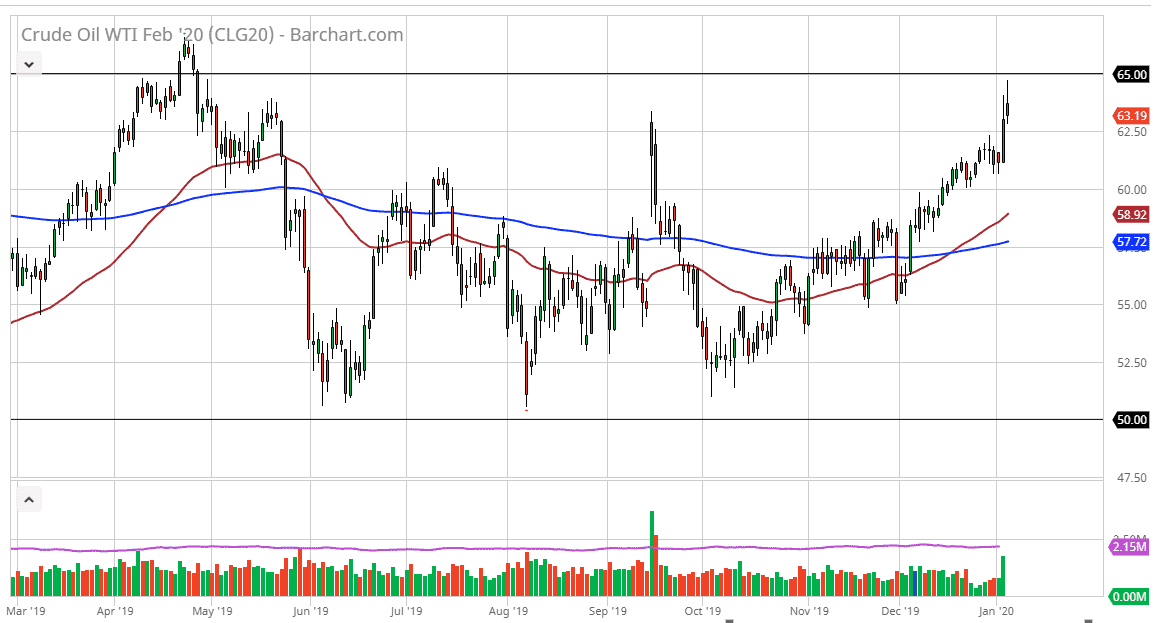

Crude oil markets have been very strong over the last couple of trading sessions after the United States killed a top ranking Iranian general. However, at the first signs of serious trouble we have seen the market rollover again. The fact that the WTI market could not break above the $65 level is somewhat telling, because we are still recognizing the previous resistance barriers. If tensions rising in the Middle East cannot drive prices higher, and we have been repulsed so drastically by this level, this tells me that there is underlying weakness when it comes to this market.

The shooting star is of course a very negative sign, but at this point I think we are more or less just overextended to begin with. Yes, there are a lot of concerns out there that the Iranians may get aggressive again, and perhaps retaliate, but at the end of the day anything that they do will probably be short-lived at best. They certainly won’t be looking for a full-scale war against the United States, as it is something that cannot win. With this in mind, perhaps traders have come to the realization that there are still major issues with oversupply when it comes to crude oil, and even though OPEC has cut production again, the reality is that the United States is energy independent, so this becomes more of an issue with Brent crude oil than WTI.

Looking at this chart, it would make quite a bit of sense to see a pullback towards the $61 level, and then perhaps even the $60 level as the 50 day EMA will start to reach towards that area. Alternately, if something does happen, the market could break above the $65 level. By breaking through there, it would show the next leg higher and it would be an impulsive move. That would almost certainly have some type of headline attached to it of significance, but so far it looks like the markets are taking the assassination in relative stride, which is quite impressive considering how the oil markets you still react to these types of situations. We are in a new era when it comes to crude oil, as the United States is the largest producer. Suddenly, this brings up bigger questions about the Middle East than anything else. That being said, I believe that a pullback is coming at the very least.