Consumer confidence contracted in Australia as Covid-19 cases outside of China increased. China relaxed restrictions, offering a much-needed improvement in the condition. Worldwide, over 80,152 cases have been confirmed, with 2,701 deaths reported. The Treasurer of Australia, Josh Frydenberg, noted the resilience of the Australian economy in the wake of issues it faced from the US-China trade war, through the devastating bush fire season, and now Covid-19. It sufficed to lead the AUD/CAD into a breakout above its support zone.

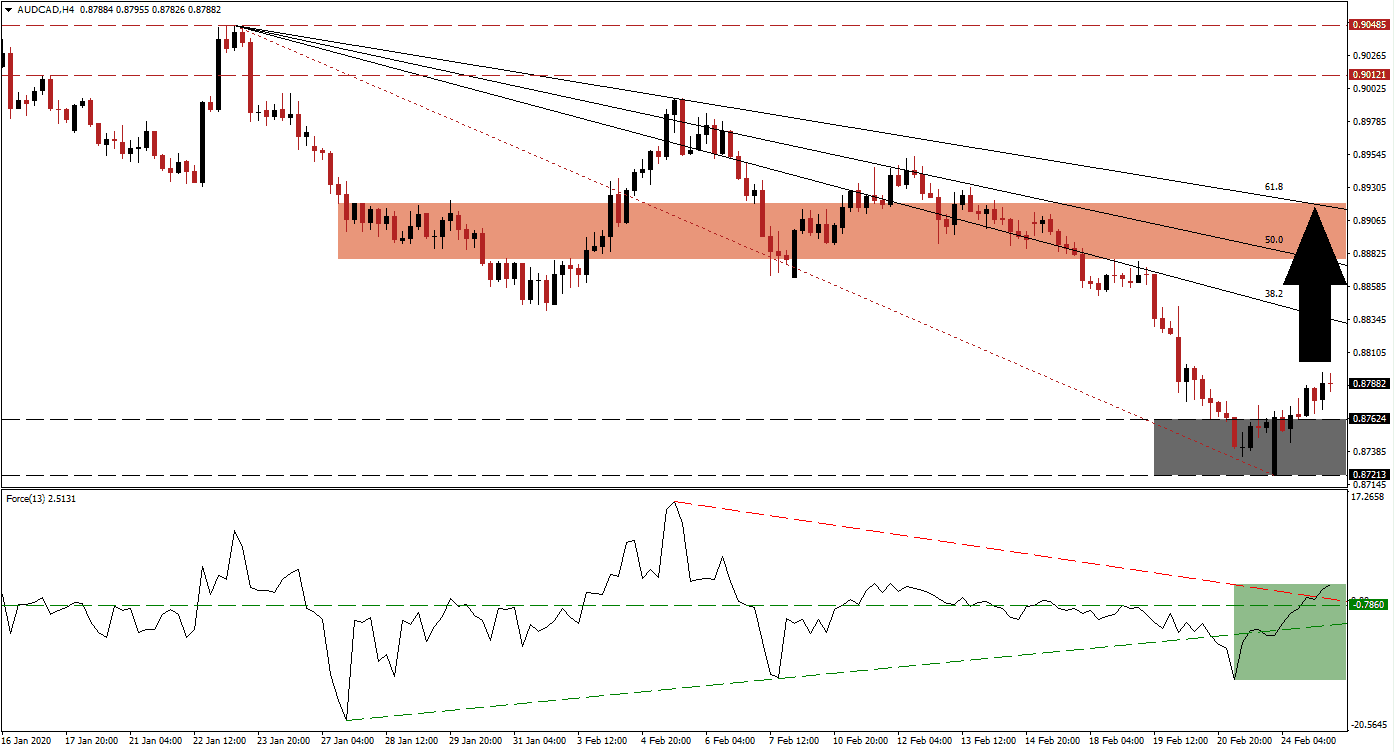

The Force Index, a next-generation technical indicator, shows a bullish momentum recovery following a temporary contraction below its ascending support level. After the recovery, the conversion of its horizontal resistance level into support materialized. The Force Index continued its advance, pushing above its descending resistance level, as marked by the green rectangle. Bulls are now in charge of the AUD/CAD, with this technical indicator completing a cross-over into positive conditions. You can learn more about the Force Index here.

A short-covering rally is emerging, anticipated to close the gap between this currency pair and its descending 38.2 Fibonacci Retracement Fan Resistance Level. While a reversal and test of the upper range of its support zone cannot be ruled out, the rise in bullish momentum favors an extension of the breakout. This zone is located between 0.87213 and 0.87624, as marked by the grey rectangle. The unexpected contraction in Canadian manufacturing sales provided the fundamental catalyst for the breakout in the AUD/CAD.

This currency pair is well-positioned to accelerate into its short-term resistance zone located between 0.88788 and 0.89193, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing this zone while maintaining the long-term downtrend in this currency pair. A breakout will require a new catalyst, which may emerge in the form of additional economic disappointments out of Canada with Australian weakness already priced into the AUD/CAD. You can learn more about a breakout here.

AUD/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.87850

Take Profit @ 0.89150

Stop Loss @ 0.87450

Upside Potential: 130 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.25

In the event of a reversal in the Force Index below its ascending support level, the AUD/CAD may attempt a breakdown below its support zone. Given the extreme oversold condition of this currency pair, in conjunction with the fundamental outlook, supported by technical developments, any breakdown will provide Forex traders a great buying opportunity. The next support zone awaits price actions between 0.85770 and 0.86150, dating back to June 2010.

AUD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.87100

Take Profit @ 0.86100

Stop Loss @ 0.87450

Downside Potential: 100 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.86