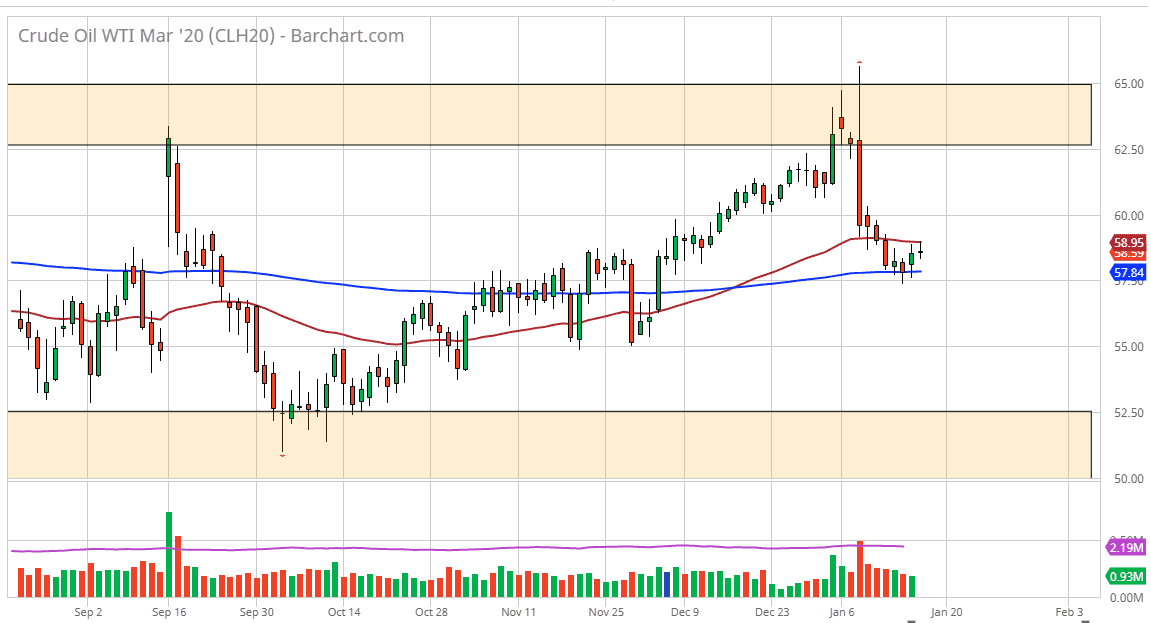

The West Texas Intermediate Crude Oil market did very little during the trading session on Friday as traders began to think about the three day weekend in the United States. That being said, the market has bounced from the 200 day EMA and the last couple of days, so that of course is very bullish. The hammer from the Wednesday session of course suggests that the market is likely to continue to find buyers. Ultimately, if we were to break above the 50 day EMA that’s a signal to start buying as we will have clearly shown signs of recovery.

Keep in mind that the market had initially tried to break above the recent consolidation area, but then broke down significantly. The significant break lower was due to the systematic shocks that we continue to feel and then pulled back from in the Middle East. That being said though, it looks very likely that the market will recover a bit, and although I don’t necessarily think that we are going to shoot through the moon here, the reality is that we were grinding higher before all of that noise anyways, so this looks as if it is a simple continuation of a market that was going higher to begin with.

That being said, I do believe that there is still a lack of demand out there that is going to continue to cause issues. Because of this, I don’t think that the market is going to break out to the upside, clearing the $65 level. The alternate scenario of course is that we continue to break down due to a lack of demand.

In that lack of demand scenario, we break down below the hammer from the Wednesday session, and then perhaps reaching towards the $55 level next. Below there, the $52.50 level would be the next target, perhaps down to the $50 level given enough time. All things being equal though, we are roughly near the middle of the overall range, so therefore it’s not a huge surprise to see that there’s been a reaction anyway. The fact that the 200 day EMA was there is only a bonus, so having said that it makes a lot of sense that we have seen this. If we can break above the top of the candlestick for the day, that also clears the 50 day EMA, bring in even more traders.