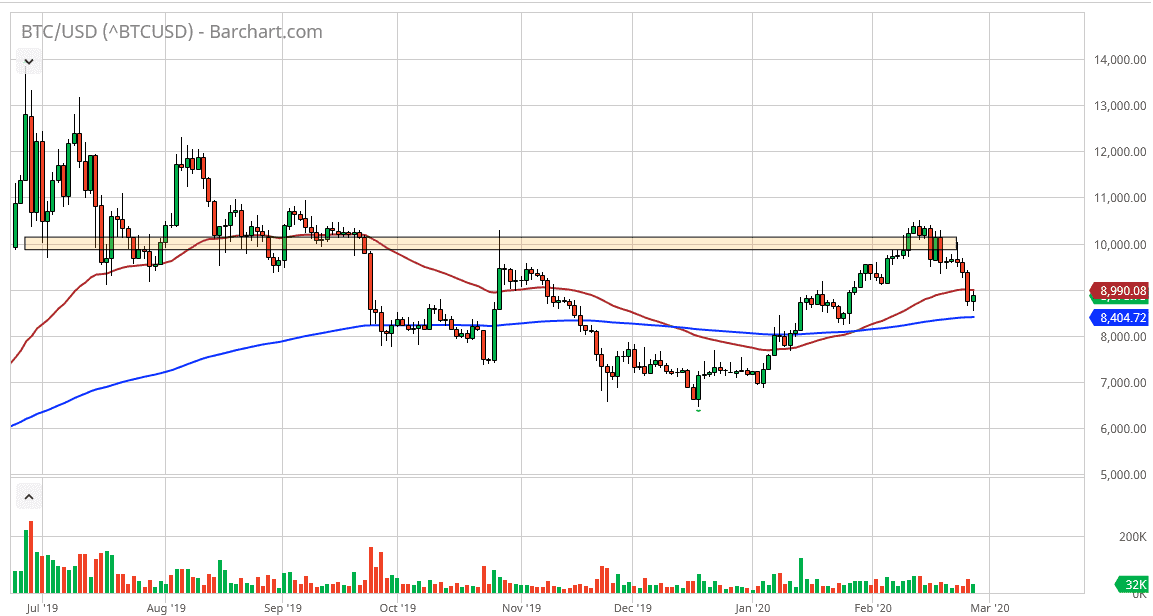

Bitcoin markets initially fell again on Thursday but found enough support just above the 200 day EMA to show signs of life again. The Bitcoin market had gotten a bit ahead of itself, so a bit of a pullback makes quite a bit of sense. The market has been a bit of a safe haven for those looking to get money out of particular nations, the most obvious one being China. Now that we have seen a massive selloff and perhaps bit of profit-taking, it does make sense that you would have to drop the way we have. The question now is whether or not the market will try to revisit the highs again. The fact that the market has bounced the way it has suggests that the market certainly has a lot of demand built in.

If the market breaks down below the 200 day EMA, then it’s likely that we could get a move towards the $8000 level, but right now it does look like we are at least trying to rally after a significant sell off, as one would expect. The $10,000 level above will continue to attract a lot of attention obviously, as it was the scene of a recent selloff and it is of course a large, round, psychologically significant figure. With that, even if we were to break out to the outside and go much higher, one would have to look at a pullback as a potential and necessary momentum building exercise. That momentum building exercise is going to be necessary in order to break through that significant barrier.

If the market does manage to break to a fresh, new high, it’s very likely that we then go looking towards the $11,000 level. Furthermore, the market could then go to the $12,000 level after that. At this point, I do believe that the buyers are trying to make a significant stand so therefore if we can break above the 50 day EMA it’s likely that more money will flow into this market. In fact, that’s my signal to start buying again. Going into the weekend it will be interesting to see whether or not there is enough risk appetite out there to invest in Bitcoin, but if there is it’s obviously a very bullish signal. At this point, I anticipate more buying than selling but I will look at the 50 and the 200 day EMA as crucial signals.