New Zealand reported a smaller than expected decrease in exports for January, resulting in a narrower trade deficit. Business confidence contracted in February as the economy is facing the fallout from Covid-19, which continues to spread globally. This morning’s data sufficed to pause the sell-off in the AUD/NZD, as it reached its short-term support zone. Preventing a rally was dismal private expenditure data out of Australia for the fourth quarter, partially countered by an unexpected increase in plant and machinery capital expenditures. You can read more about a support zone here.

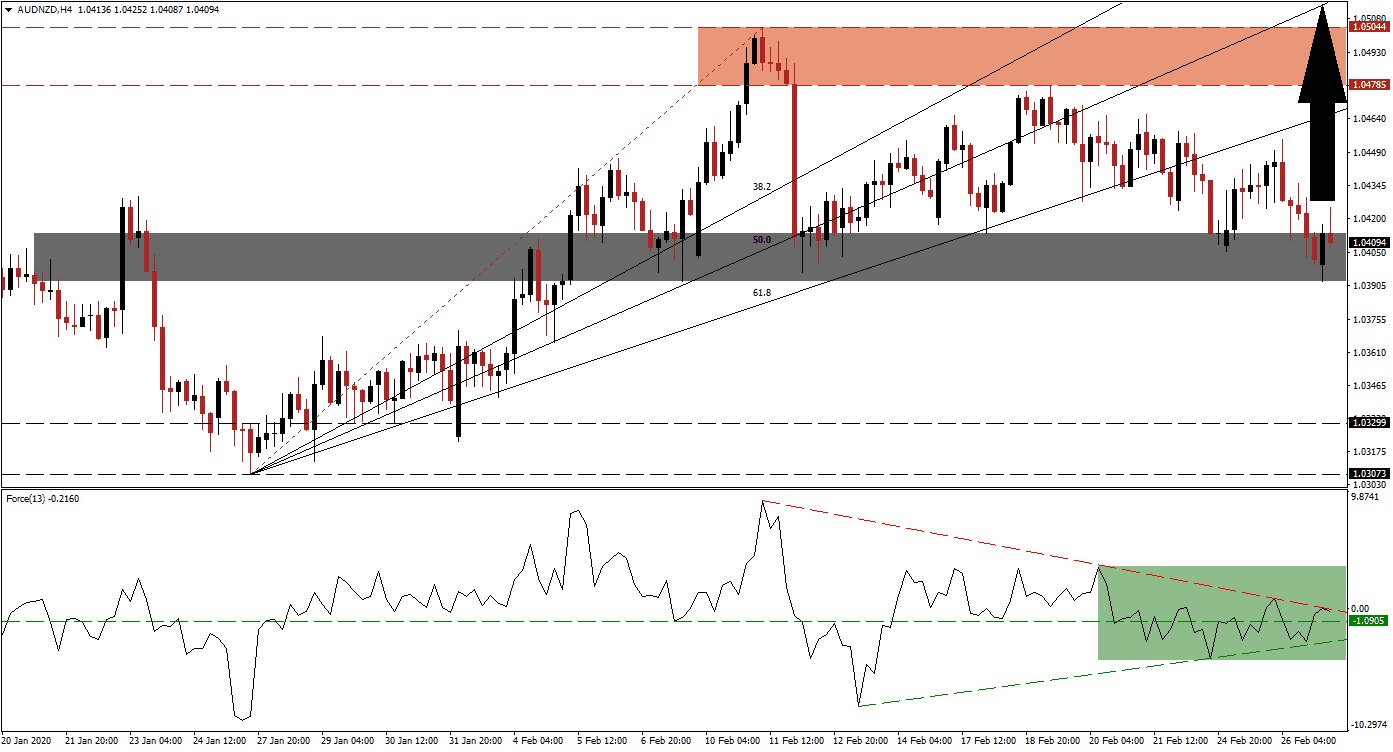

The Force Index, a next-generation technical indicator, points towards an increase in bullish momentum after recording a higher low. It allowed for an ascending support level to materialize from where the Force Index reversed to the upside. The horizontal resistance level was converted into support, as marked by the green rectangle. This technical indicator is now challenging its descending resistance level. A push into positive conditions is expected, placing bulls in control of the AUD/NZD.

This currency pair was previously able to bounce off of its short-term support zone located between 1.03923 and 1.04134, as marked by the grey rectangle. Due to the rise in bullish momentum, coupled with fundamental developments, the AUD/NZD is poised to enter a short-covering rally. The closure of the gap between price action and its ascending 61.8 Fibonacci Retracement Fan Resistance Level, approaching the bottom range of its resistance zone, should be closed as a result. You can learn more about a short-covering rally here.

One key level to monitor is the intra-day high of 1.04423, the peak of the breakout that converted its short-term resistance zone into the current support zone. A move above this level is favored to result in the net addition of buy orders, providing enough momentum for the AUD/NZD to advance into its resistance zone. This zone is located between 1.04785 and 1.05044, as marked by the red rectangle. With the Fibonacci Retracement Fan moving above it, a breakout is likely to result in more significant upside.

AUD/NZD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.04100

Take Profit @ 1.05100

Stop Loss @ 1.03800

Upside Potential: 100 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.33

In case of a breakdown in the Force Index below its ascending support level, the AUD/NZD is anticipated to be pressured into an extension of its corrective phase. Forex traders are advised to consider any breakdown from current levels as a good buying opportunity. Given dominant bullish developments, the downside potential appears limited to its long-term support zone located between 1.03073 and 1.03299.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03600

Take Profit @ 1.03100

Stop Loss @ 1.03850

Downside Potential: 50 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.00