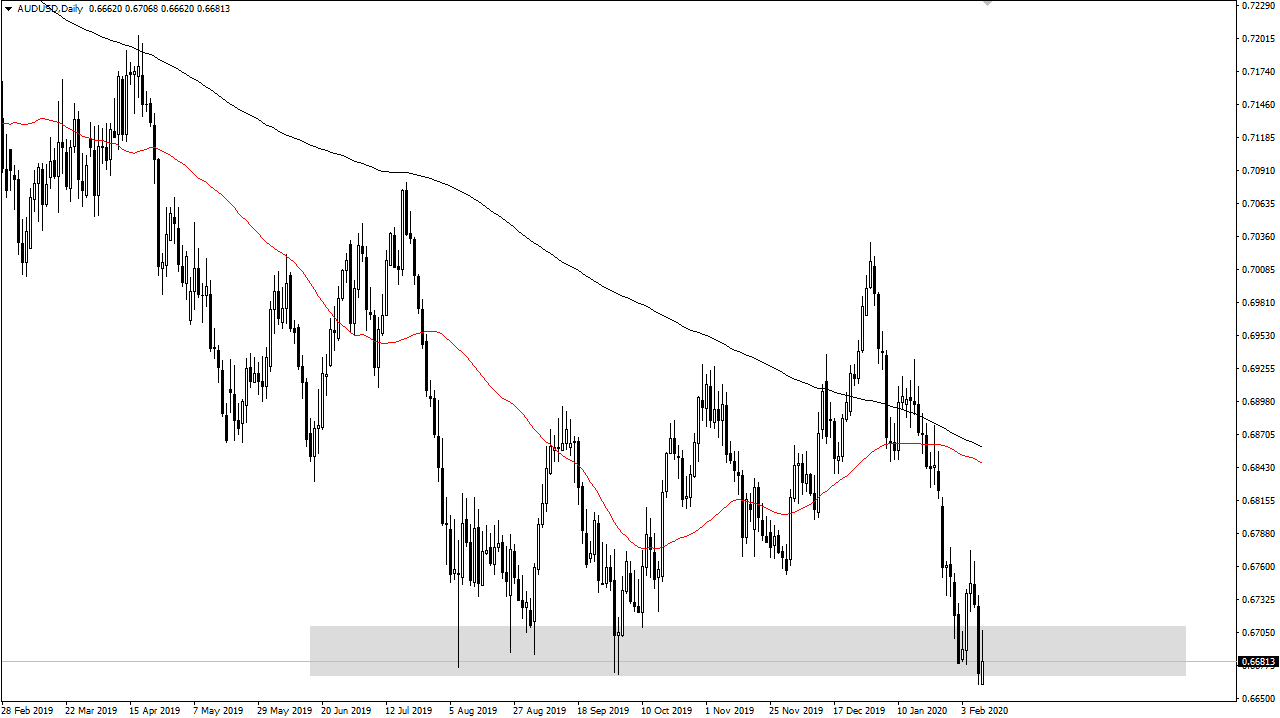

The Australian dollar initially tried to recover after gapping lower at the open on Monday, only to sell off yet again. By doing so, the market looks as if it is going to continue to go much lower and break down significantly. The Australian dollar is facing the brunt of all things negative when it comes to China.

AUD/USD

The Australian dollar has initially tried to rally during the trading session on Monday but then broke down rather significantly to form an inverted hammer. That being said, if the market continues the way it has it’s very likely that rallies will be sold into and the Aussie will continue much lower. Keep in mind that the Australian dollar is highly levered to the Chinese economy and as long as there are concerns about growth in that country, it’s very likely that the Aussie will continue to be sold. In fact, I don’t really have a scenario where I’m looking to buy the Australian dollar unless of course we get some type of massive turnaround signal on a longer-term chart such as the weekly timeframe or above.

Until the coronavirus is contained, it seems very unlikely that this pair will be able to rally for a significant amount of time. I see multiple selling opportunities above, not the least of which would be at last week’s highs. If we break down below the bottom of the candlestick for the last 48 hours of trading, this market more than likely takes off to go much lower, perhaps as low as 0.64 based upon historical charts. We are entering the area that the Australian dollar traded in during the financial crisis, so that is quite impressive in and of itself.

If the market were to break to the upside, it will then have to deal with the 50 day EMA and the 200 day EMA, both of which will attract a lot of longer-term technical traders. Truthfully, it’s not until we break above the 200 day EMA or form something like a hammer on the weekly chart that I can consider buying, which one would have to think would have a lot to do with the coronavirus being contained in China itself, something that we are nowhere near right now. Furthermore, one has to wonder how this will affect growth in the next couple of quarters, not just the present one.