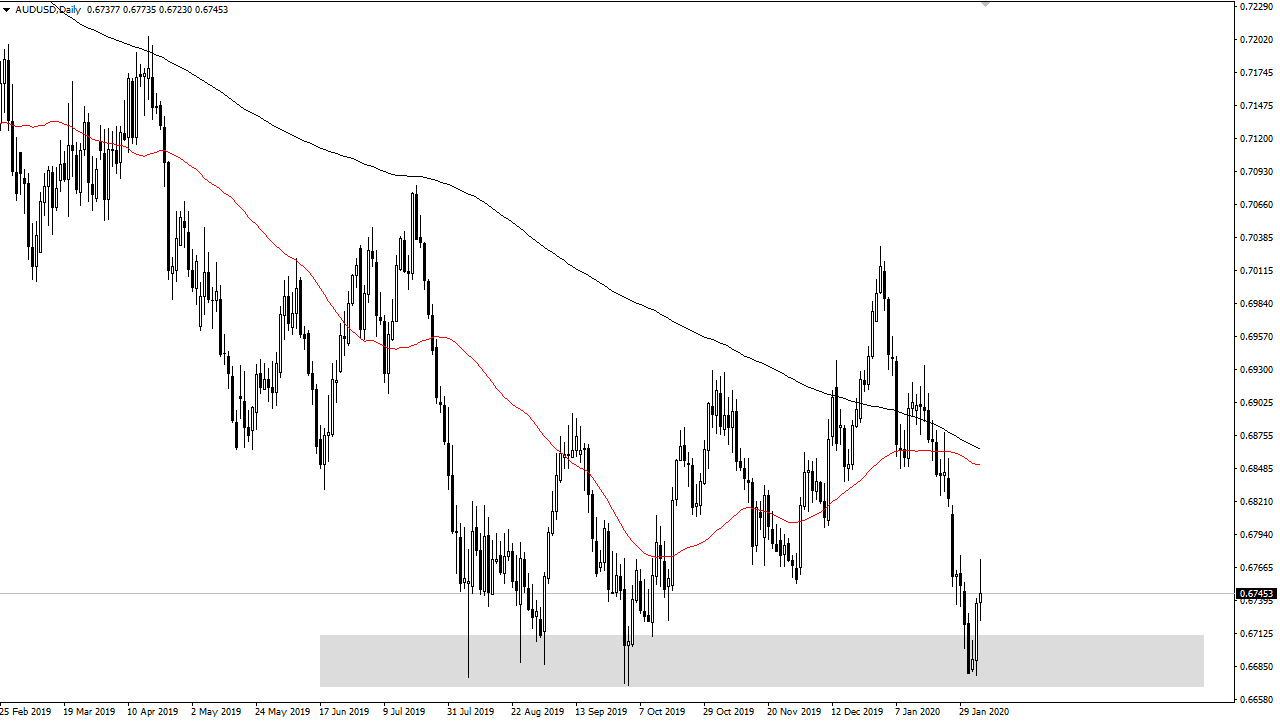

The Australian dollar has rallied during most of the trading session on Wednesday but found enough resistance near the 0.6775 level to rollover again to form a less than impressive candlestick. This suggests that perhaps it is going to take some work to finally break out to the upside but if we were to clear the top of this shooting star shaped candlestick, that would be a very bullish sign as it would show not only the daily resistance from Wednesday getting wiped out, but it would also show an area on the chart that looks as if there was more selling from historically around getting blown out as well.

Keep in mind that the market in general has bounced from a major support level underneath, which is the top of the consolidation range during the financial crisis 12 years ago. I still believe that the Australian dollar will recover in 2020, and recent comments coming out of the Reserve Bank of Australia by Gov. Philip Lowe have suggested that perhaps the economic conditions globally are starting to improve. Obviously, the most recent problem has been the coronavirus, and that has a direct effect on Australian exports to China. This should be a transitory issue though, and it is more than likely only a matter of time before the Chinese economy turns back over to positive momentum, and the Australian start supplying that very same economy with raw materials such as copper, aluminum, and iron. As China is Australia’s biggest customer, the Australian currency and therefore the economy is highly tied to mainland China.

Ultimately, this is a market that seems to have a lot of support at the 0.67 level so we will have to wait to see whether or not that can hold. It does look as if it is going to pull back a bit, and quite frankly even if we are trying to form a bit of a base it would make a certain amount of sense to get a little bit of a pullback as we are running against so much downward pressure. The market had been overstretched to the downside, and now it looks as if it is trying to form some type of consolidation region in this particular area to turn things around. That being said, this is going to continue to be a very noisy chart.