Apple’s revenue warning due to Covid-19 served traders a reminder that dismissing the threats of it to the global supply chain was premature. More cases are being reported, the death toll rises, and the disruptions to businesses are ongoing. The longer the virus keeps China hostage, the bigger the fallout will be. As the primary Chinese Yuan proxy currency, the Australian Dollar is directly exposed to developments. Following corporate warnings, including HSBC’s $7.3 billion restructuring charge, the AUD/USD dropped into its support zone but with resilient bullish momentum underneath.

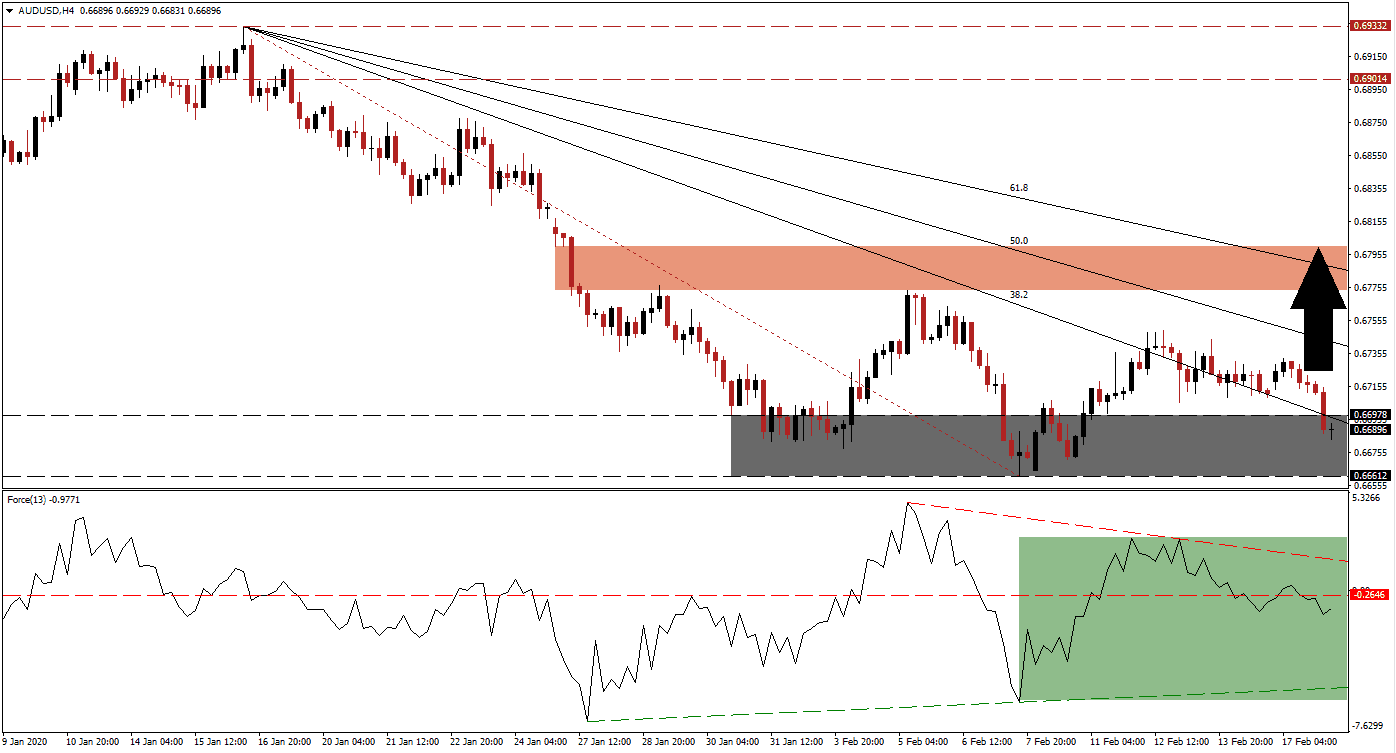

The Force Index, a next-generation technical indicator, contracted together with this currency pair, guided to the downside by its descending resistance level, but it recorded a significantly higher low. After the Force Index converted its horizontal support level into resistance, as marked by the green rectangle, bearish pressures eased, positioning this technical indicator for a quick rebound. A recovery into positive conditions will place bulls back in charge of price action in the AUD/USD, preceding a breakout. You can learn more about the Force Index here.

This currency pair was able to launch two breakouts from its support zone located between 0.66612 and 0.66978, as marked by the grey rectangle, with a third breakout pending. US economic data has continuously shown weakness in core components while printing acceptable headline figures. Structural weakness is anticipated to add a fundamental catalyst for the AUD/USD to enter a short-covering rally after a double breakout, which will include a push above its descending 38.2 Fibonacci Retracement Fan Resistance Level.

Forex traders are advised to monitor the intra-day high of 0.67323, the peak that resulted from the latest bounce in this currency pair before the 38.2 Fibonacci Retracement Fan Support Level was converted into resistance. A breakout above this level is expected to result in the net additions of new buy orders. This will elevate the AUD/USD into its short-term resistance zone located between 0.67737 and 0.68001, as marked by the red rectangle. More upside is likely to follow, but a new catalyst is preferential. You can learn more about a breakout here.

AUD/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.66900

Take Profit @ 0.68000

Stop Loss @ 0.66550

Upside Potential: 110 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.14

In case of an extended contraction in the Force Index, leading to a breakdown below its ascending support level, the AUD/USD is expected to be pressured below its support zone. Given the dominant fundamental outlook, supported by the developing technical picture, any push to the downside remains limited to its next support zone. Forex traders are recommended to consider this an outstanding buying opportunity. Price action will challenge this zone between 0.65525 and 0.65795, dating back to March of 2009.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.66250

Take Profit @ 0.65650

Stop Loss @ 0.66550

Downside Potential: 60 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.00