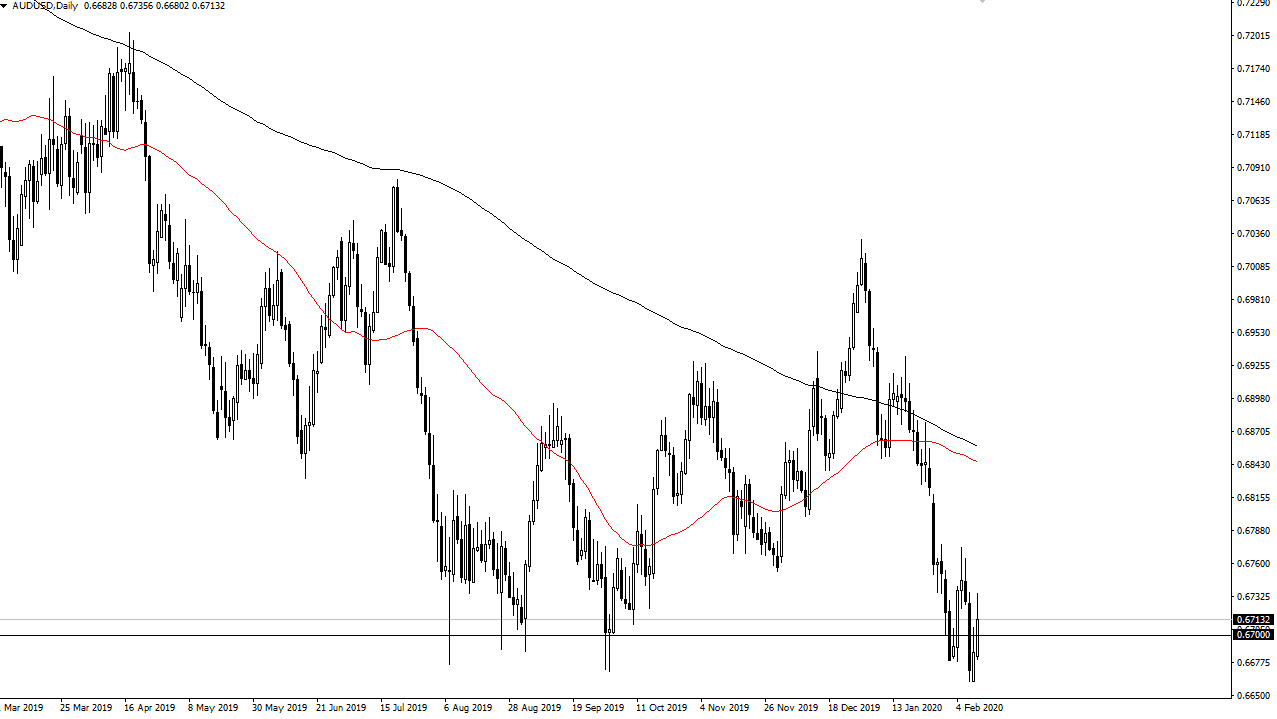

The Australian dollar has rallied to kick off the trading session on Tuesday, breaking above the 0.67 level yet again. The market breaking above that area is a good sign, but quite frankly there is enough resistance extending all the way to at least the 0.6775 level that should keep this market down. The end of the trading session was very negative, so it’s possible that we could pull back from here and continue to attack the lower levels. We have not made a “higher high”, so having said that we continue to chop around in general. The 0.67 level of course is crucial, because it is the top of the overall consolidation area that extends down to the 0.64 level that was such a prominent area during the financial crisis over a decade ago.

Part of the bounce may have been due to the fact that Chinese companies are starting to get back to work, albeit slowly. The idea of course is that China may need more in the way of commodities from the Australians in order to produce items. I think this might be jumping the gun a bit, but it is the thinking if nothing else. The RBA is likely to cut rates going into the future so that of course will weigh upon Australian dollar strength in general.

I believe that to the downside, the market could very well go looking towards the 0.64 level given enough time, but it isn’t going to be easy to chop through all of that messy trading. To the upside, if the market is to break above the 0.6780 level, then it’s likely to go towards the 50 day EMA above, which is currently near the 0.6850 level. The 200 day EMA is just above there, so I would have to assume that there is a lot of resistance built into that region. If we were to break above both of those moving averages, it could in fact be a bit of a trend change, but right now we need to see some type of good news coming out of China in order to see this market turnaround that directly and stringently.