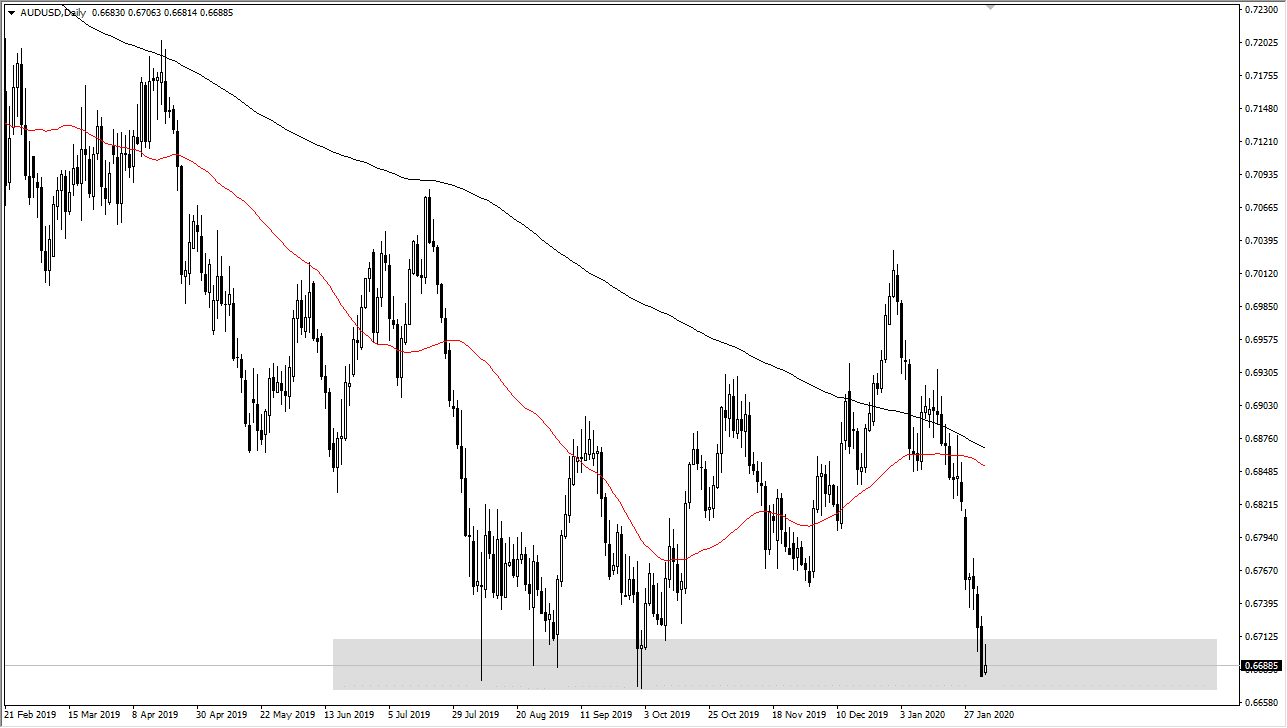

The Australian dollar has been extraordinarily negative for some time, and right now it looks as if we are getting ready to test an extraordinarily crucial level underneath. Remember, the Australian dollar is highly sensitive to all things China related and it should be noted that the Chinese manufacturing sector is still under assault as manufacturing continues to slow down. There are plenty of factories still closed due to the coronavirus, and that doesn’t look like it’s going to change anytime soon. With that it’s very likely that we will continue to see the Australian economy taken on the chin. After all, the Australian economy is highly sensitive to the input demand of the Chinese factories, as they are a major supplier of copper, iron, aluminum, and the like.

To the downside, the 0.6650 level is offering short-term support, but if we were to break down below there it’s likely that the market will go looking towards the 0.65 handle. It should be noted that the area underneath is the area that the market had been trading in during the financial crisis, so we are most certainly getting a bit overextended to the downside from the longer-term perspective. That doesn’t mean that we can’t go lower, but it should be noted that we are most certainly late in the move.

That being said, the Australian dollar will still be at the hands of the coronavirus. As long as that’s a major issue, the Australian dollar will continue to suffer. That being said though, if the coronavirus does start to get under control, the Australian dollar is probably one of the first places that currency traders will start to put money. That being said, a retaking of the 0.67 level was a good sign initially during the trading session, but as you can see, we could not break out for any significant amount of time. The candlestick for the day it looks a lot like an inverted hammer, and that of course is not a good sign. Having said that, we are at extreme lows so good news could come into play. Otherwise, a break down below the 0.6650 level opens up the next 50 pips, and so on. I have no interest in trying to buy this market, at least not until we get a daily candlestick that engulfs this candlestick, and decidedly so.