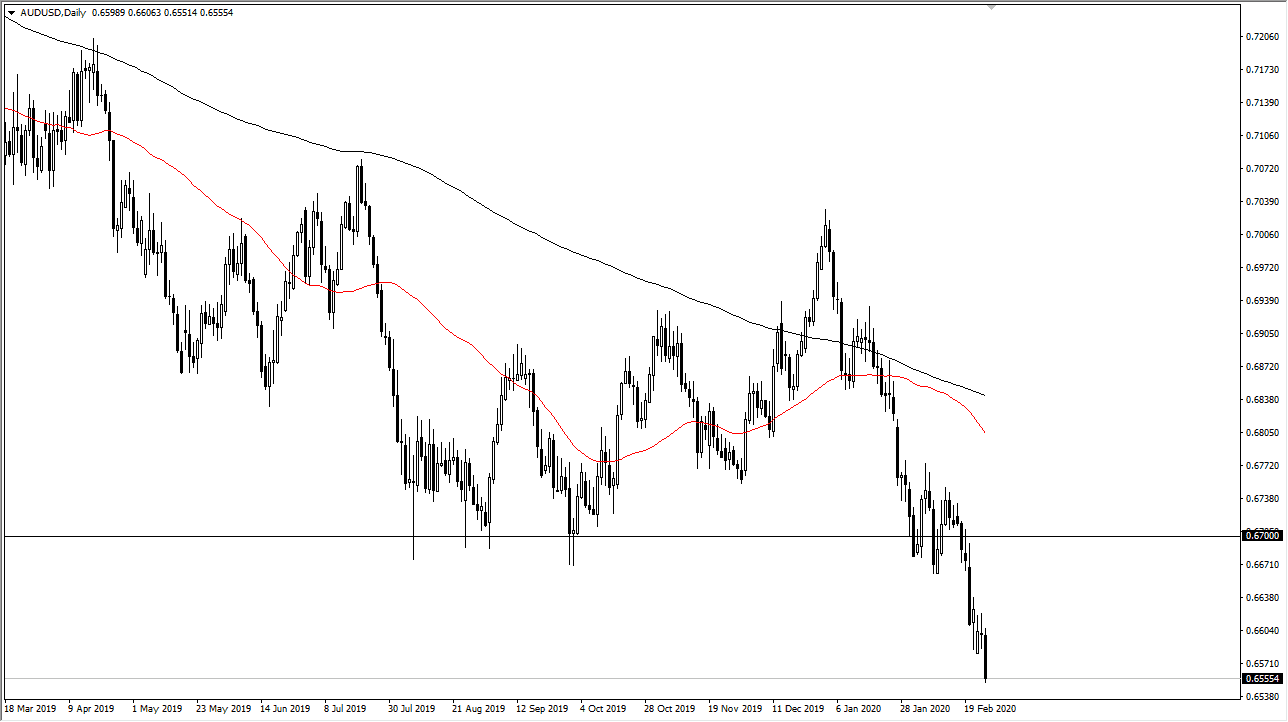

The Australian dollar is likely to continue breaking down, as we have sliced through the recent support level. The fact that the market has closed that the very low of the day suggests that the Australian dollar still has more room to run to the downside. That being said, the market is a bit overextended to the downside so don’t be surprised at all if we see some type of short-term rally. That rally should offer selling opportunities, as the US dollar of course is going outperform the Australian dollar when there are concerns about coronavirus and of course the Reserve Bank of Australia likely to cut interest rates in the short term doesn’t help either.

Ultimately, I look at the 0.66 level as a small resistance barrier, and the 0.67 level should also offer resistance. I believe at that level you will see much more selling, so if we were to break above the 0.6775 level, then it’s very likely that the market could break out to the upside, reaching towards the 0.69 level, and then possibly even the 0.70 level.

To the downside, I anticipate that the market is going to see a move down to the 0.63 level, which is the bottom of the range from the financial crisis bottom. That being the case, it’s obvious that we have a very depressed Australian dollar currently, so therefore it is worth noting that we need some type of bounce to take advantage of. Granted, we could break down right away but it’s likely that some type of bounce will probably try to present itself. I think at this point the fact that the market is closing so low on the range tells me that we could very well see continuation, but again markets can’t go in one direction forever.

At the 0.63 level, it’s very likely that we will see some type of an attempt to bounce but if we break down through their it’s very possible that the next place, we would be looking at is the psychologically important 0.60 level. That of course will be a huge battle, and it’s hard to imagine that we break down below there. That being said, we do have a way to go but the Australian dollar will eventually offer value that we can take advantage of. That hasn’t happened yet, and we aren’t looking at it right now. Fade rallies that show signs of weakness.