The Australian dollar has initially tried to rally during the trading session on Monday but gave back the gains as traders continue to show on the Aussie dollar in general. Ultimately, the market is looking at the Reserve Bank of Australia cutting interest rates in the future, and then should continue to weigh upon the Australian dollar. While I do believe that the Australian dollar will eventually find a bottom somewhere in this general vicinity, the short term still looks very negative.

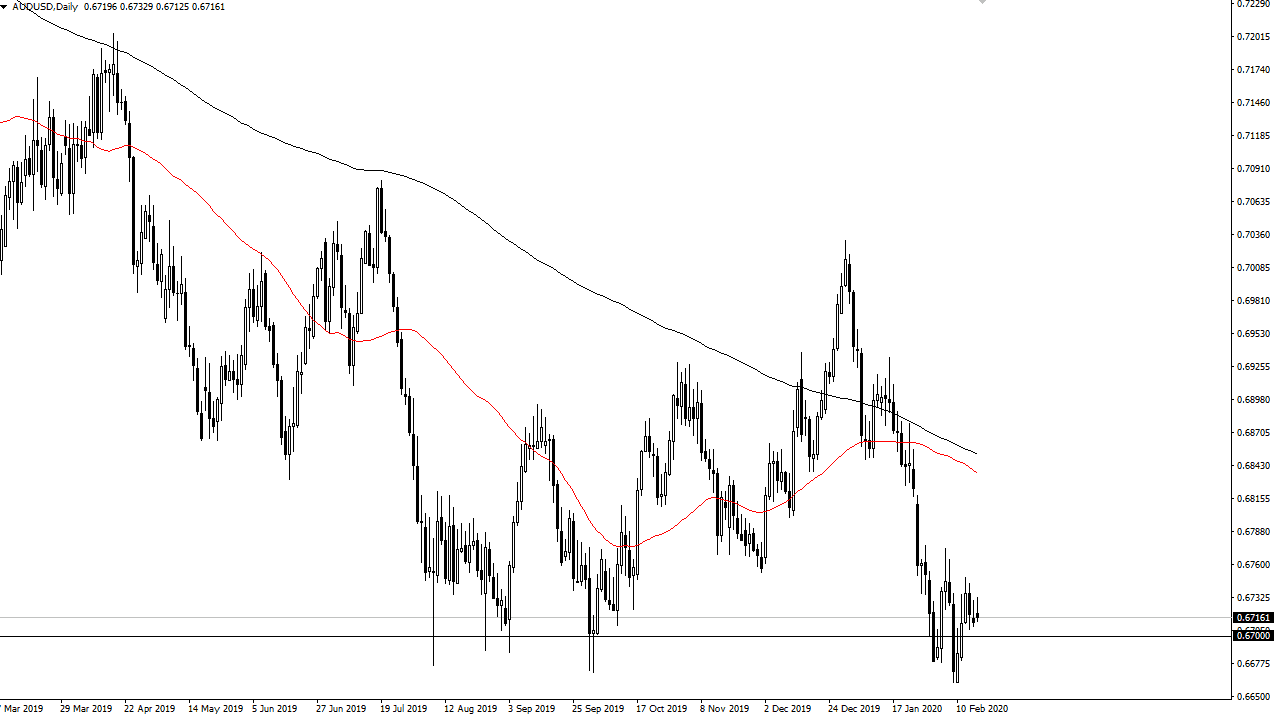

You will notice that I have the 0.67 level marked with a horizontal line. That is essentially the beginning of consolidation down to the 0.63 level from the financial crisis. I would also point out the fact that we have tried several times to break down through this area and are making lower highs. This tells me that we are very likely to see this market continued to find sellers, and with the central bank in Sydney looking to cut rates in the future or at least likely to do so, the market will continue to favor the greenback in the short term. Ultimately, the Australian dollar is highly sensitive to the Chinese economy, and of course it is struggling at the moment. All things being equal, this is a market that will continue to favor the greenback, due to the fact that the US economy is far outperforming Australia and will continue to do so as long as coronavirus is an issue in China.

All of that being said, we are probably getting close to word to the end of the panic phase, so it’s likely that the market will slow down its selling of the Aussie. However, if the negativity out of China continues to accelerate, then we will most certainly see this pair get hammered. I do believe that although we are likely to go lower, the area between now and the 0.63 level is very noisy so I would expect the move lower to be very choppy to say the least, and therefore not as easy. If you are looking to sell the Australian dollar, you may find it easier to do against other currencies and markets that it has it been oversold in. This could include the Japanese yen or perhaps even the Swiss franc. Nonetheless, it’s very difficult to be a buyer of this pair until we break above the 0.6775 handle, which probably opens up the door to the 0.6875 level afterwards.