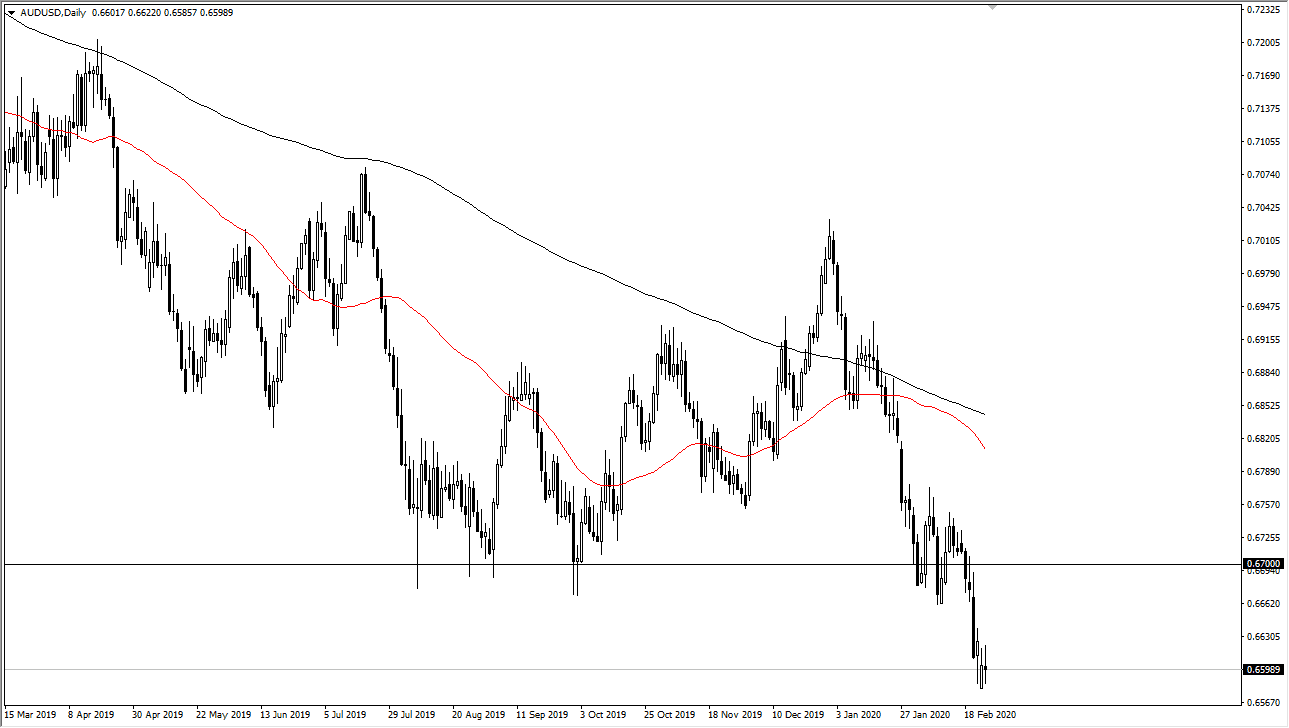

The Australian dollar continues to sit still at an extremely low level, as the market has done almost nothing for the last couple of days. Granted, the market has chopped around quite a bit, but it hasn’t made any definitive moves. I don’t expect that to be easy for the Australian dollar to change things right now, but at this point the 0.67 level above is the ceiling so I simply look for opportunities to sell yet again. China and by extension the rest of Asia still suffers with the virus in everything you shut down, so there’s very little hope of the Australian dollar gaining for a significant move. However, we are at a major support area that extends down to the 0.63 level. There are people out there waiting to see whether or not this major area holds as support. In other words, we are going nowhere anytime soon.

The Australian dollar is highly tethered to the Chinese economy and the outlook for that part of the world of course is rather bleak. Ultimately, this will continue to be an issue for the Aussie, because not only do we have that issue, but we also have to worry about the fact that the Reserve Bank of Australia is likely to continue looking at potential rate cuts. This will be especially true if the coronavirus situation continues much longer. Both Australia and China were hurting before this happened, and this most certainly has not helped the entire scenario.

At this point, rallies are to be sold and I think that will continue to be the way that the Aussie trades. The 0.63 level underneath is the bottom during the financial crisis 12 years ago, and a breakdown below that level would be extraordinarily negative to say the least. I don’t see that happening, but I also don’t see a reason for this market to go a lot higher from here. If it does break above the 0.6775 handle, then I’d be willing to have a go at a long position, but right now I think you are looking at short-term volatility that should be sold into at the first hints of strength, as the Aussie simply cannot get off of its back. Furthermore, the US dollar represents safety and there has been a rush into the treasury markets as of late. I remain negative of this pair but recognize that on a longer-term chart we may eventually form a signal that cannot be argued with.