Singapore’s fourth-quarter GDP surprised to the upside, followed by a dominant reading for January non-oil exports. This was countered by the government’s downgrade for 2020, as it now predicts an annualized contraction between -0.5% and 1.5%, citing the negative impact of Covid-19. A potential recession has been noted, an event Singapore last faced in 2001 when its economy contracted by 1.0%. The AUD/SGD remained little changed inside of its resistance zone with a breakdown pending.

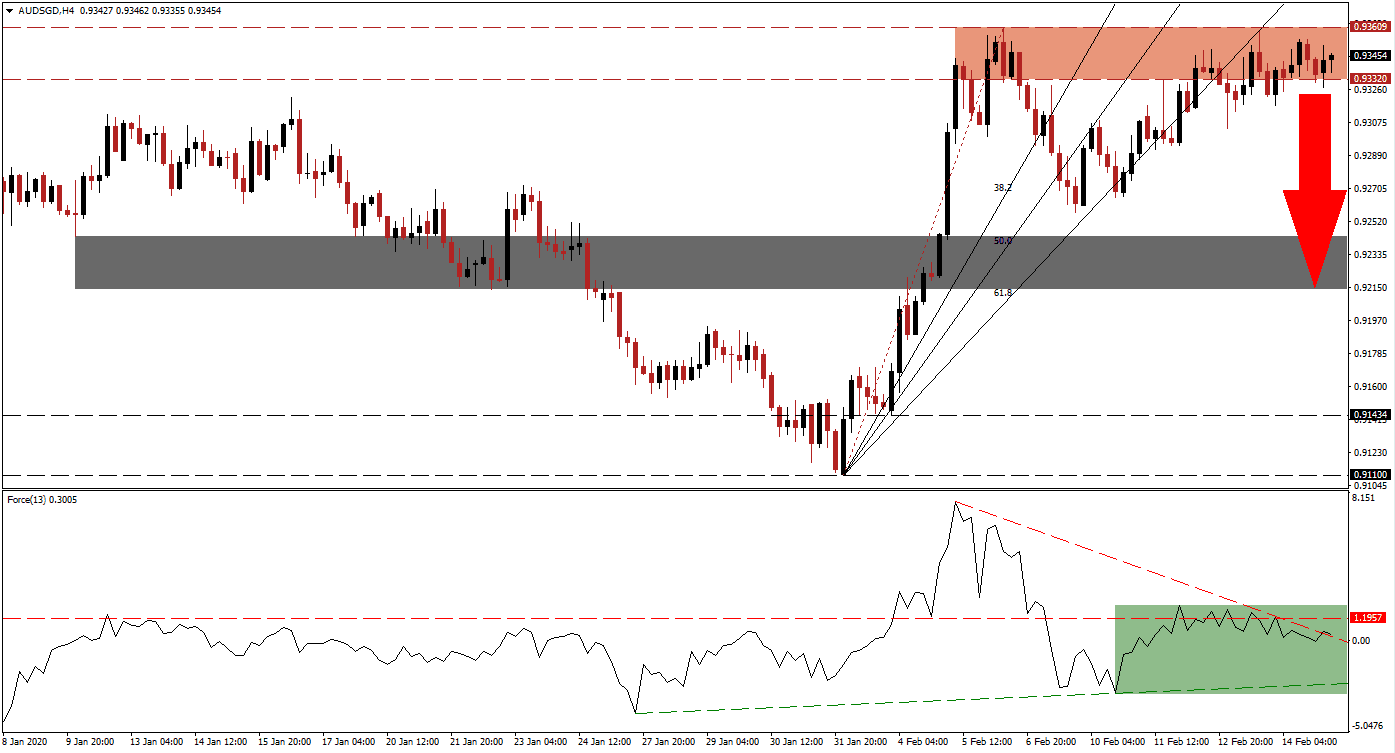

The Force Index, a next-generation technical indicator, indicates the rise in bearish momentum as price action recovered from its initial breakdown. A negative divergence emerged, suggesting a trend reversal is imminent. The Force Index recorded a significantly lower high after reversing off of its ascending support level. It was rejected by its horizontal resistance level, while its descending resistance level is adding to downside pressures, as marked by the green rectangle. This technical indicator is now expected to drop into negative conditions, placing bears in control of the AUD/SGD.

A violent price spike took this currency pair from its long-term support zone into its resistance zone, resulting in a steep Fibonacci Retracement Fan sequence. The first breakdown in the AUD/SGD below its resistance zone located between 0.93320 and 0.93609, as marked by the red rectangle, was reversed by its ascending 61.8 Fibonacci Retracement Fan Support Level. Price action now moved below this level, adding to bearish developments and increasing breakdown pressures.

Due to the strong advance, a breakdown in the AUD/SGD below its resistance zone is likely to trigger a profit-taking sell-off. This is anticipated to quickly close the gap between price action and its short-term support zone located between 0.92142 and 0.92436, as marked by the grey rectangle. While fears concerning Covid-19 have eased off of its peak, and financial markets already moved past potential disruptions, the threat remains in place. You can learn more about a breakdown here.

AUD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.93450

Take Profit @ 0.92150

Stop Loss @ 0.93850

Downside Potential: 130 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.25

In the event of a recovery in the Force Index above its horizontal resistance level, off of its descending resistance level, the AUD/SGD may extend farther to the upside. With the Australian economy facing the fallout of deadly bush fires, the upside potential remains limited to its next resistance zone located between 0.94162 and 0.94476. This will close a minor price gap to the downside while allowing Forex traders to enter fresh short positions.

AUD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.94000

Take Profit @ 0.94450

Stop Loss @ 0.93800

Upside Potential: 45 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.25