Better than expected housing data out of Canada released yesterday was trumped by a surprise surge in the value of home, owner-occupier, and investor loans out of Australia. This came on the back of the devastating bush fire season and the deadly coronavirus outbreak. It allowed the AUD/CAD to recover from inside of its support zone after recording a higher low. NAB business conditions remained stable in January, but confidence was depressed. You can learn more about a support zone here.

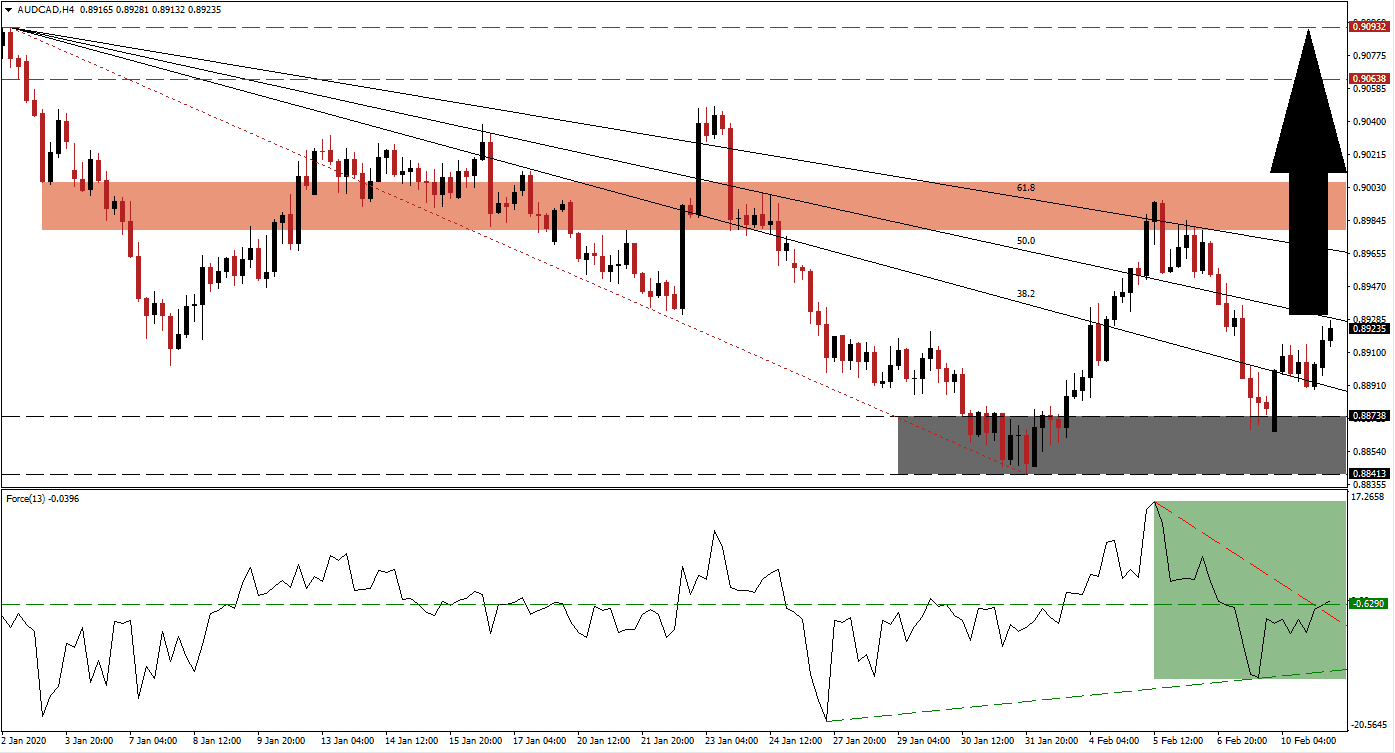

The Force Index, a next-generation technical indicator, confirmed the lower low in this currency pair with one of its own. As a result, an ascending support level emerged from where the Force Index accelerated to the upside. It completed a breakout above its descending resistance level and then converted its horizontal resistance level into support, as marked by the green rectangle. This technical indicator is now on the verge to move into positive conditions, placing bulls in charge of the AUD/CAD.

Following a brief dip into its support zone located between 0.88413 and 0.88738, as marked by the grey rectangle, this currency pair completed a breakout above its descending 38.2 Fibonacci Retracement Fan Resistance Level. Bullish momentum is anticipated to push the AUD/CAD through its 50.0 Fibonacci Retracement Fan Resistance Level, inspiring the next wave of net buy positions into this currency pair. The Australian economy may be one of the hardest-hit economies from the coronavirus, and volatility is likely to increase.

A breakout above the intra-day low of 0.89353, the low of the previous instance price action bounced higher off of its Fibonacci Retracement Fan trendline, is favored to provide sufficient upside pressure for the AUD/CAD to challenge its short-term resistance zone. This zone is located between 0.89788 and 0.90056, as marked by the red rectangle. It will lead to a marginally higher high, enabling the pending breakout sequence to extend into its long-term resistance zone. This currency pair will reach this zone between 0.90638 and 0.90932. You can learn more about a breakout here.

AUD/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.89250

Take Profit @ 0.90900

Stop Loss @ 0.88700

Upside Potential: 165 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 3.00

In case of a breakdown in the Force Index below its ascending support level, the AUD/CAD could be pressured into more downside. With the depressed oil price preventing the Canadian Dollar to advance, together with the bullish long-term outlook for the Australian economy, any downside potential is limited to its next support zone between 0.87290 and 0.87760, dating back to June 2010, presenting Forex traders with an excellent buying opportunity.

AUD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.88200

Take Profit @ 0.87300

Stop Loss @ 0.88600

Downside Potential: 90 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.25