending support level, as marked by the green rectangle, from where a breakdown below its horizontal support level is favored. Its descending resistance level adds to downside pressures in the CAD/CHF as bears are set to take control of price action with a push into negative territory.

Due to the exhausted upside in this currency pair, a breakdown below its resistance zone located between 0.74316 and 0.74557, as marked by the red rectangle, is expected to trigger a profit-taking sell-off. This will close the gap between the CAD/CHF and its ascending 38.2 Fibonacci Retracement Fan Support Level. Adding to bearish developments is the move in price action below its Fibonacci Retracement Fan trendline. With the safe-haven appeal of the Swiss Franc, an extended sell-off is pending.

Forex traders are recommended to monitor the intra-day low of 0.73865, the low of a previously reversed breakdown attempt. A push lower is anticipated to result in a wave of sell orders, adding net short-positions to the CAD/CHF. It will add the necessary downside volume to pressure this currency pair into its short-term support zone located between 0.73301 and 0.73527, as marked by the grey rectangle. A new fundamental catalyst will be required to extend the correction. You can learn more about a breakdown here.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.74300

Take Profit @ 0.73300

Stop Loss @ 0.74600

Downside Potential: 100 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.33

In the event of a breakout in the Force Index above its ascending support level, which currently acts as resistance, the CAD/CHF may attempt a reversal. With Covid-19 on track to cause more massive economic damage than currently priced into markets, the upside potential for this currency pair appears limited. Forex traders are advised to consider an advance as an improved short-selling opportunity. The next resistance zone awaits price action between 0.75156 and 0.75360.

CAD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.74800

Take Profit @ 0.75300

Stop Loss @ 0.74600

Upside Potential: 50 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.50