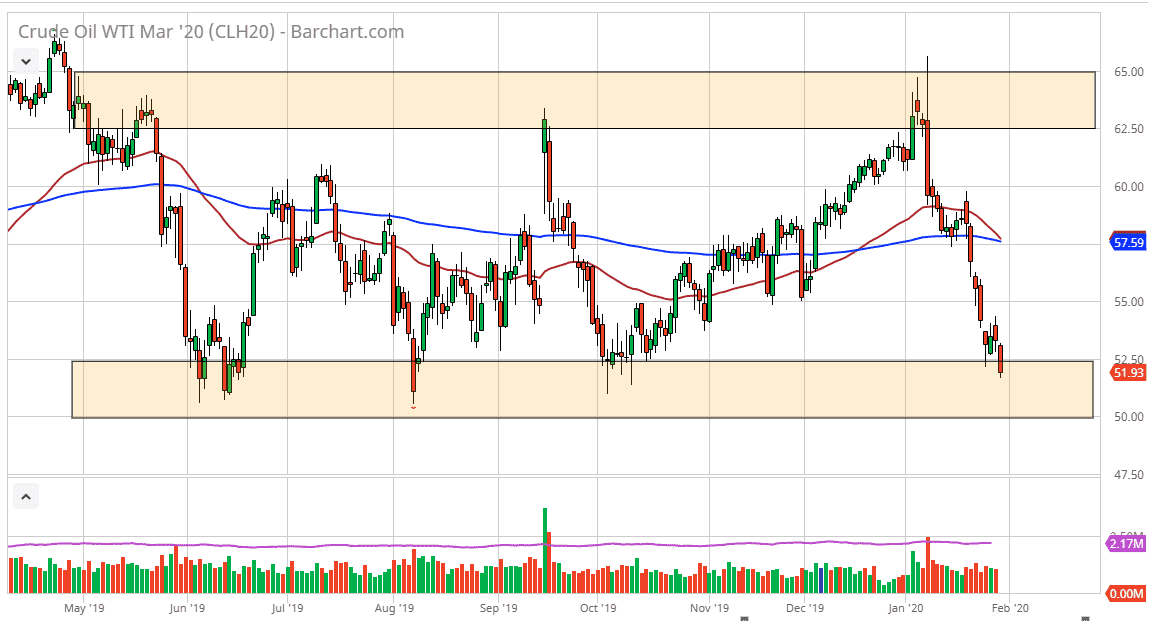

The West Texas Intermediate Crude Oil market broke down again during Thursday trading as the beat down for crude oil continues. After all, there are concerned about global growth and of course there is the built-in excuse of the coronavirus slowing things down also. That being said, the market looks to see plenty of support all the way down to the $50.00 level, so if we were to break down below there, it’s likely that the market breaks down towards the $47.50 level. At this point, the market looks very likely to be overextended to the downside and I suppose there is only a matter of time before some type of bounce comes. After all, even though we have broken down significantly over the last couple of weeks, the reality is that we have raised straight towards the support level at the bottom of the overall range.

The bounce from here should send this market looking towards the $54 level again, perhaps even the $55 level. The 50 day EMA is getting ready to cross below the 200 day EMA which is a very bearish sign, but I think at this point what we are seeing is the market trying to break itself down. I do believe that we are likely to see value hunting given enough time, but if the $50 level gets broken to the downside, it would essentially be the “trapdoor opening” for the sellers. In that scenario, the market more than likely goes down to the $45 level, possibly even the $40 level. Ultimately, the market is struggling to pick itself back up, as the market is starting to worry about the overall production and global demand when it comes to crude oil itself.

The market has fallen rather rapidly though, so I think that it will take some type of fresh negativity to push the market through the bottom here. At this point, a “relief rally” could come back into the picture. All things being equal, this is a market that has a lot of things to pay attention to but at the end of the day nothing has truly changed from a long-term standpoint, even though it has been very difficult for those who would be buyers. I suspect it is probably best to wait for some type of bounce or support of daily candlestick to start buying. As far as selling is concerned, you can’t chase the trade all the way down here. You would need to see a daily close below the $50 level to feel comfortable doing so.