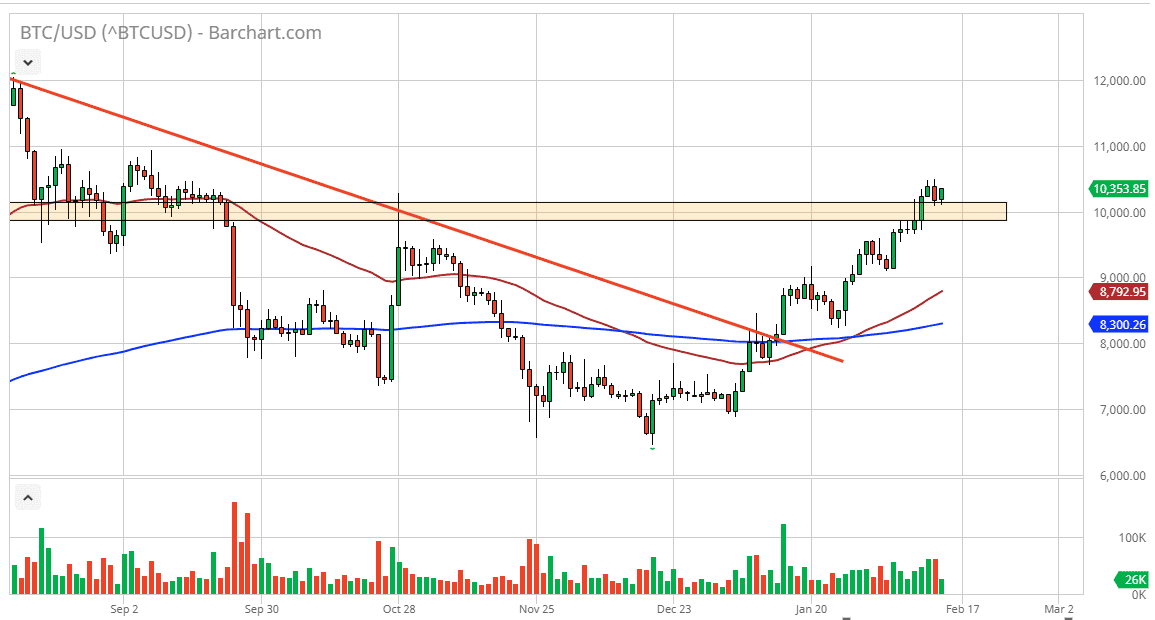

Bitcoin markets have not pulled back significantly from the $10,000 level but instead did something that is even more interesting for those looking to go along, it has gone sideways. After a huge move like we’ve seen in Bitcoin, the market is likely to continue to go higher eventually, but it’s quite common to see a pullback as value hunting will be what pushes the market higher. People simply chasing the trade to get involved. Having said that, the other alternative is to go sideways as the market digests gains and shows that there is still plenty of interest in this market.

Ultimately, this is a market that should eventually find buyers on dips as the $10,000 level was once resistance and it should now be support. The bounce could lead towards the $11,000 level given enough time, which is a large, round, significant number and an area where we have seen both buying and selling in the past. The $10,000 level course has a major amount of psychology attached to it, so at this point it’s likely that traders will continue to look at it as potential support. Furthermore, there are some fundamental reasons for Bitcoin to go higher.

Part of the main reason that Bitcoin has rallied lately is money flowing out of China. That is typical, as money flows out of the mainland in order to find safety somewhere else. Remember, China is a little bit of a different beast than most countries. For example, if you live in the United States you can simply remit money for a transfer overseas into the European Union in order to buy assets. However, the Chinese Communist Party restricts outflows of money when it comes China, and during the coronavirus that will certainly be the case. After all, there is an intense amount of pressure on the Chinese economy right now, and therefore people are looking to buy other assets which would be “safer.” However, if the coronavirus gets contained, it will be interesting to see what happens with Bitcoin at that point, because of it falls apart then we know that was the culprit. Otherwise, then you can add the halving in May as a potential driver as well. Nonetheless, right now the technical analysis certainly suggests that we are going to find buyers on dips. If the market was to break down below the $9000 level, then I think we flip back to a downtrend.