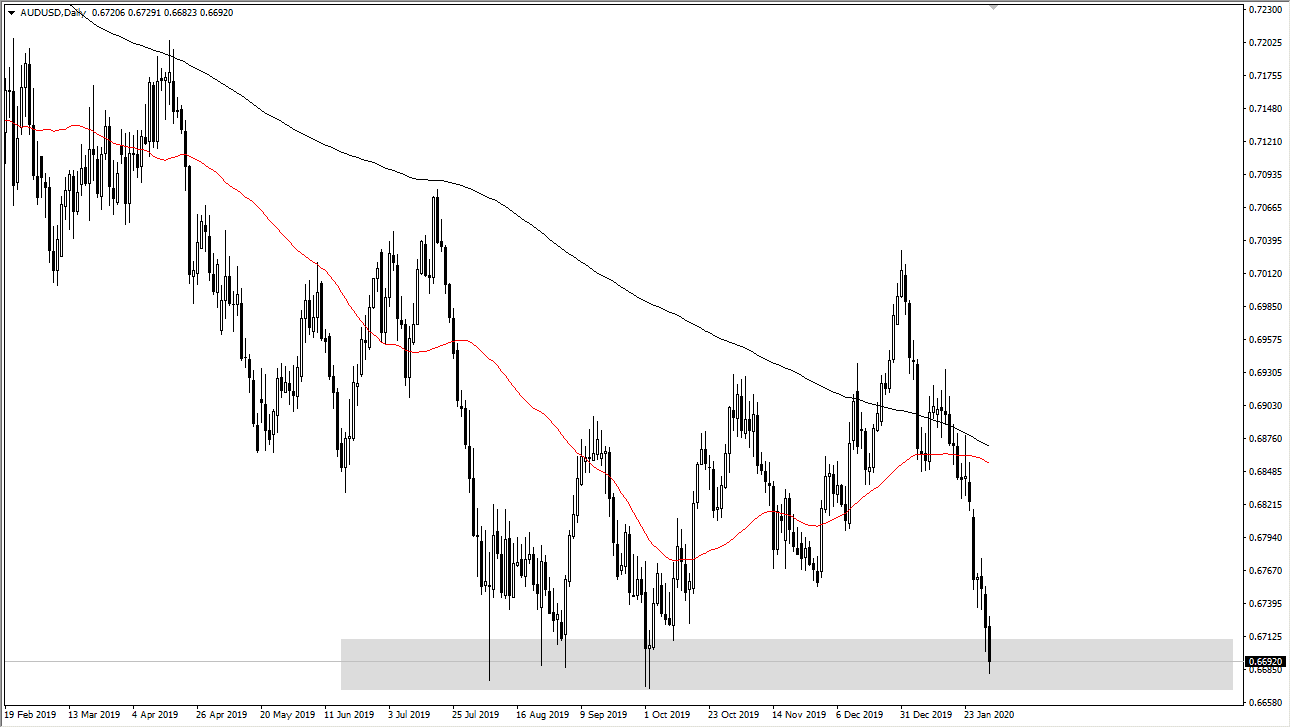

The Australian dollar has broken down significantly during the trading session on Friday, slicing through the 0.67 handle. At this point, the market is likely to continue to go lower and attack that level, but we are at such an extreme low right now that a bounce isn’t exactly out of the question. The 0.67 level is the beginning of massive consolidation that goes back to the financial crisis from over a decade ago, as it shows an area where the Australian dollar tried desperately to find its footing. I think we are at the same point now, but we probably have some negativity to go going forward.

Ultimately, this is a market that is going to continue to react to the entire coronavirus situation in China, as the headlines continue to cause quite a bit of fear in the market. Remember that the Australian dollar is a representation of the Australian economy, which of course is a major exporter of copper, which is getting absolutely crushed. Ultimately, the Chinese consumer 54% of the world supply of copper, so if industry and China starts to slow down, then obviously has a huge knock on effect when it comes to Australia.

If the market does bounce, it’s going to be a long, hard road to recovery for the Aussie, but sooner or later we should get some type of turnaround going forward. We are quite a way from that event though, probably coinciding with the coronavirus being eradicated or at least stabilize. Right now, and it looks like we are a long way away from that happening, so I think it’s likely that the Australian dollar continues to struggle and continues to offer a “sell on the rallies” type of situation.

That being said, I think there is a lot of noise out there just waiting to happen, so rallies that do occur will probably continue to see headlines that conflict whenever scenario the market is buying at the moment. I also anticipate that there will be a huge flow of news over the weekend, which of course is going to cause quite a bit of volatility. Ultimately, this is a market that I think probably has further down word pressure just waiting to happen, as volatility is almost always a negative thing unless there is some type of huge positive announcement. I highly doubt we are going to get that over the next few sessions.