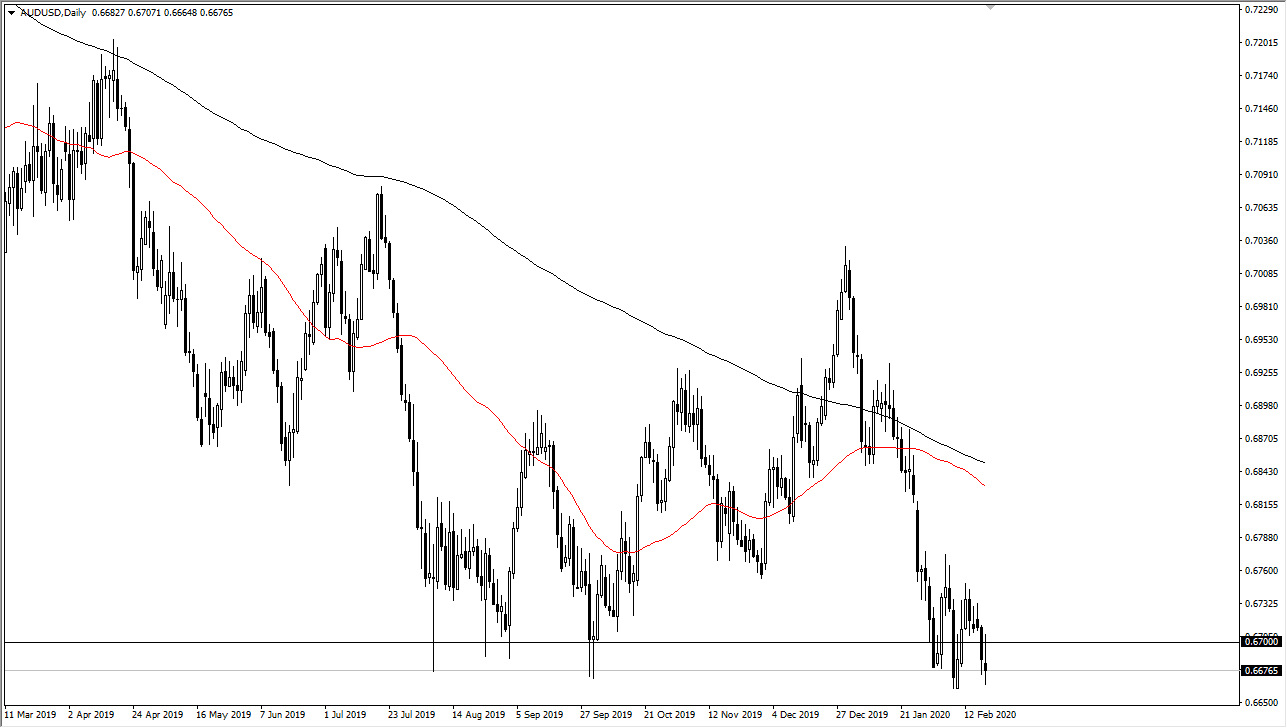

The Australian dollar went back and forth during the trading session on Wednesday, hanging around just below the 0.67 handle. This market has been very negative for some time, and as a result it is a market that you can’t be a buyer of, at least not until we break out and above the massive resistance barrier that I see at the 0.6775 handle. Breaking above that level could send this market looking towards the 50 day EMA, or perhaps even the 0.70 level. However, it is going to take something rather special for the Australian dollar to suddenly turn around and do that. Quite frankly, it is far too attached to China for Australia to suddenly be something that you should be investing in.

The Japanese economy looks as if it’s heading into a recession, so we are already starting to see further damage done to Asia in general. While gold has been rallying rather significantly, the Australian dollar has not followed as this seems to be a specifically Asian issue. Breaking down below the bottom of the lows over the last couple of sessions could send this market much lower, perhaps down towards the 0.63 level which was the bottom of the consolidation area that starts right here from the financial crisis well over a decade ago.

Ultimately, I think it’s probably more likely that we are going to continue to grind back and forth, trying to figure out which way to go next. The candlestick for the trading session on Wednesday is rather negative looking, and it looks like we could get a little bit of downward continuation. The US dollar of course has been attracting a lot of inflow due to the US economy rallying and strengthening as time goes on. Quite frankly, even if it isn’t there will be a lot of money flowing into the US treasury markets, as the trading world looks for protection in a very uncertain environment. At this point, rallies continue to be sold on short-term charts, at the first signs of exhaustion in this market. If we do break out to the upside it’s not unless we get some type of good news out of China that I would be willing to hang onto that trade for any length of time. I believe short-term traders will continue to short this market again and again.