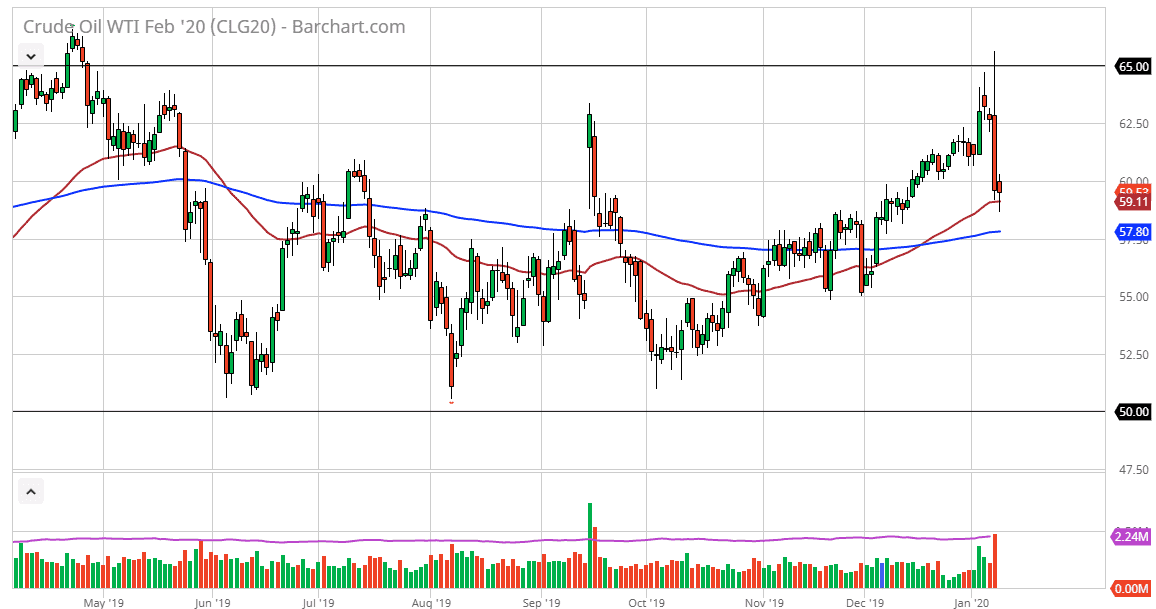

The West Texas Intermediate Crude market initially fell during the trading session on Thursday but turned around to form a bit of a hammer sitting right at the 50 day EMA. This of course is a very bullish sign, especially considering that the market is sitting just below the $60 level. If the market could break above the top of the candlestick for the trading session on Thursday, the market is likely to go looking towards the $61.50 level. Beyond that, we could even go as high as $62.50 after that. However, it is the jobs number during the day on Friday and that of course will have its own effect on the market.

The oil markets got absolutely hammered after initially spiking much higher due to the US assassination of Iranian General Soleimani, which of course had people concerned about a larger war. Furthermore, during the early hours on Wednesday, the markets got a major jolt when the Iranians fired back with the rocket attack. We broke through the $65 level but then broke down rather significantly once it became obvious that it was not an attack meant to kill US troops, and therefore everybody seems to accept the market settling down. The fact that the 50 day EMA has held is rather important as well. Underneath there, the 200 day EMA also is within reach. Typically, the area between these two moving averages will cause a bit of support or resistance depending on the direction you are going.

That being said, the Friday session of course features the Non-Farm Payroll numbers, and that will have a significant amount of influence on what happens next. Looking at the chart, it’s very likely that we will trying to capture some of the gains, but keep in mind that the jobs number will greatly influence on what happens next. After all, the jobs number is better than anticipated it should drive up demand in theory. That should drive up the price of crude oil. That being said, the most recent number was very bearish, so the upside is probably somewhat limited. For those not looking to trade the immediate announcement, it might be better to wait until the end of the trading session to make a longer-term decision, but it must be said a short-term bounce is more likely than not based upon the oversold condition that the market finally settled on at the end of the day on Wednesday. However, breaking down below the bottom of the hammer from the Thursday session is most decidedly very negative and will put quite a bit of pressure on the market.