Australian economic data showed an acceleration in the manufacturing recession, but an increase in annualized building approvals. Providing a minor sentiment boost was the rebound in job advertisements, which was enough to allow a breakout in the AUD/SGD above its support zone to materialize. The confirmed cases and death toll of the coronavirus continue to rise, fueling fears over the impact on the fragile global economy. Chinese equity markets opened after a prolonged holiday, plunging by over 8%. You can learn more about a support zone here.

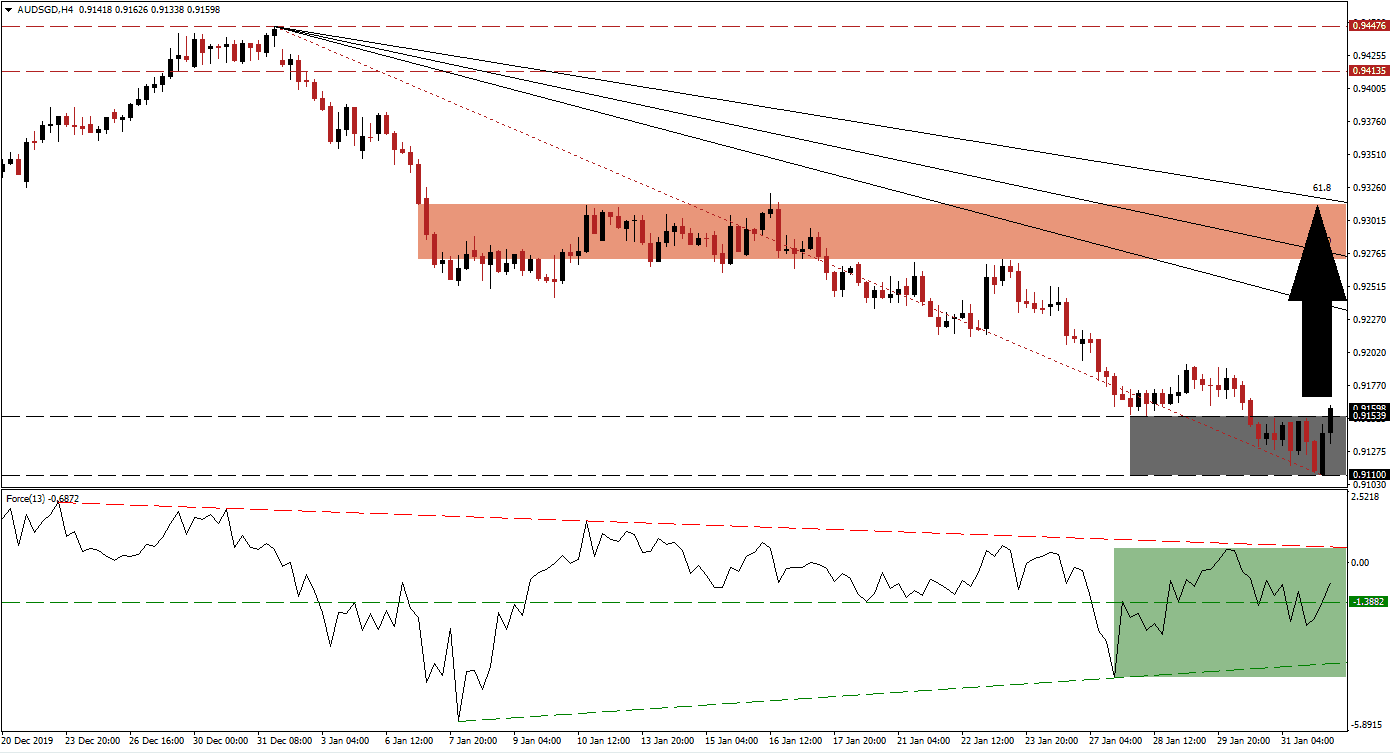

The Force Index, a next-generation technical indicator, points towards a recovery in bullish momentum. While the AUD/SGD extended its slide, the Force Index pushed higher, forming a positive divergence, granting an early signal that the sell-off is prone to a reversal. After converting its horizontal resistance level into support, as marked by the green rectangle, this technical indicator is expected to cross into positive territory, placing bulls in control of price action. A breakout above its descending resistance level is likely to further fuel a recovery in this currency pair.

Following the breakout in the AUD/SGD above its support zone located between 0.91100 and 0.91539, as marked by the grey rectangle, a short-covering rally is favored to emerge. This should close the gap between this currency pair and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Chinese industrial profits contracted in December, while the manufacturing sector slowed its rate of expansion. The Australian Dollar is the primary Chinese Yuan proxy currency, directly impacted by the Chinese economy.

One key level to monitor is the intra-day high of 0.91935, the peak of a previously failed breakout attempt, which led to a lower low in this currency pair. A move above this level is anticipated to attract the next wave of net buy orders in the AUD/SGD, accelerating the pending advance. Price action is expected to challenge its short-term resistance zone located between 0.92723 and 0.93135, as marked by the red rectangle, enforced by its 61.8 Fibonacci Retracement Fan Resistance Level. You can learn more about a breakout here.

AUD/SGD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.91600

Take Profit @ 0.93100

Stop Loss @ 0.91150

Upside Potential: 150 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.33

In case of a breakdown in the Force Index below its ascending support level, the AUD/SGD is likely to attempt an extension of its corrective phase. With a bullish long-term fundamental outlook, supported by an improving technical scenario, the downside appears limited to its next support zone located between 0.90080 and 0.90350. This dates back to August 2001, and Forex traders are advised to consider this an excellent buying opportunity.

AUD/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.90900

Take Profit @ 0.90350

Stop Loss @ 1.64700

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20