After the Reserve Bank of Australia kept interest rates unchanged at 0.75%, as was expected by markets, the Australian Dollar stabilized. The economy has been bruised by bush fires and the outbreak of the deadly coronavirus, which continues to spread with over 20,000 confirmed cases and a rising death toll. Despite the myriad of bearish fundamental developments, the AUD/USD stabilized inside of its support zone. Bullish momentum is expanding, favoring a breakout in this currency pair.

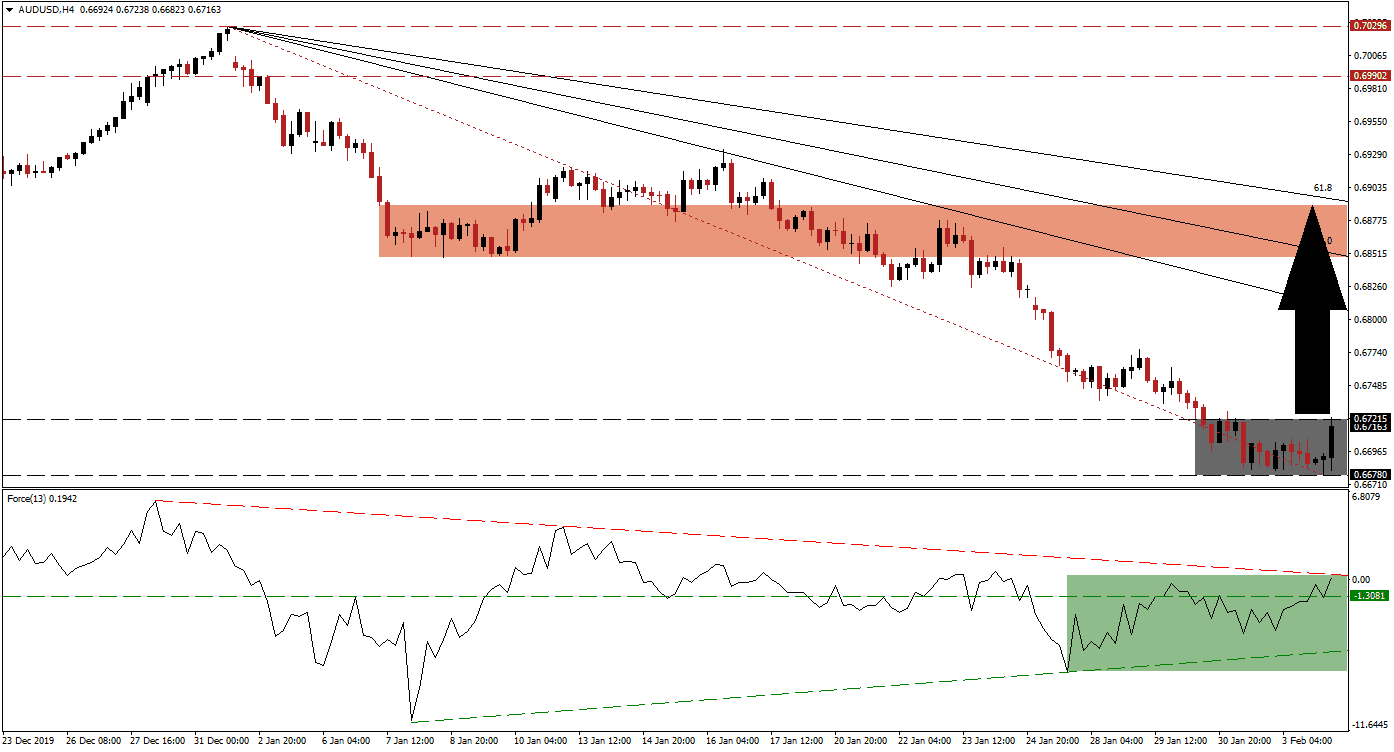

The Force Index, a next-generation technical indicator, provided the first signal that the sell-off is exhausted, exposed to a counter-trend move. As the AUD/USD continued its move to a four-month low, the Force Index advanced, allowing for a positive divergence to form. A series of higher lows led to the conversion of the horizontal resistance level into support, as marked by the green rectangle. This technical indicator has now moved into positive conditions, placing bulls in charge of price action, from where a push above its descending resistance level is anticipated.

Another bullish development emerged after price action moved above its Fibonacci Retracement Fan trendline. This occurred inside of the support zone located between 0.66780 and 0.67215, as marked by the grey rectangle. A breakout above this zone is likely to lead to a short-covering rally, closing the distance between the AUD/USD and its descending 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a short-covering rally here.

While fears regarding the economic damage of the coronavirus have ebbed at the start of this week, it remains premature to dismiss the threat to the global supply chain. One critical level to monitor in the AUD/USD is the intra-day high of 0.67763, the peak of a previous bounce off of the Fibonacci Retracement Fan trendline. A breakout should result in the net additions of new buy orders in this currency pair, fueling a rally. Price action will face its next short-term resistance zone between 0.68487 and 0.68891, as marked by the red rectangle. It is enforced by the 61.8 Fibonacci Retracement Fan Resistance Level.

AUD/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.67150

Take Profit @ 0.68850

Stop Loss @ 0.66700

Upside Potential: 170 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.78

In the event of a reversal in the Force Index, followed by a breakdown below its ascending support level, the AUD/USD is likely to attempt an extension of the sell-off. Given the improving fundamental outlook for the Australian economy, assisted by the improving technical picture, any breakdown attempt appears to be limited to its next support zone. This zone is located between 0.65525 and 0.65795, dating back to March of 2009, marking an excellent buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.66500

Take Profit @ 0.65650

Stop Loss @ 0.66850

Downside Potential: 85 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.43