Australian economic data showed an unexpected increase in imports, which resulted in a smaller than forecasted trade surplus for December. Fourth-quarter retail sales excluding inflation beat economists’ predictions, adding a fundamental boost to the Australian Dollar. New Zealand is closed for a national holiday, allowing the AUD/NZD to maintain its recovery from depressed levels. Fears over the deadly coronavirus have eased significantly, further elevating this currency pair, which is now challenging its resistance zone.

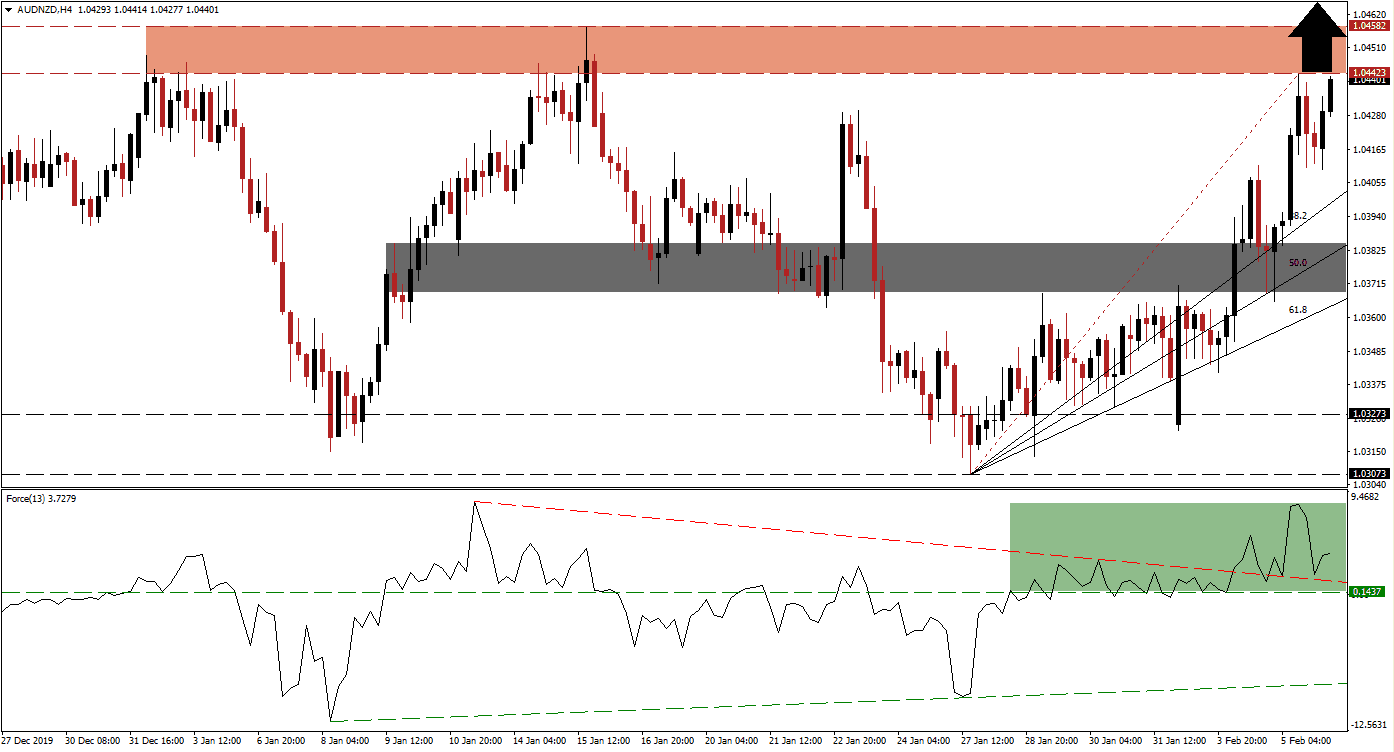

The Force Index, a next-generation technical indicator, indicates dominant bullish momentum after advancing off of its ascending support level, formed due to a higher low. Following the conversion of its horizontal resistance level into support, a minor sideways trend emerged. The Force Index extended its advance with a breakout above its descending resistance level, now turned into temporary support, as marked by the green rectangle. Bulls are in firm control of the AUD/NZD, as this technical indicator maintains its position in positive territory.

After this currency pair turned its short-term resistance zone into support, with an initially reversed breakout before accelerating to the upside, the Fibonacci Retracement Fan sequence was redrawn. This zone is located between 1.0368 and 1.03849, as marked by the grey rectangle. Since the Australian Dollar is the primary Chinese Yuan proxy currency, positive developments regarding the containment of the coronavirus provide a boost to the AUD/NZD. You can learn more about the Fibonacci Retracement Fan here.

Price action is now favored to complete a breakout above its resistance zone located between 1.04423 and 1.04582, as marked by the red rectangle. The bottom range of this zone additionally marks the end-point of the redrawn Fibonacci Retracement Fan sequence. Bullish momentum retreated from its 2020 high, but another surge is pending. This is expected to elevate the AUD/NZD into its next resistance zone, which awaits price action between 1.05688 and 1.06048.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.04400

Take Profit @ 1.06000

Stop Loss @ 1.04000

Upside Potential: 160 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 4.00

In case of a breakdown in the Force Index below its descending resistance level, followed by a conversion of its horizontal support level into resistance, the AUD/NZD is likely to partially retrace its advance. Due to the bullish outlook in this currency pair, the downside potential appears limited to its short-term support zone, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level. This will represent a great buying opportunity for Forex traders.

AUD/NZD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 1.03900

Take Profit @ 1.03700

Stop Loss @ 1.04000

Downside Potential: 20 pips

Upside Risk: 10 pips

Risk/Reward Ratio: 2.00