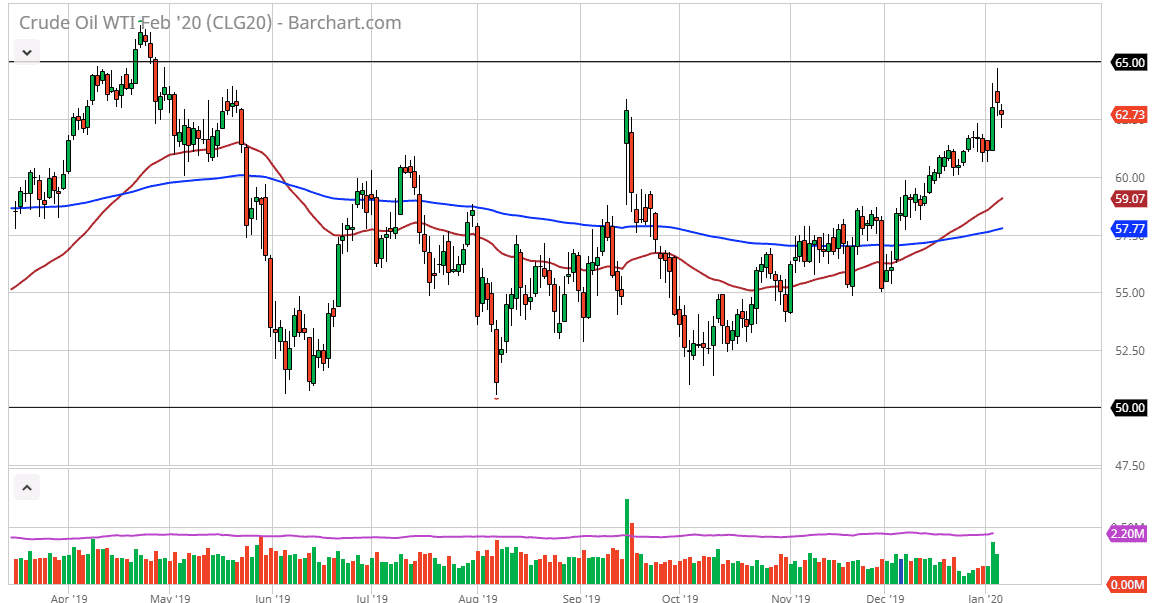

The West Texas Intermediate Crude Oil markets gapped lower to kick off the trading session on Tuesday but found enough support near the $62.50 level to turn around and show signs of life again. Nonetheless, we are at the top of a large consolidation area between the $50 level on the bottom and the $65 level on the top. Because of this, I would anticipate that we could probably pull back a bit further, but the fundamental situation has changed quite a bit since we had reached towards the bottom last time.

OPEC of course has cut production, and the United States and Iran are starting to ratchet up tensions. This has a bullish knock on effect when it comes to crude oil, and as a result we have seen the market grind higher. I think that the keyword here is going to be grind, as the market has been overextended. The markets will probably need to pull back in order to find the proper momentum to break out. However, if we were to break below the $60 level, that would probably cause a bit of a break down, perhaps down to the 50 day EMA, near the $59 level. Below there, we would then attack the 200 day moving average. Ultimately, this is a market that is going to still continue to be driven by headlines around the world, not the least of which will be the US/Iranian situation.

I think at this point though, there is a serious lack of demand, so if there’s any cooling-off of tensions it’s likely that this market will pull back a bit more significantly. It’s difficult to trade this market for anything more than a short-term trade, because quite frankly when we get a lot of headlines involving geopolitical issues, markets tend to react rather quickly. Remember, futures markets are driven mainly by computerized trading these days, so please keep in mind that the market will react immediately to headlines, not necessarily logically. The machines now react to headlines on certain Twitter feeds, causing all kinds of noise. At this point, it’s all about short-term trading, but I think you need to see some type of pullback in order to start buying again as it allows a little bit of momentum to be built up and perhaps drive the market towards the highs again. Again though, there are several levels underneath that getting broken could cause issues though.