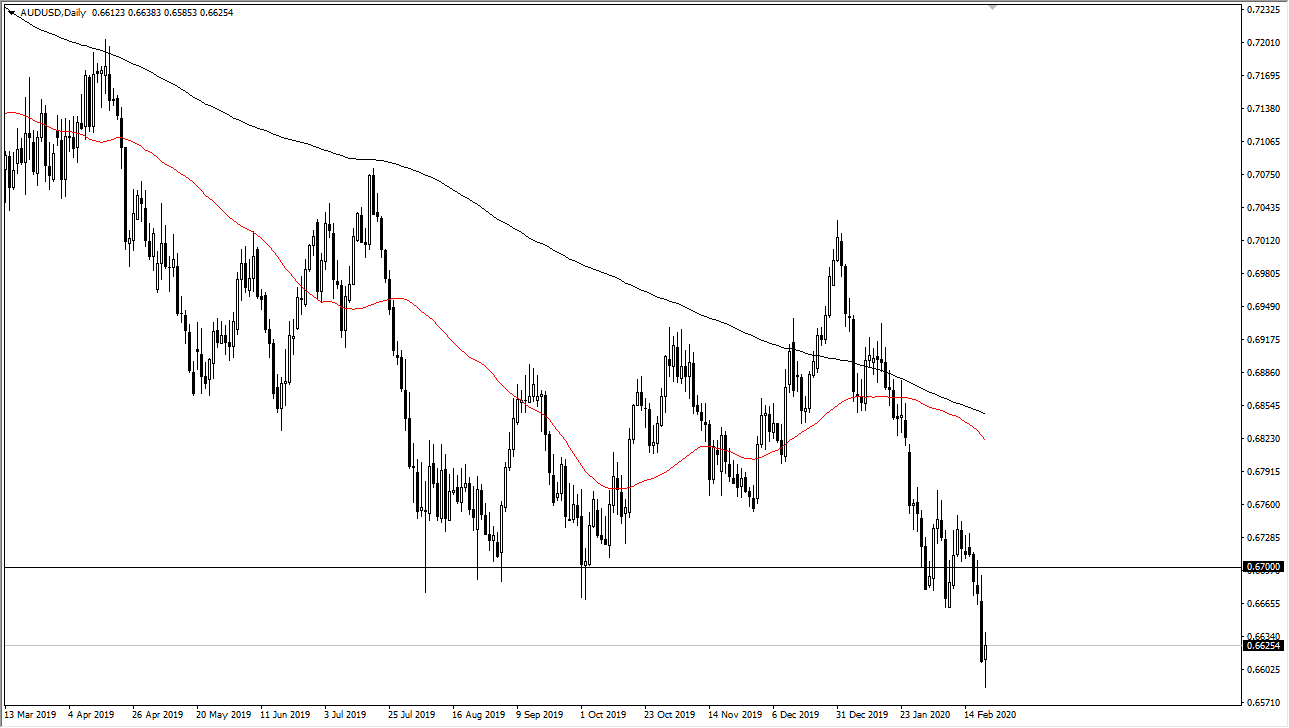

The Australian dollar went back and forth during the trading session on Friday, initially dipping lower but turning around to form a bit of a hammer which is a slightly bullish sign. That being said though, I don’t think that the Australian dollar is something that you should be buying, rather it is something that you should be looking towards the higher levels in order to start selling. Some sign of an exhaustive candlestick near the 0.67 level would be more than enough of a reason for me to start selling as the Australian dollar is highly sensitive to the Chinese economy. The Chinese economy is of course getting hammered due to the coronavirus outbreak, and therefore it’s very likely that the market is simply taken a bit of a break and looking to start selling off yet again.

From a longer-term standpoint, I believe that the market is likely to reach down towards the bottom of the consolidation area just below that had formed during the financial crisis, meaning that the 0.63 level would be tested. If we were to break down below there, then the Australian dollar will completely fall apart. I would need to see some type of massive switch in the overall global situation to make that happen. Yes, the US dollar has been strengthening quite a bit, but one would have to think that the market is trying to find a bit of a floor for the longer-term move.

The outbreak of coronavirus has started to pick up outside of China, so that of course isn’t going to help the situation either. Remember, the Australian dollar is considered to be a “risk appetite based currency”, meaning that as more cases pop up in places like Japan and Korea, people start to think whether or not those economies are going to be looking at picking up any type of commodities coming out of Australia. I think that is essentially a situation that is very anti-Australia, but especially the Australian dollar versus the US dollar. Rallies are to be sold, and I’m waiting to see some type of exhaustive candle after this short-term pop to take advantage of. If we break down below the bottom of the candlestick for the Friday session, that does open up a selling opportunity down to the 0.63 handle again. The 0.65 level will more than likely cause a bit of support as well, but clearly the market is still very negative.