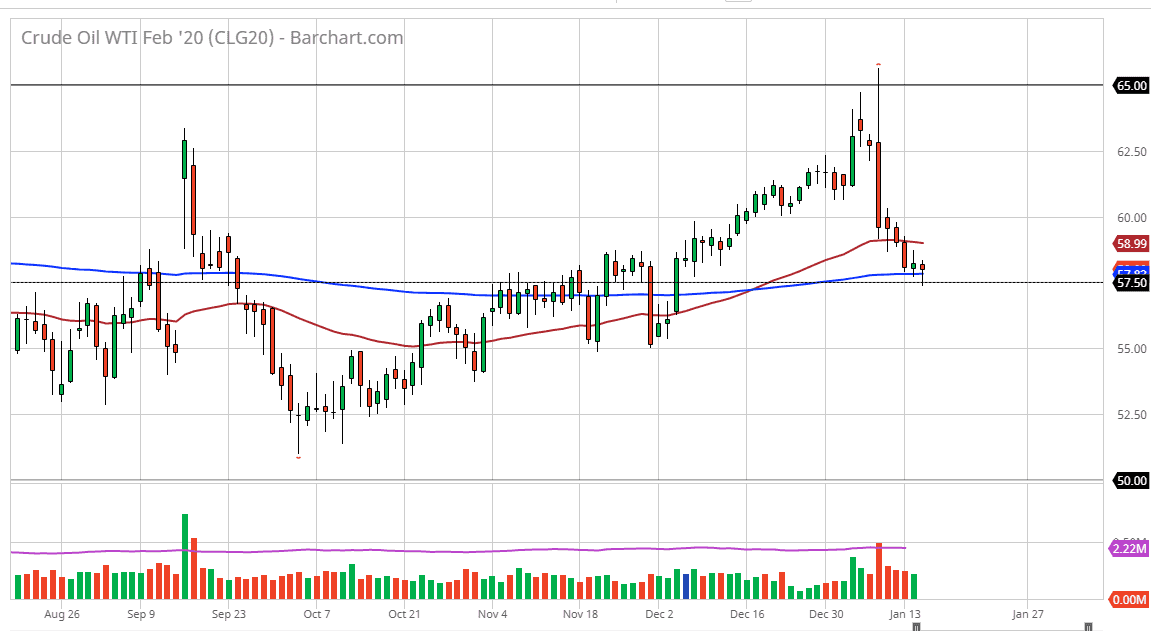

The West Texas Intermediate Crude Oil market has bounced a bit during the trading session on Wednesday, showing a positive reaction to the $57.50 level. By doing so, the market now looks as if it is showing signs of bullish pressure, and it is possible that the 200 day EMA is going to continue to offer support. Furthermore, you should keep in mind that the $57.50 level is the middle of the overall consolidation area between $50 on the bottom and $65 on the top. Because of this, there will be a lot of sellers and buyers in the same general vicinity.

The inverted hammer from the previous session being broken to the upside could send this market much higher, perhaps reaching towards the $60 level followed by the $62.50 level. Alternately, if the market was to break down below the hammer from the trading session here on Wednesday, then the market is very likely to go looking towards the $55 level underneath which is massive support. All things being equal, this is a market that looks as if it is starting to find a bit of support in this area after selling off quite drastically. So now the question is what will the market be paying attention to?

One of the biggest problems that we have right now as there is simply a lack of demand out there. The global growth story is soft, and that of course is exacerbated by the fact that the Americans continue to find and extract more oil, which of course they are not bound by the production quotas put out by OPEC. Because of this, and the fact that the Americans and the Iranians have eased tensions for the time being, oil is somewhat limited and what it can do for any type of reaction. That being said, we have also seen the US dollar giveback a little bit of the gains during the trading session and that of course can help crude oil prices as well. We are oversold, so at the very least I would expect some type of bounce in the short term. If we break down though, then we clearly have further to go to the downside. At this point, I believe that the market will continue to see value hunters in this general vicinity, but the question now is whether or not they can actually take control.