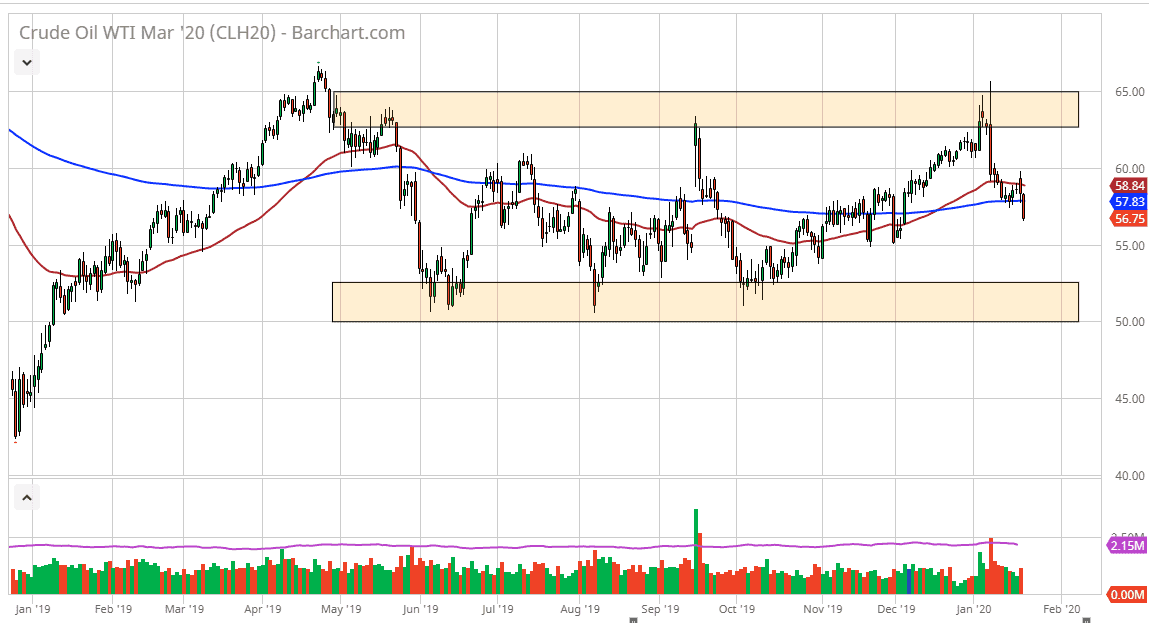

The West Texas Intermediate Crude Oil market has broken down significantly during the trading session on Wednesday, slicing through the 200 day EMA and even the $57.50 level which had offer quite a bit of support based upon the hammer from last Wednesday. Breaking down below that hammer is a very negative sign, and it’s likely that we would continue to go much lower. Ultimately, this is a market that I think then goes looking towards the $55 level, perhaps even down to the $52.50 level.

Rallies at this point would be selling opportunities from what I can see, and the 50 day EMA which is painted in red should offer plenty of resistance as well. That being said, if the market was to break above the $60 level, then I think that the market could go looking towards the $62.50 level. All things being equal, I like the idea of fading signs of exhaustion on short-term charts, as the negativity that has entered this market seems to be increasing. That being said, we should take a look at the bigger picture as well.

The bigger picture is that we have been consolidating between the $65 level and the $50 level over the last several months. In other words, it would not be a huge surprise to see this market continue to drift lower, and while it may feel very negative in the short term, the reality is that it would be a simple continuation of the overall range bound trading that we have seen for some time. At this point, the market looks as if the 50 day EMA is ready to break down below the 200 day EMA, showing signs of negativity as well. Furthermore, the candlestick looks very negative from the trading session, showing signs of conviction to the downside as we are closing towards the bottom of the longer range. The fundamental situation continues to be one that sees a serious lack of demand in general, but at the same time OPEC is looking to cut production. It’s obvious that the market is going to continue to see a lot of volatility, but I think we need to make a return to the downside before we can bounce again. The best way to trade this market is probably going to be selling it from a short-term perspective on signs of failure.