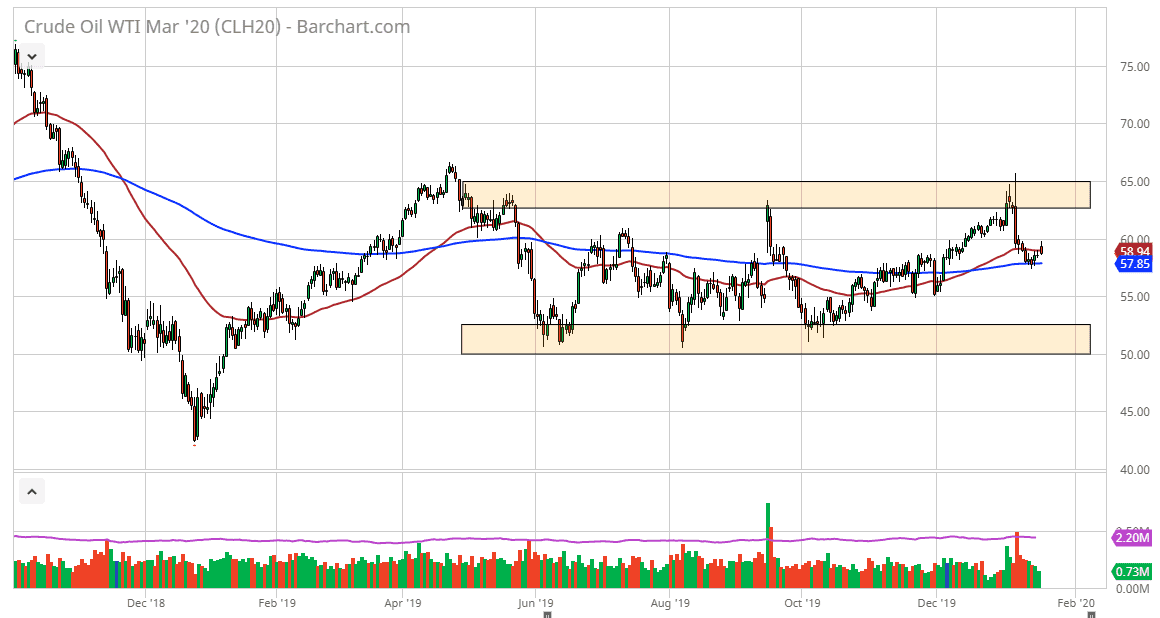

The West Texas Intermediate Crude Oil market initially rallied during the trading session on Monday but gave back the gains closer to the $60 level. Ultimately, the market then broke down below the 50 day EMA, as the markets continue to be very noisy. It was Martin Luther King Jr. Day in the United States, so volume certainly would have been very anemic. That being said though, if the market pulls back a bit from here it’s likely that we will see the 200 day EMA colored in blue offer quite a bit of support.

Alternately, if the market breaks above the $60 level, then it’s likely that we go looking towards the $62.50 level which is the beginning of the resistance band at the very top of the overall consolidation. Alternately, if we were to break down below the 200 day EMA, we could go looking towards the $55 level, but at this point it doesn’t seem to be an easy thing to do. Nonetheless, pay attention to geopolitical situations involving the Middle East, because quite frankly that will be one of the main drivers.

The market is currently hugging what could be thought of as a bit of a trend line, so there is the possibility that we get a bounce. I would stay out of this market for 24 hours, as we need the market to prove itself as to which direction it does want to go in the end. If that’s going to be the case, sitting on your hands and waiting for a break above the $60 level is probably the best thing you can do if you’re bullish, just as a break down below the lows of last week would be the signal you are looking for in order to start selling and aiming towards the $55 level. At this point, the markets will have made a decision that you can follow for a couple of days. In this general vicinity, I would expect a lot of noise to continue to be the case in the immediate real estate that we are trading on. Overall, this is a market that I believe needs to make a decision that we will then follow, but in the meantime it’s best to live those who cannot look at the big picture to try and make the decision. Larger accounts then yours will make the decision, your job is to simply follow.