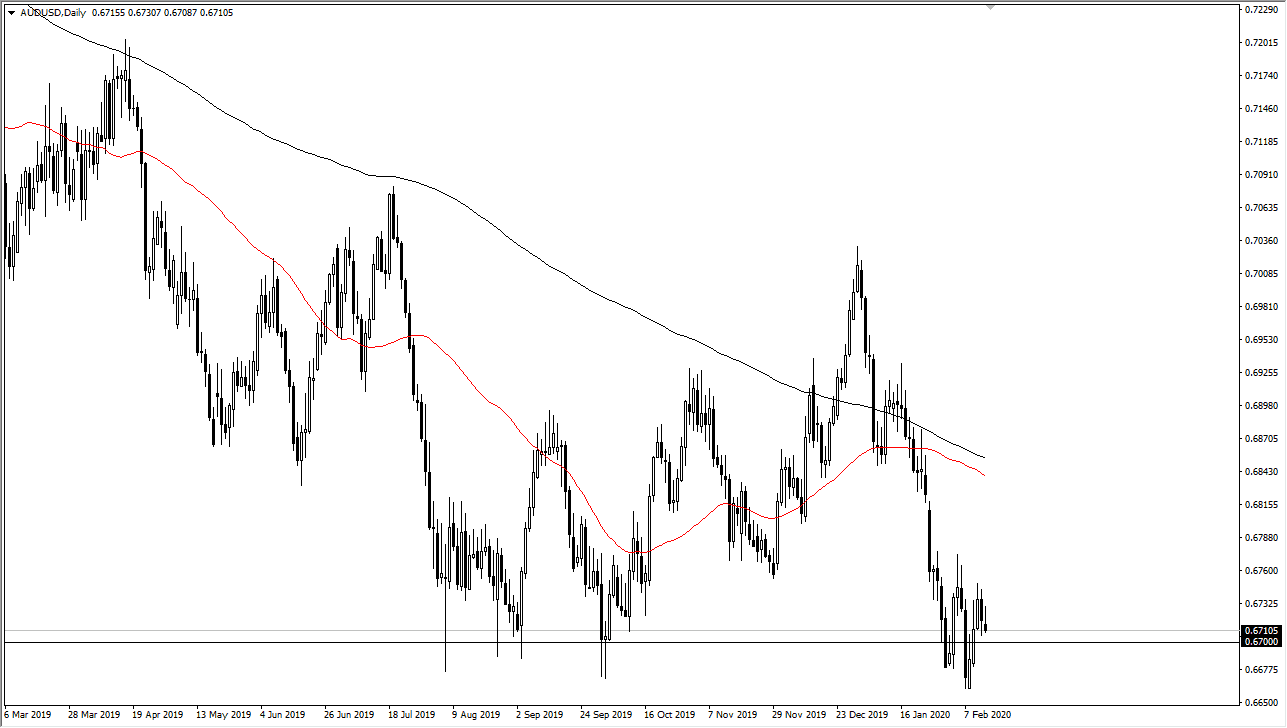

The Australian dollar initially tried to rally during the trading session on Friday but gave back the gains a turnaround and form a bit of a shooting star. Ultimately though, we are testing a major support level in the form of the 0.67 handle, an area that is a large, round, psychologically significant handle. Because of this, I think it will continue to attract both buyers and sellers, but you should also keep in mind that the area below that level is extensively the consolidation range that we had traded in during the financial crisis well over a decade ago.

The bottom of that range goes down to the 0.63 handle, so there is an area below that I think longer-term traders will be looking at as a potential buying opportunity. After all, the coronavirus can only go on so long and eventually the Chinese economy will turn around. The Australian supply China with most of their raw materials so it makes quite a bit of sense that it will move right along with China as per usual. The US dollar has been very strong but might possibly be a little bit overbought at this point, so that’s another reason that we could bounce from here. If the market was to break above the 0.6775 handle, it’s likely that the market goes looking towards the 50 day EMA and the 200 day EMA above on its way towards the 0.70 level.

Ultimately, I think this could be a nice buying opportunity given enough time, but you will need to see a certain amount of resiliency in this area. I will be looking at the weekly chart for that scenario, but right now we don’t quite have that set up. Breaking above the 0.6775 level would break the top of an “inverted hammer”, which of course in and of itself would be a signal to start buying. As far as falling from here, it’s very likely that we could but I believe it’s probably better off to sit on the sidelines and to try to get cute selling at what should be the overall bottom. In the short term I expect to see a lot of volatility and back and forth, so keep in mind that the market could cause some issues and could drop, but I believe at this point it’s going to come down to the coronavirus and whether or not China can come out of that. If it does, that could be the catalyst to finally go to the upside as China will have huge demand for Aussie commodities.