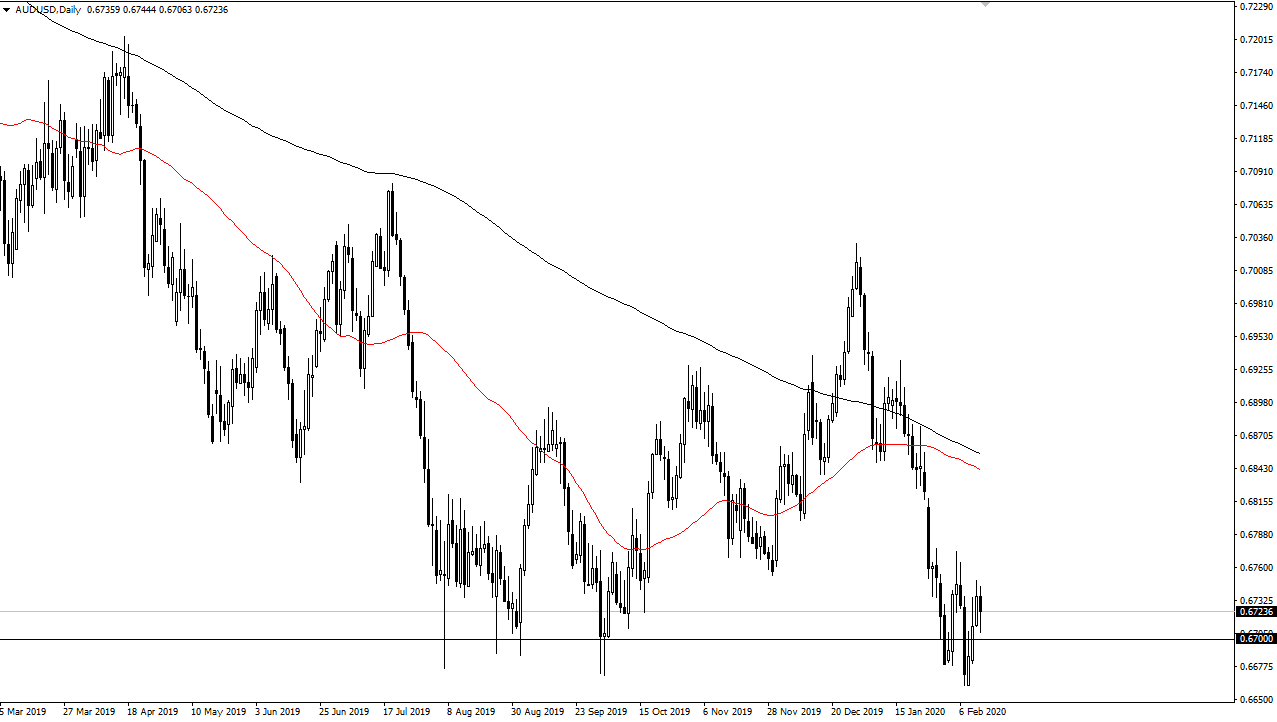

The Australian dollar has fallen a bit during the trading session on Thursday but continues to find buyers as we approach the 0.67 handle. This is an area that is important on the longer-term chart as it is the top of the overall consolidation area that we had seen in the realm of the crisis 12 years ago. In other words, the Australian dollar is at extraordinarily low levels, but I would also point out that there are a lot of concerns when it comes to China and as long as that is the case, the Aussie is going to struggle.

Keep in mind that the Australian economy is highly levered to the Chinese manufacturing and construction industries, as it supplies iron, copper, aluminum, and many other industrial hard commodities. With that in mind, it makes sense that the two economies are highly sensitive to each other. With the Chinese going through the US/China trade war, the Australians were basically taking it on the chin as it hurt the economy on the mainland China. Add in the coronavirus break out, and then it makes sense that the Australian dollar has been crushed recently. Having said that, it does look likely that the market is trying to find a little bit of a base here due to the fact that the Chinese seem to be getting aggressive fighting the virus itself and perhaps we are starting to see the market react to that as such.

Further exacerbating this pair declining is the fact that the US dollar has been strengthening as the US economy is so much stronger than the rest of the world. That being said though, the market looks like it is trying to turn things around, although it is going to be a very messy proposition. Trading a trend change is very difficult and I do think that we are getting relatively close to one. In fact, I believe if it weren’t for the coronavirus, we would have already seen that massive turnaround as markets are forward-looking and not trading what’s going on in the present. Overall, the market is searching for a bottom, but this always tends to be very difficult. Short-term pullbacks could offer buying opportunities, but you need to do so in very small bits and pieces. Building up a core position is probably the best way to trade this market, and you will need to be able to stomach a lot of choppiness.