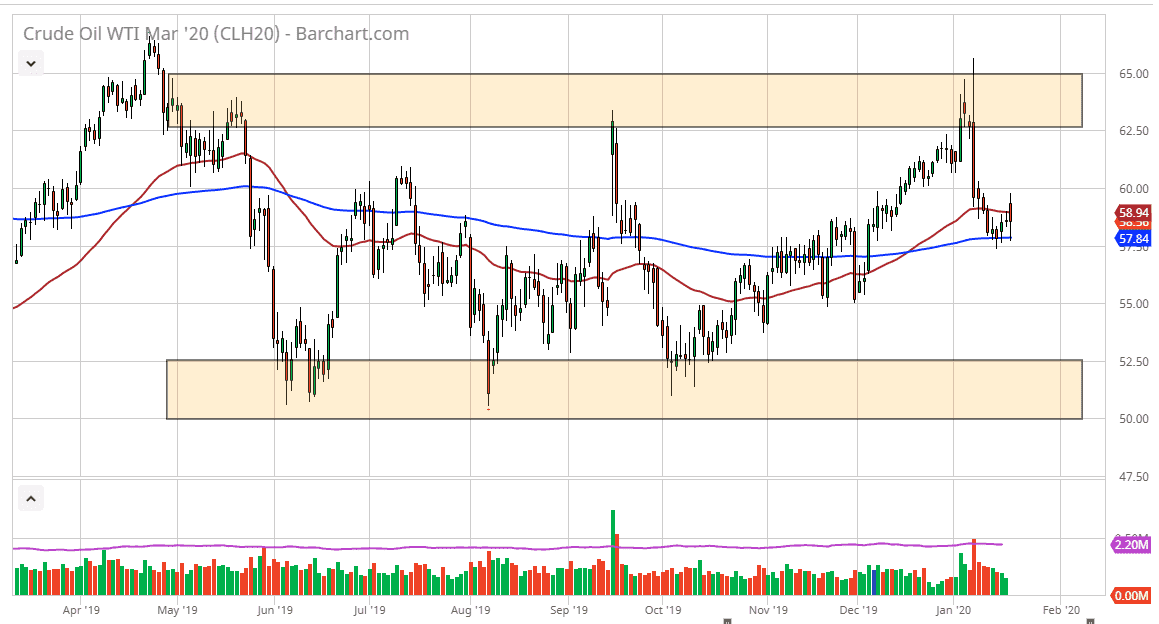

Crude oil markets rallied a bit during the trading session on Tuesday but found the $60 level to be a bit too expensive and fell towards the 200 day EMA. We have bounced from there as well, so although the candlestick for the day is rather bearish, the reality is that the 200 day EMA holding is a somewhat bullish sign. Furthermore, this is a market that seems to find “fair value” near the $57.50 level, as it is in the middle of overall consolidation. Because of this, the fact that we are closing near that level should not be a huge surprise but sooner or later we will need to get some type of impulsive candlestick to place a trade.

In this scenario, I’m going to simplify the process. I will be a buyer above $60 on a daily close, just as I would be a seller below the $57.50 on a close below. If the market were to break above the $60 level, the market could very well go looking towards the $62.50 level. Alternately, if we were to break down below that $57.50 level, it’s very likely that the market goes looking towards the $55 level, possibly even as low as the $52.50 level.

All things being equal, we are still in a range and crude oil does in fact tend to do that for long periods of time. It’s a very technically driven market, and right now it looks like the $57.50 level is essentially “balance”, as the market ways the different conflicting fundamental reasons for price to go up or down. The oversupply of crude oil is the obvious bearish pressure, not to mention the fact that global growth is probably a bit suspicious at this point. On the other hand, OPEC has promised to cut production, and of course there are always concerns about geopolitical issues. At this point, I anticipate that this market probably goes back and forth and therefore it’s likely that we will get an impulsive candlestick that we can follow. Until then, market participants will probably look at this is a short-term market more than anything else. Eventually though, we will get the move and simply follow right along with it. I would not be quick to put in a huge position though, as we are more than likely going to see a lot of chop in this general vicinity.