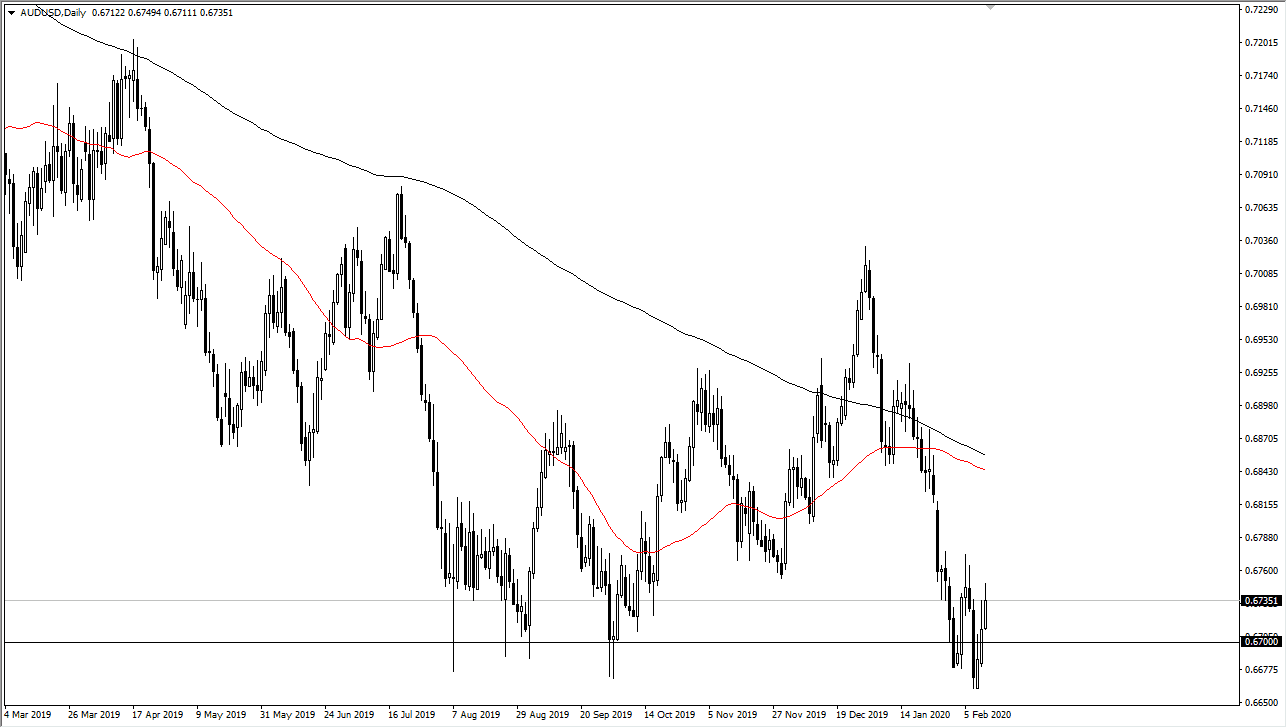

The Australian dollar rallied significantly during the trading session on Wednesday, as traders continue to try to test whether or not the “all clear” is sounded. Having said that, the US dollar is by far the strongest currency out there, but you should also pay attention to the fact that new cases of coronavirus seem to be slowing down in China and that is a major driver of what’s going to happen in Australia. The Chinese are the biggest customers of the Australians when it comes to exporting raw materials. With that being the case, it’s very interesting to see that correlation show itself yet again. At this point, the 0.66 level looks 0.67 level looks to be rather important, which makes quite a bit of sense considering that it was the top of the consolidation during the financial crisis.

If this market is going to continue to trade around this area, you could get value hunters in this general vicinity. However, if the market was to break above the 0.6775 handle, then that’s when we start to see a bit of bullish pressure come in. This will also be in perhaps a bit of front running ahead of any type of Chinese recovery. However, it wouldn’t take much in the way of a scare to send this market lower.

What is a bit interesting at this point is that the Australian dollar seems to be moving right along with WTI Crude Oil, and Brent Crude, as the correlation between these markets is rather high. It’s all about China at this point, so it will be crucial to see whether or not the Asians can break this thing out. If they don’t, then we probably go looking towards the 0.67 handle again, where we will continue to consolidate. A fresh, new low could be rather drastic as it could send this market back into that financial crisis consolidation region, meaning we could go as low as 0.63. That being said, I do think it’s only a matter of time before value hunters come back in and pick up the Aussie for a longer-term trade. I believe this point the market is trying to stabilize itself, but it will be a longer-term effort.