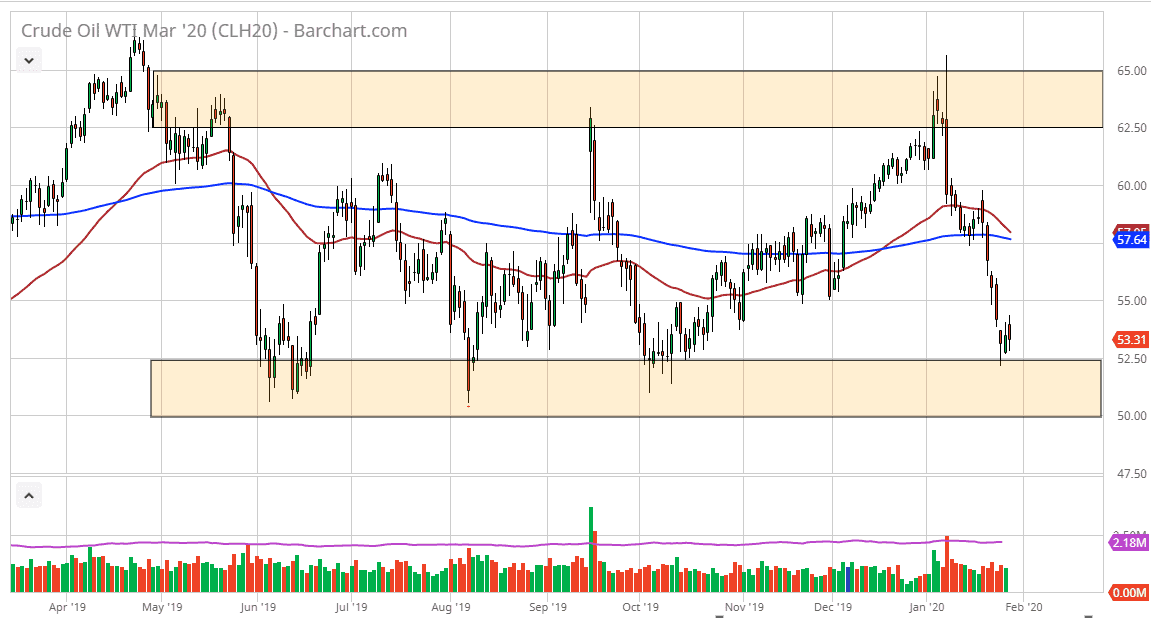

The West Texas Intermediate Crude Oil market has initially gapped higher to kick off the trading session on Wednesday, only to turn around and reach towards the bottom of the overall consolidation range that it has been in for some time. We are trading at the very bottom of the longer-term range, and therefore it makes sense that a little bit of a bounce may occur. In fact, that’s essentially what I am banking on at this point, as the $52.50 level should continue to offer support that runs down to the $50.00 level. As a result, I believe that a bounce to the $55 level is very likely, based upon simple structural support. Further compounding this idea is the fact that we had fallen to this area so quickly, and therefore it’s difficult to imagine that the market is simply going to slice through the support level without at least having a bounce or two in the process.

If we did break down below the $50.00 level, that would obviously be a very negative turn of events and could open up the door down to the $45 level. At this point, the risk is most certainly to the upside, lease for the next couple of trading sessions as we are oversold by just about any metric you use. If we can break above the $55 level, then it’s likely that we go looking towards the $57.50 level next where a couple of the more important moving averages that I follow said, the 50 day EMA and the 200 day EMA. The fact that the 50 day EMA is trying to cross below the 200 day EMA suggests that we could get the so-called “death cross”, which of course is a very negative sign. That being said though, as we are in a range bound market it doesn’t carry as much weight as it would if we were rolling over from a huge trend higher. With that in mind, I believe it’s only a matter of time before we returned to the median of the range, which is closer to those moving averages. There are rumors about OPEC cutting production going forward, so that of course would continue to be supportive for the price of crude oil, but so far that is not something that has been proven correct. That being said though, there are whispers about that out there, so it should continue to cause yet another reason why this market might bounce slightly.