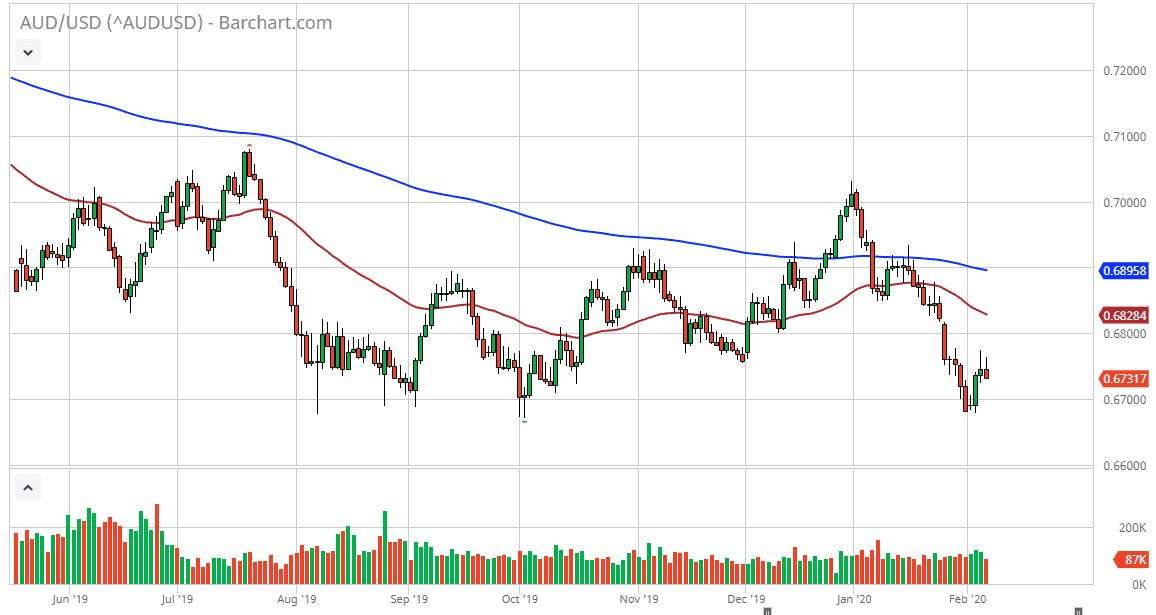

The Australian dollar has initially rallied during the trading session on Thursday but gave back the gains in order to form a less than impressive candlestick. Ultimately, this is a market that should find quite a bit of support now the 0.67 level, but if we do break down below there then the market is going to continue grinding lower. That being said, the 0.67 level is the top of an overall consolidation area that goes back to the day is during the last financial crisis. In other words, we are at extremely oversold conditions.The Australian dollar continues to suffer at the hands of the coronavirus, as it has all but shut down the Chinese economy. The Chinese economy demands a lot of exports coming out of Australia, and that of course drives up the value of the Australian dollar. That being said, if we do continue to see trouble in China then we could get a bit of a breakdown. Longer term though I believe that there is a significant amount of support near the 0.67 level so I don’t anticipate that we will break through there very easily.

The alternate scenario of course would be to turn around a break above the top of the shooting star from the session on Wednesday, which could open up the door towards the 0.6850 level. The 50 day EMA is just below there sloping lower, turning things much lower. That should give an opportunity for sellers to get involved as well. I do believe that eventually the Australian dollar is trying to turn things around, but if we are in fact trying to change the trend it’s very messy to say the least as trend changes involve a lot of money being reversed. I don’t know that’s the case, but we are most certainly in an area where we could see that happen. However, the next couple of days will probably feature volatility with more of a negative slant, especially if the jobs number in the United States comes out much stronger than anticipated. Short-term trading is probably about as good as this gets right now.