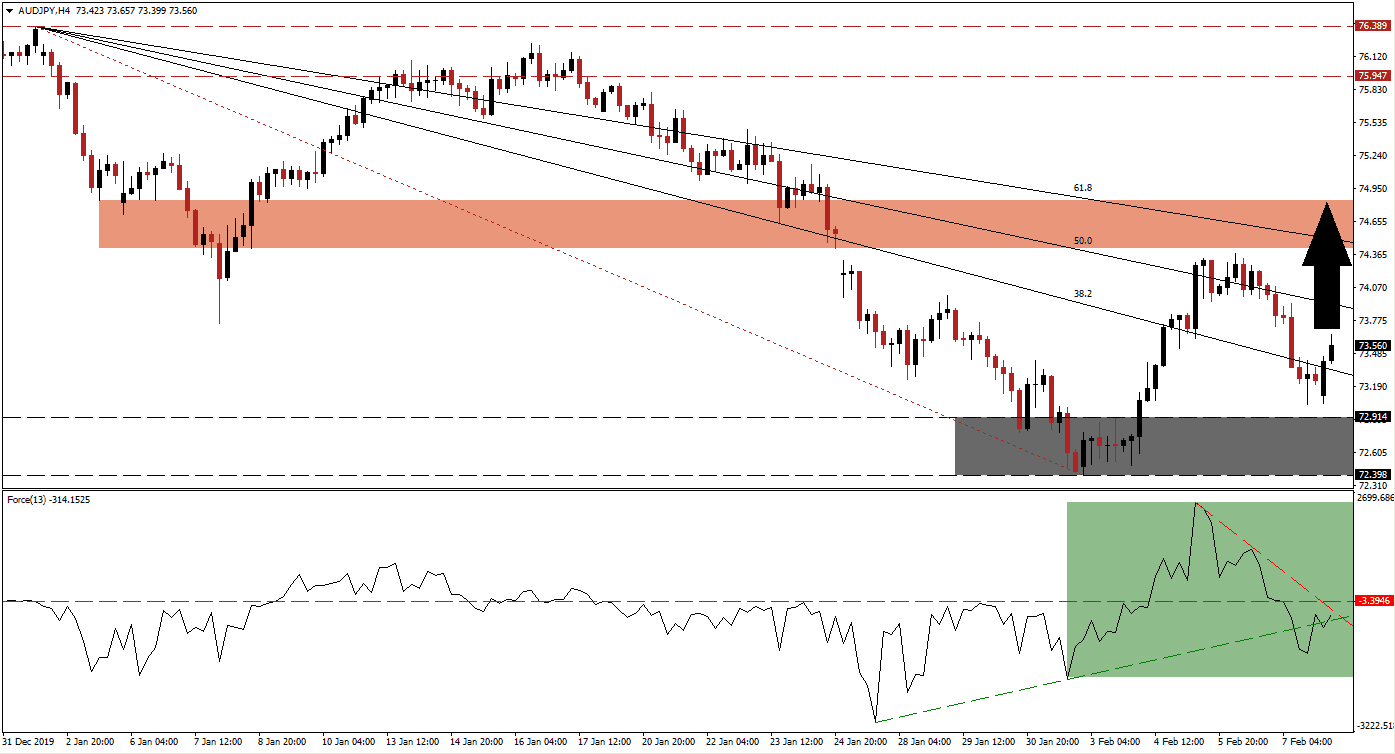

With damages to the global supply chain due to the coronavirus intensifying, financial markets fail to properly price-in the economic damages. Japan reported a better-than-expected trade surplus for December, off of depressed levels, and before disruptions related to the virus. The AUD/JPY was able to push above its descending 38.2 Fibonacci Retracement Fan Resistance Level, converting it into support. Commentary by Australian Prime Minister Morrison noted that trade talks with Indonesia will be crucial to diversify its economy away from China.

The Force Index, a next-generation technical indicator, points towards the build-up in bullish momentum after briefly dipping below its ascending support level. After reversing from a higher low, the Force Index is now faded with its descending resistance level, as marked by the green rectangle. A breakout is anticipated to carry this technical indicator above its horizontal resistance level, into positive territory, placing bulls in charge of the AUD/JPY. You can learn more about the Force Index here.

As a result of the previous correction in this currency pair, the AUD/JPY recorded a lower low. The initial breakout above its support zone located between 72.398 and 72.914, as marked by the grey rectangle, resulting in a higher high. Price action was rejected by its short-term resistance zone after eclipsing its 50.0 Fibonacci Retracement Fan Resistance Level. The reversal resulted in a higher low, initiating the formation of a bullish chart pattern. More upside is expected to follow, as the rise in bullish momentum is set to fuel the recovery.

This currency pair is now favored to push into its short-term resistance zone located between 74.419 and 74.845, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is on the verge of crossing below it. An advance into this zone will additionally close a previous price gap to the downside. Price action may briefly pause its advance, but the AUD/JPY is positioned to attempt a spike into its long-term resistance zone located between 75.947 and 76.389 unless fundamental conditions change.

AUD/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 73.550

Take Profit @ 74.800

Stop Loss @ 73.200

Upside Potential: 125 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.57

A breakdown in the Force Index below its ascending support level is likely to lead the AUD/JPY into another reversal. Given the long-term fundamental outlook for this currency pair, the downside potential appears limited to the bottom range of its current support zone. Short-term economic damages to the Japanese economy may offset safe-haven demand for the Japanese Yen, adding an upside catalyst to this currency pair.

AUD/JPY Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 72.850

Take Profit @ 72.400

Stop Loss @ 73.050

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25