Following the Reserve Bank of New Zealand’s decision to keep interest rates unchanged at 1.00% yesterday, together with the assessment of the economic impact of the coronavirus, the New Zealand Dollar rallied. This pressured the AUD/NZD into a sell-off, ended by its short-term support zone, and keeping the long-term uptrend intact. The overnight announcement that 15,000 new cases were reported in China. Globally, over 60,000 cases have been confirmed with over 1,360 fatalities. As the virus continues to spread, mostly in China and its neighbors, both figures are likely to rise sharply.

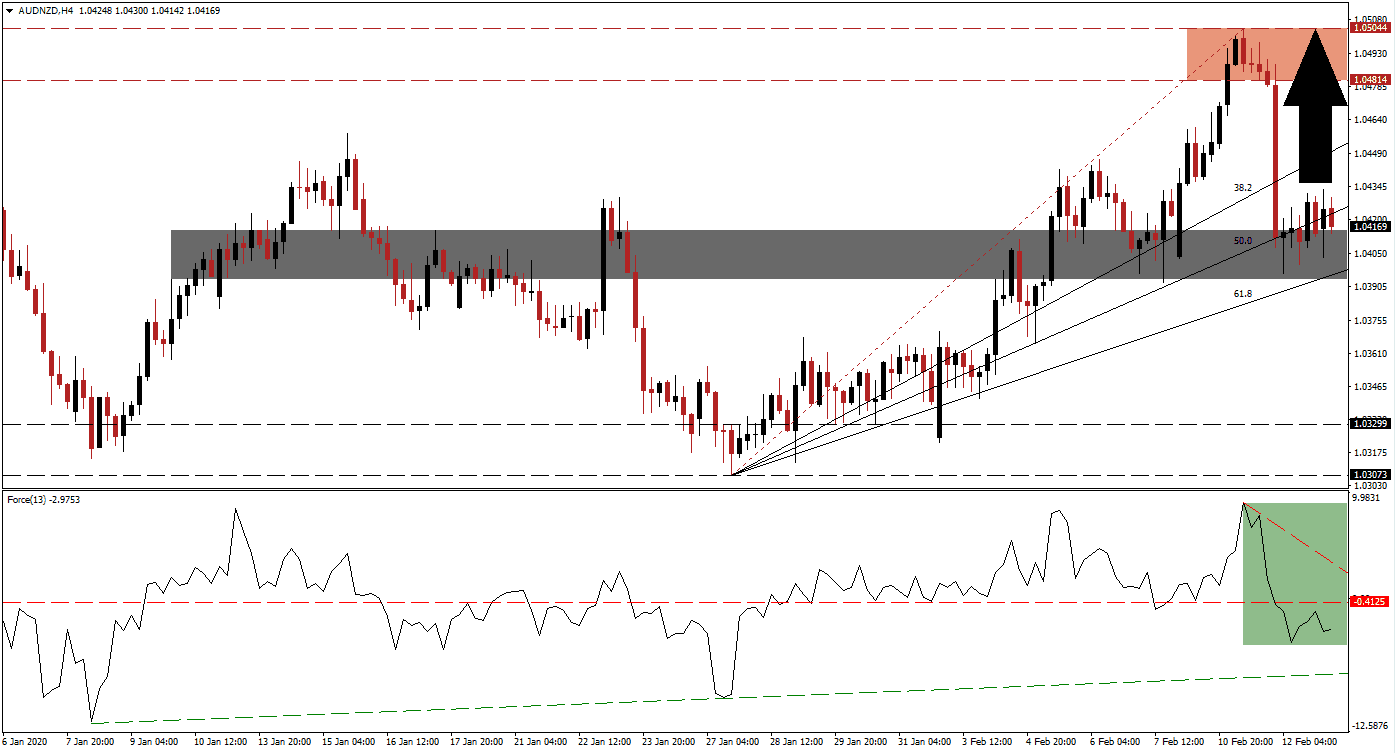

The Force Index, a next-generation technical indicator, advanced to a new 2020 high in unison with this currency pair. Bullish momentum started to fade after the AUD/NZD moved into its resistance zone. A marginally lower high resulted in the formation of a descending resistance level, while the Force Index accelerated to the downside, as marked by the green rectangle. Once the horizontal support level was converted into resistance, this technical indicator stabilized before challenging its ascending support level. A reversal is anticipated to place bulls in charge of price action. You can learn more about the Force Index here.

With the coronavirus pressuring the global economy, Australia’s agriculture sector faces the biggest headwind. The Reserve Bank of Australia noted that the economic fallout from Covid-19, the official name of the virus, is worse than that of the 2002/2003 SARS outbreak. This currency pair ended its corrective phase after bouncing off of its short-term support zone located between 1.03938 and 1.04155, as marked by the grey rectangle. The AUD/NZD is now in the process of retaking its 50.0 Fibonacci Retracement Fan Resistance Level, converting it into support.

Forex traders are advised to monitor the intra-day high of 1.04466, the peak of a previous advance off of its short-term support zone, which failed to push above its Fibonacci Retracement Fan trendline. A breakout is favored to result in the addition of new net buy orders in the AUD/NZD. This should provide enough upside pressure to elevate price action into its resistance zone located between 1.04814 and 1.05044, as marked by the red rectangle. You can learn more about a breakout here.

AUD/NZD Technical Trading Set-Up - Reversal Scenario

Long Entry @ 1.04150

Take Profit @ 1.05000

Stop Loss @ 1.03900

Upside Potential: 85 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 3.40

In case of an extended contraction in the Force Index, leading to a breakdown below its ascending support level, the AUD/NZD is expected to attempt one of its own. The downside potential for this currency pair is limited to its long-term support zone, located between 1.03073 and 1.03299. This will represent an excellent buying opportunity for Forex traders to consider, as the outlook remains increasingly bullish.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03650

Take Profit @ 1.03100

Stop Loss @ 1.03900

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20