The Australian dollar has rallied quite significantly during the trading session on Tuesday, after the Reserve Bank of Australia decided to keep its rates on hold. The statement suggested that although there was a certain amount of concern at this point, the RBA was willing to sit back and wait for hard data to come through concerning the “Phase 1 deal” between the United States and China, as well as the coronavirus which both have had a massive effect on this economy.

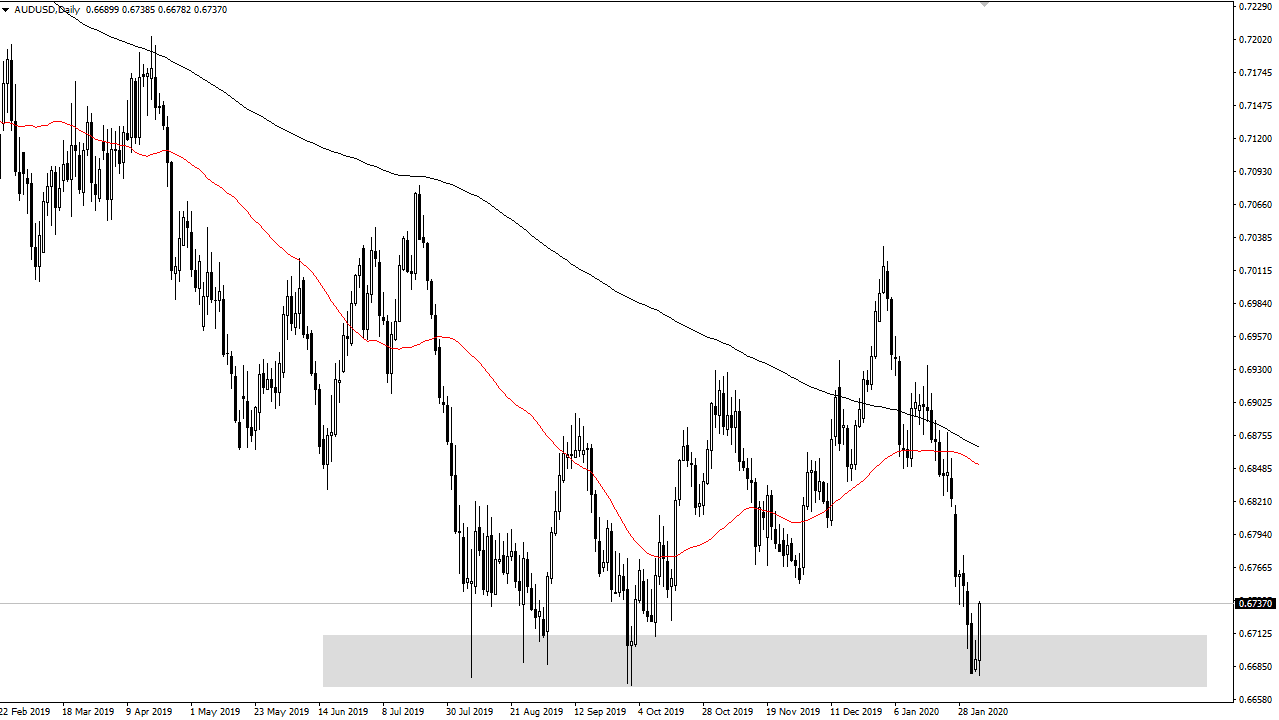

The bullish candlestick formed right at where we had seen a couple of loads previously, so this is a sign that the market is in fact paying attention to the 0.67 level, which coincidentally is the top of the range that the market had traded in during the financial crisis. With that in mind, we are obviously very historically cheap when it comes to the Aussie dollar, so that should be in the back of your mind when you look at this chart.

It was completely “risk on” around the world during the trading session on Tuesday so therefore the Australian dollar may have gotten a bit of an extra boost when it comes to the rally. Wall Street bought everything it can get its hands on, and therefore people are willing to step out and pick up more risk. Having said that, the Australian dollar is unfortunately very sensitive to news coming out of China, which at this point has not been very good. It is because of this that I think this bounce wound up offering a nice selling opportunity above, but I would be hesitant to put money to the downside in this market until there is some type of bearish candlestick on the daily chart to get me interested. Right now, I do not have that set up, but I recognize that the area right around the 0.6750 level is the initial hurdle that this market must overcome. If we were to see selling step back up in that area, then it’s very likely that the market will return to the 0.67 handle. Having said that, we are probably overdue a little bit of a relief rally anyway, so I anticipate that the next few candlesticks could very well be positive. Even so, the market is decidedly bearish so this rally should be kept in perspective as to where we have been over the last couple of weeks.