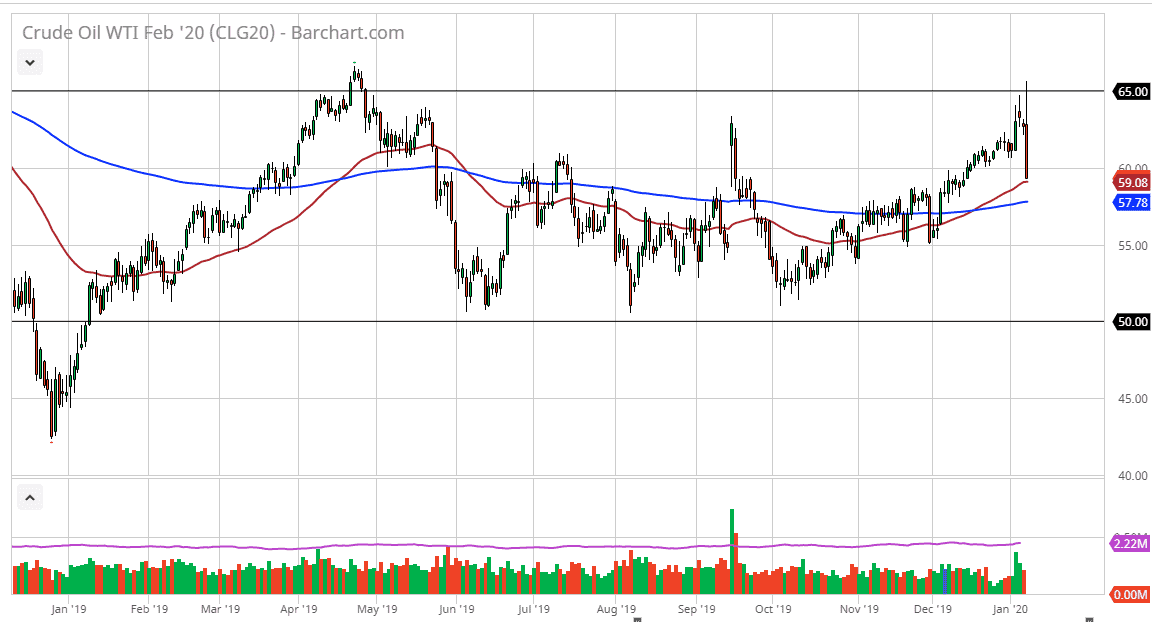

The West Texas Intermediate Crude Oil market has originally rallied during the trading session on Wednesday, breaking above the $65 level as word got out that the Iranians had sent over a dozen missiles at US bases in Iraq. However, this was the top of an overall range so there would have been a certain amount of resistance built in. By breaking above there it exposed that the market may have been a little bit overdone, and then we fell almost immediately. It was exacerbated by the fact that the Iranians didn’t hit anything, and clearly had only launch the missiles as more or less a symbolic gesture.

The Iranians suggested that they had “slapped America across the face” by launching the missiles but as they didn’t hit anything of importance, it’s obvious that they weren’t trying to start a war. In fact, they also suggested that the escalation of tensions was not what they were looking for. As a response, Donald Trump suggested that there would be more sanctions against the Iranians, but he also had suggested that the escalation of conflict was not what he was looking for. That caused a certain amount of selling as well, because it takes the tension right out of the Middle East and therefore the threatening of crude oil suddenly doesn’t become as big of an issue.

Furthermore, the inventory number that came out during the trading session on Wednesday was a build of 1.2 million barrels in the United States, as opposed to an expected number of three point -3.4 million barrels. This was a horribly bearish number, and now the market has crashed into the 50 day EMA. With that being the case, it’s very likely that we will probably see the market try to stabilize in this general vicinity but with the jobs number coming out on Friday, it’s very likely that the market will do very little during Thursday and will probably react more to the Non-Farm Payroll figures next. If the Middle East is going to come down, and fear should jump out of the market and we should just simply kind of bounce around in this area. I would not expect over the next 24 hours to see much in the way of momentum, as we await the next major economic release, the jobs figures in the United States.