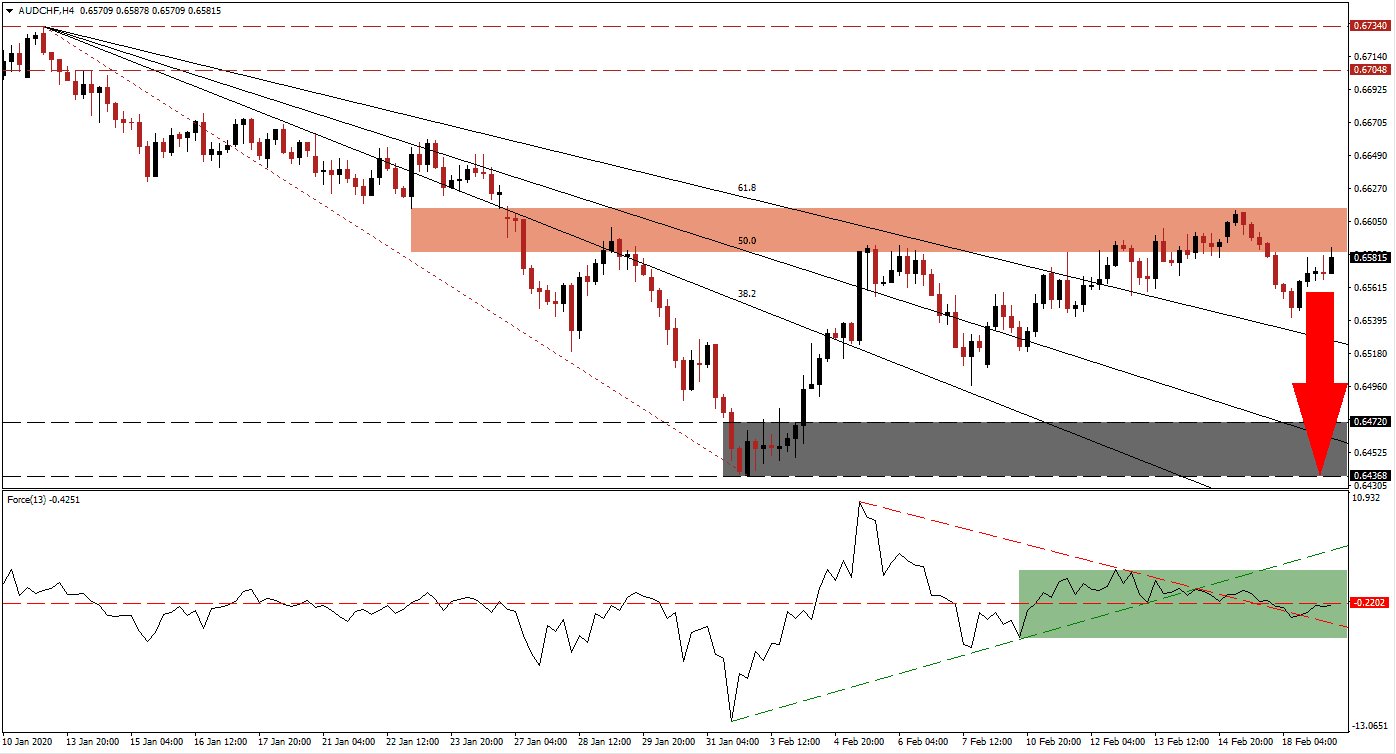

Australian wage growth stagnated in the fourth quarter, expanding by 0.5% quarterly, matching the third-quarter growth rate. Bush fires that ravaged the economy impacted the labor market, while the global economic slowdown added to this morning’s soft data. With Covid-19 increasing pressure on the supply chain, more disappointments should be accounted for. The AUD/CHF drifted into its short-term resistance zone, but as bullish momentum is fading, a price action reversal is pending.

The Force Index, a next-generation technical indicator, stalled as this currency pair initially reached its resistance zone. As this currency pair extended its moderate advance, a negative divergence emerged with the Force Index contracting. It managed a breakdown below its ascending support level, followed by a conversion of its horizontal support level into resistance. This technical indicator is now positioned in negative conditions above its descending resistance level, as marked by the green rectangle. Bears are in control of the AUD/CHF, a renewed push to the downside pending.

Bearish pressures increased after price action completed a breakdown below its short-term resistance zone located between 0.65846 and 0.66137, as marked by the red rectangle. After approaching its descending 61.8 Fibonacci Retracement Fan Support Level, the AUD/CHF rebounded in a typical post-breakdown pattern, granting Forex traders a second short-entry opportunity. Soft Australian economic data and safe-haven demand for the Swiss Franc are anticipated to enforce the dominant long-term downtrend.

One key level to monitor is the intra-day low of 0.65414, the reaction low from which this currency pair recovered. A breakdown is expected to lead the next wave of net sell-orders, providing more fuel to the pending corrective phase. Expectations for an interest rate cut by the Reserve Bank of Australia, together with market manipulation by the Swiss National Bank, provide a fundamental cross-current, are likely to commence elevated volatility. The AUD/CHF is, therefore, favored to contract into its support zone located between 0.64368 and 0.64720, as marked by the grey rectangle. You can learn more about a breakdown here.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.65800

Take Profit @ 0.64400

Stop Loss @ 0.66150

Downside Potential: 140 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 4.00

In the event of an upside extension in the Force Index, reclaiming its ascending support level, currently acting as temporary support, the AUD/CHF is likely to attempt a breakout. Given the developing fundamental conditions, supported by short-term technical factors, the upside potential is limited. This currency pair will challenge its next resistance zone, located between 0.67048 and 0.67340, presenting Forex traders a great short-selling opportunity.

AUD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.66300

Take Profit @ 0.67200

Stop Loss @ 0.65850

Upside Potential: 90 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.00