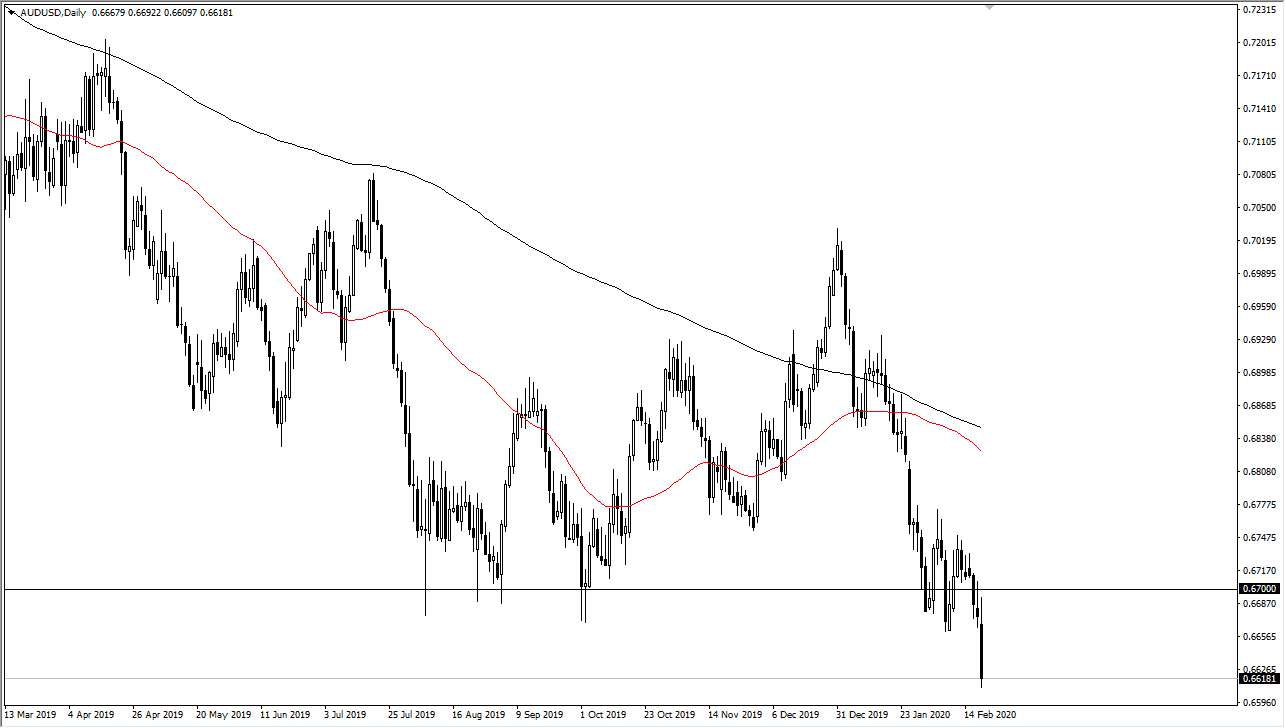

The Australian dollar traded between the 0.67 level and the 0.63 level during the financial crisis 12 years ago, and it now looks as if we are ready to go back into that area again. Ultimately, the market breaking down the way it has during the trading session on Thursday was a sign that we are ready to go much lower and could have been kicked off by the People’s Bank of China cutting interest rates early in the session. Indonesia also cut interest rates, so that gives people an idea that perhaps the entire region is going to have to loosen monetary policy in order to fight the effects of the coronavirus and the slowing down of economic growth.

Keep in mind that Australia is highly levered to the Chinese economy, so it makes sense that this currency pair moves mainly upon Chinese headlines. The Reserve Bank of Australia has recently suggested that perhaps interest rate cuts are coming, and therefore I believe that traders are trying to get ahead of the curve when it comes to the Aussie. All things being equal, this is a market that looks as if it is ready to continue lower, kicking off the next leg of selling. Ultimately, I do believe that we go looking towards the 0.63 level, but it may take some time to get there.

I will be watching longer-term charts of course, because this is also an area that should offer support for a turnaround eventually. In the short term though, it certainly doesn’t look like that’s going to be the case. The US dollar continues to be strengthened by the global situation, which doesn’t seem to be getting any better anytime soon. The acceleration to the downside is quite impressive, but you can see that the market had been trying to break down through the support level for a couple of weeks, and now we have finally done so. I anticipate that short-term rally should offer selling opportunities going forward, as there is no real reason for the market to turn around quite yet. The market will need to see some type of good news out of China for the Aussie to turn around. We are probably quite away from that as the trade war tariffs and the coronavirus have provided a “one-two punch” when it comes to all things China related.