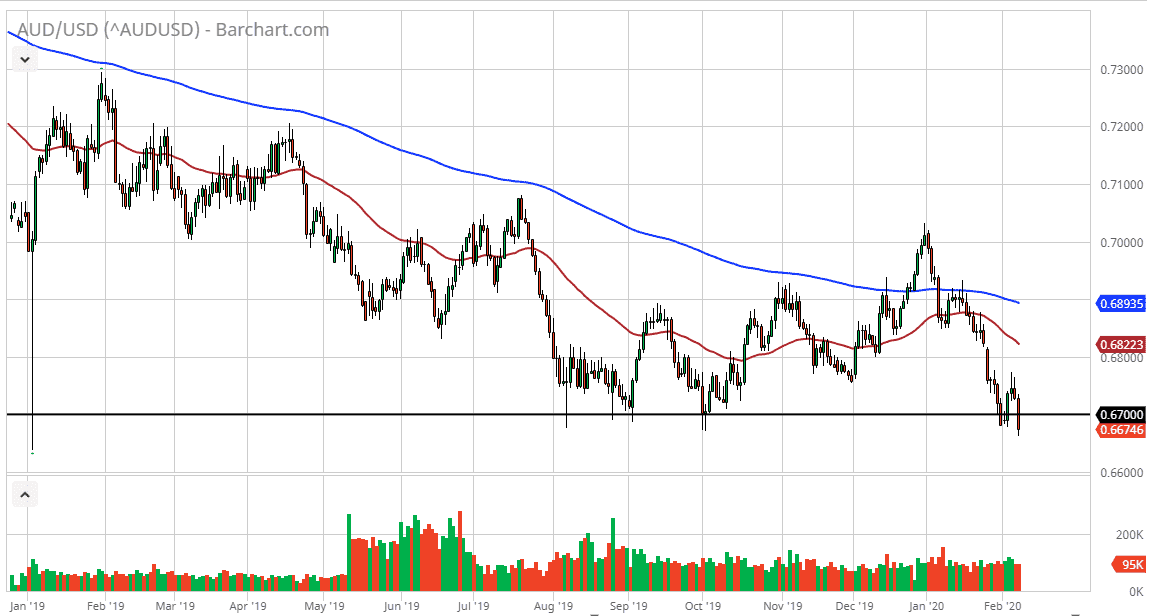

The Australian dollar has broken down significantly during trading on Friday, as we continue to see a lot of bearish pressure in this pair. This makes a lot of sense, because the coronavirus continues to ravage the Chinese mainland and therefore it makes quite a bit of sense that there are concerns about demand for the Australian commodities that are such a huge part of the economic strength of Australia.

That being said, this past week we have seen the Reserve Bank of Australia suggest that perhaps rate cuts are in the future, although they did hold still this time. Ultimately, this is a currency that looks as if it is going to test the lows of the financial crisis from over a decade ago, that means that we could go as low as 0.64. The Australian dollar continues to get hammered and at this point I don’t see any type of relief until the Chinese coronavirus situation gets under control. After all, the Chinese economy was already slow, and now things have gotten even worse. In other words, copper, iron, and other exports out of Australia will more than likely grind to a halt.

To the upside, if we break above the couple of shooting stars from the middle the week, it could open up the market for a move towards the 50 day EMA, but it seems very unlikely for that to happen without some type of news catalyst. With that, I like the idea of fading short-term rallies, and most certainly selling a break below the bottom of the candlestick for the Friday session. Speaking of which, one of the main reasons why we did break down further in my estimation is the fact that we were going into the weekend, and a lot of traders will more than likely have taken profits in case of headlines coming out while the market was closed.

I do believe that eventually there will be an opportunity to buy the Australian dollar for a huge move that lasts several years, but we aren’t there yet. If it wasn’t for the coronavirus, we may have seen it but since that’s not the case we have to trade the market we are given, and it most certainly favors the downside at this point. Beyond that, the US economic numbers continue to outperform the rest of the world, so that of course continues to push money into the greenback.