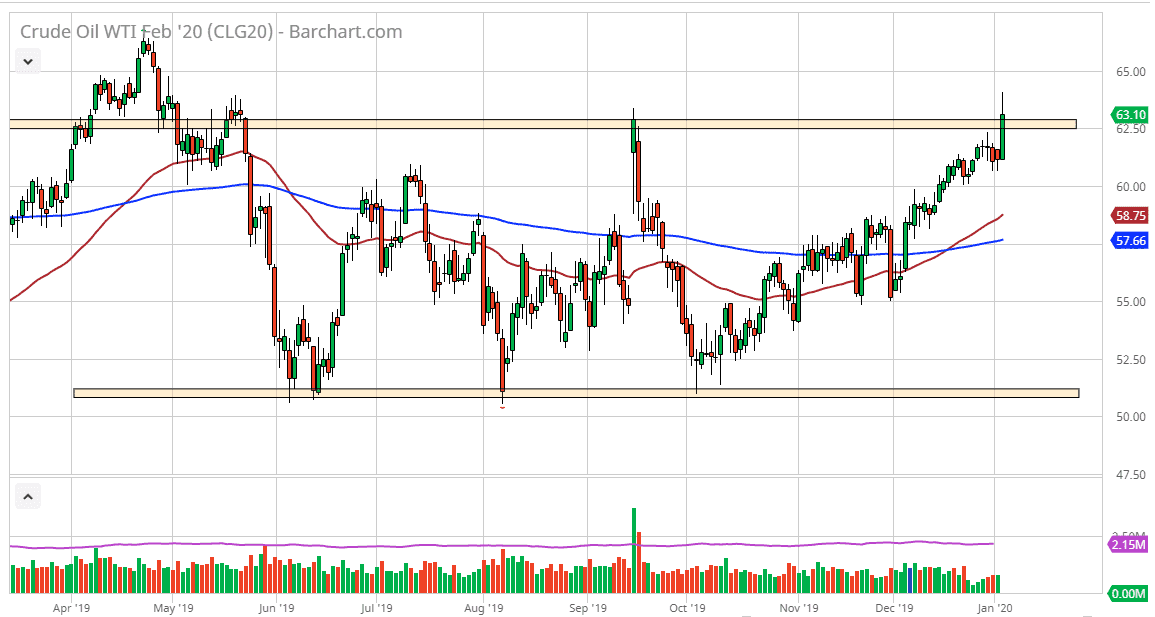

The West Texas Intermediate Crude Oil market has broken higher during the trading session on Friday, reaching above the $62.50 level. By doing so, it is a strong sign but honestly, I find more telling is the fact that an Iraqi general was killed, and although oil shot higher, it did not completely break out above this resistance. This to me tells just how concern the market is about oversupply. There seems to be a significant resistance barrier between $62.50 and $65.00 above, so I think at this point it’s not until we break above the $65 level the people can take this breakout seriously. As we have rallied a bit but gave back a lot of the gains just above that level, it shows that there is no significant momentum to follow through, at least not yet.

I suspect that the next move is probably dictated by the Iranians, as to whether or not they react and perhaps more importantly what that reaction might be. Sometimes, it’s more about what a market want to rather than what it will do. I think watching this market will be crucial and if we wipe out the Friday candlestick to the downside, it’s very likely that this market will break towards the 200 day EMA. Because of this, Alternately, if we were to break above the top of the candlestick for the Friday session as likely that the market could go looking towards the $65 level, which is a large, round, psychologically significant figure that if we break above, it’s likely that we could go much higher. Having said that, we will have to see what the Iranians do but if they don’t do much, oil probably continues to struggle. It’s going to take something rather drastic by the Iranians to get the market to break out from a longer-term move.

From a much longer-term standpoint, the demand for crude oil is going to shrink, not only because of global slow down as far as economic activity is concerned, but the fact that the Americans are such major producers of crude oil at the moment. The world is simply watching crude oil, so with that being the case, if we don’t have enough geopolitical tensions to get the markets moving, they will probably sit right about where they are. The Monday candlestick should be crucial as to where we go next.