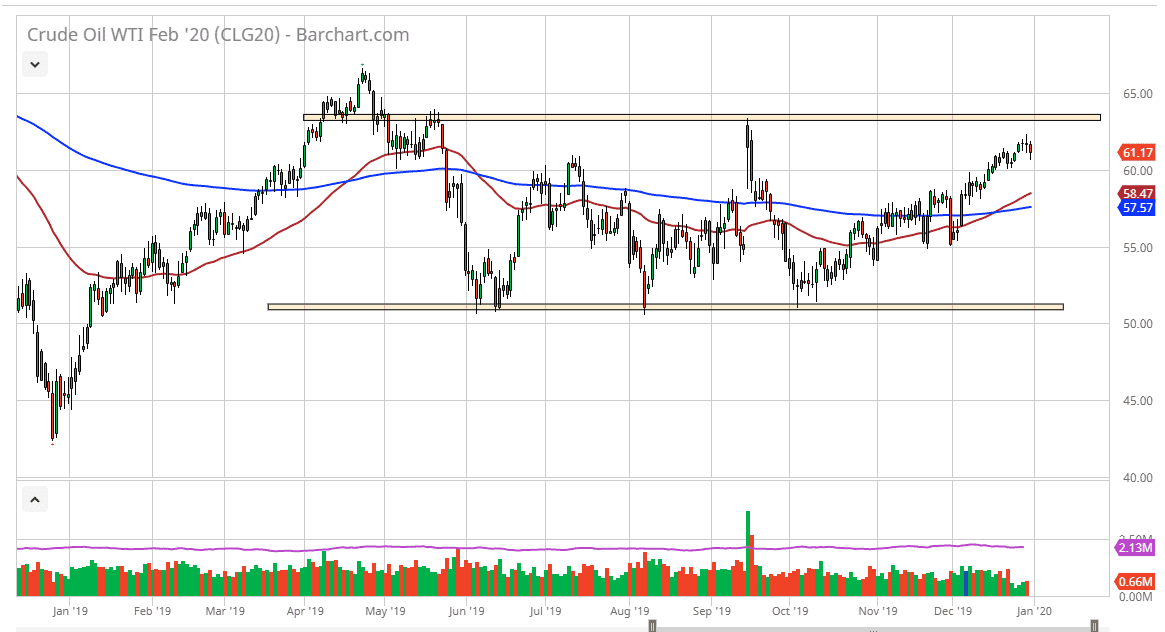

The West Texas Intermediate Crude Oil market initially pulled back during the trading session but did bounce a bit on Tuesday. Nonetheless, we have a significant amount of resistance above in the form of the $62.50 level, and possibly extending as high as the $65 level. We have been in a larger consolidation area in general, stretching from roughly that area down to the $52.50 level. The market does tend to be very technical so it’s not a huge surprise to consider that we are consolidating in a $10 range. That being said, the candlestick for the trading session on Tuesday is somewhat bullish but I recognize that there is a lot of noise just above, and quite frankly even though OPEC cut production we have been exactly seen an explosion to the upside. This for me speaks volumes.

At this point in time I think that a pullback makes quite a bit of sense, but I would anticipate that the $60 level should offer a bit of support. Also, we have the 50 day EMA that has recently crossed above the 200 day EMA forming the so-called “golden cross”, and therefore it’s likely that we will continue to see bullish pressure given enough time. Ultimately, I like the idea of going long on dips, unless course we break down below those two moving averages which would show a major selloff and perhaps a return to the bottom of the overall range near the $52.50 level.

At this point, I think there are a lot of questions still when it comes down to the demand for crude oil, so having said that it’s likely that the market is going to be stuck in this range at least in the short term. If we do break out above the $62.50 level, then the market will start looking towards the $65 level. I don’t think that we breakdown through the bottom of this range, mainly because OPEC will continue to do everything it can to keep markets somewhat afloat. Nonetheless, American drillers will jump into this market hand over fist with prices approaching the $65 handle. In other words, I think we are going to see more of the same in the crude oil market during most of the year. In other words, we will probably be very range bound but to start off 2020, I think we will continue a little bit of a pullback before bouncing again.